Bank of Japan Rate Hike Could Trigger 20-30% Bitcoin Decline as Markets Price 98% Probability

Markets are bracing for a potentially pivotal week for Bitcoin as the Bank of Japan (BOJ) heads into its December 18–19 policy meeting. Expectations point to a near-certain rate hike. Prediction markets and macro analysts alike are converging on the same conclusion: Japan is poised to raise rates by 25 basis points. Such a move

Markets are bracing for a potentially pivotal week for Bitcoin as the Bank of Japan (BOJ) heads into its December 18–19 policy meeting. Expectations point to a near-certain rate hike.

Prediction markets and macro analysts alike are converging on the same conclusion: Japan is poised to raise rates by 25 basis points. Such a move could reverberate far beyond its domestic bond market and into global risk assets, especially Bitcoin.

Bank of Japan Rate Hike Puts Bitcoin’s Liquidity Sensitivity Back in Focus

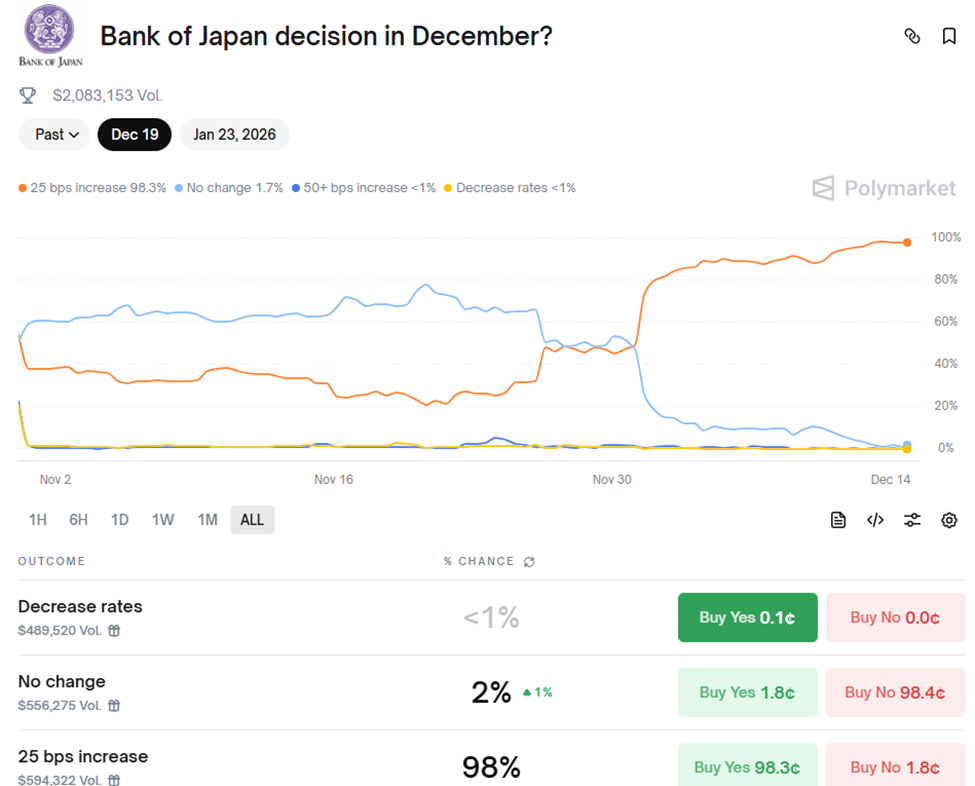

Polymarket is currently assigning a 98% probability of a BOJ hike, with a measly 2% wagering that policymakers will hold interest rates steady.

BOJ Interest Rate Probabilities. Source:

Polymarket

BOJ Interest Rate Probabilities. Source:

Polymarket

The general sentiment among crypto analysts is that this is not good for Bitcoin, with the pioneer crypto already trading below the $90,000 psychological level.

Polymarket is pricing in a 🇯🇵 BOJ rate hike with 98% certainty right now.This is not good… 👀 pic.twitter.com/Huace8iTBk

— Mister Crypto (@misterrcrypto) December 14, 2025

If implemented, the move would take Japan’s policy rate to 75 basis points, a level not seen in nearly two decades. While modest by global standards, the shift is significant because Japan has long been the world’s primary source of inexpensive leverage.

For decades, institutions borrowed yen at ultra-low rates and deployed that capital into global equities, bonds, and crypto, a strategy known as the yen carry trade. That trade is now under threat.

“For decades, the Yen has been the #1 currency people would borrow & convert into other currencies & assets… That carry trade is diminishing now, as Japanese bond yields are rising rapidly,” wrote analyst Mister Crypto.

If yields continue to climb, leveraged positions funded in yen may be unwound, forcing investors to sell risk assets to repay debt.

Liquidity Fears Grow Amid Bitcoin’s BOJ Track Record

The historical backdrop is fueling anxiety in crypto markets. Bitcoin is currently trading at $88,956, down 1.16% in the last 24 hours.

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

However, traders are focused less on the current price and more on what has happened after previous BOJ hikes.

- In March 2024, the price of Bitcoin fell by roughly 23%.

- In July 2024, it dropped around 25%.

- Following the January 2025 hike, BTC slid more than 30%.

Against this backdrop, several traders see a troubling pattern, urging investors to brace for volatility this week.

“Every time Japan hikes rates, Bitcoin dumps 20–25%. Next week, they will hike rates to 75 bps again. If the pattern holds, BTC will dump below $70,000 on December 19. Position accordingly,” cautioned analyst 0xNobler.

This week, therefore, analysts see the Bank of Japan as the biggest threat to the Bitcoin price, with a play to $70,000 now in the cards.

THE BANK OF JAPAN MIGHT BE BITCOIN’S BIGGEST ENEMYJapan holds the most US debt.Every time they hike, Bitcoin bleeds:March 2024: -23%July 2024: -30%Jan 2025: -31%Next hike: Dec 19Next move: loading…If the pattern repeats, $70K is in play. pic.twitter.com/R5916R702I

— Merlijn The Trader (@MerlijnTrader) December 14, 2025

Similar projections have been echoed across crypto-focused accounts, with repeated references to a potential drop below $70,000 if history rhymes. Such a move would constitute a 20% drop below current levels.

Bitcoin (BTC) Price Performance. Source:

TradingView

Bitcoin (BTC) Price Performance. Source:

TradingView

Regime Shift or Liquidity Shock? Why Traders Are Split on the BOJ–Fed Policy Mix

Yet not everyone agrees that a BOJ hike spells inevitable downside. A competing macro narrative argues that Japan’s tightening, when paired with US Federal Reserve rate cuts, could ultimately be bullish for the crypto market.

Macro analyst Quantum Ascend framed the situation as a regime shift rather than a liquidity shock.

Japan raising rates has a lot of people worried about the potential impact on the market. 🚨Couple that with the Fed cutting rates, and it's seemingly a mixed picture.But it's NOT.This is EXTREMELY BULLISH for crypto‼️Here's why ⬇️

— Quantum Ascend (@quantum_ascend) December 13, 2025

According to this view, Fed cuts would inject dollar liquidity and weaken the USD, while gradual BOJ hikes would strengthen the yen without meaningfully destroying global liquidity.

The result, Quantum Ascend argues, is capital rotation into risk assets with asymmetric upside, crypto’s “sweet spot.”

Still, near-term conditions remain fragile. The Great Martis cautioned that bond markets are already forcing the BOJ’s hand.

“This could trigger the carry trade unwind and cause havoc in equities,” the analyst warned.

The analyst also pointed to broadening tops in major stock indices and globally rising yields as signs of mounting stress.

Meanwhile, Bitcoin’s price action reflects the uncertainty. The pioneer crypto’s price has been largely flat through December, marking what analysts call a very choppy period into the end of the year.

Specifically, analyst Daan Crypto Trades cites low liquidity and limited conviction ahead of year-end holidays.

With equities flashing topping signals, yields breaking higher, and Bitcoin historically sensitive to Japan-driven liquidity shifts, the BOJ’s decision is shaping up to be one of the most consequential macro catalysts of the year.

Whether it triggers another sharp drawdown or sets the stage for a post-volatility crypto rally may depend less on the hike itself and more on how global liquidity responds in the weeks that follow.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of a Dynamic Clean Energy Marketplace

- REsurety's CleanTrade platform, a CFTC-approved SEF, standardizes VPPAs, PPAs, and RECs to boost clean energy market liquidity and transparency. - The platform's regulated framework enabled $16B in notional value within two months of its 2025 launch, reducing transaction friction and enabling real-time pricing. - Corporations like Unilever and Walmart leverage CleanTrade to align ESG goals with verifiable decarbonization outcomes, avoiding greenwashing through project-level metrics. - Strategic partnersh

ZK Atlas Enhancement and Its Impact on Blockchain Scalability

- ZKsync's 2025 ZK Atlas Upgrade introduces Airbender, a RISC-V-powered zkVM achieving 15,000–43,000 TPS with $0.0001 fees, revolutionizing blockchain scalability. - The upgrade attracts $15B in institutional capital, with Deutsche Bank and Sony leveraging ZKsync for asset tokenization and supply chain solutions via ZK Chain. - ZKsync outperforms Arbitrum in finality and privacy while aligning with Ethereum's scaling vision, projected to dominate 60.7% CAGR growth in ZK Layer 2 markets by 2031.

Ethereum’s Valuation Could Reach $20 Trillion by 2035, Analyst Projects

Vitalik Buterin Sells Crypto: $16.8K UNI, KNC, DINU Move Sparks Market Speculation