Midnight Network’s NIGHT Token Rallies 200% as Crypto Privacy Narrative Heats Up

Cardano’s Midnight (NIGHT) token soared nearly 200% in its first 24 hours, becoming the most-trending asset on major trackers. The launch coincides with a powerful privacy-token rally driven by EU regulation pressure, rising surveillance concerns, and renewed demand for zero-knowledge technology.

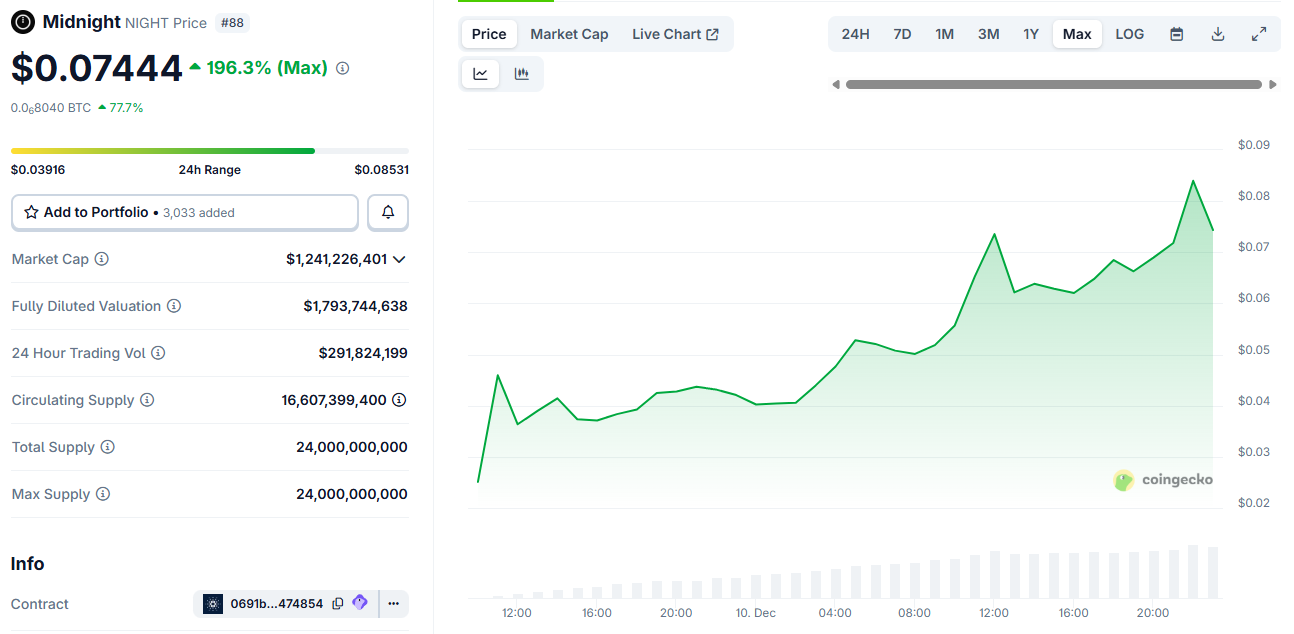

Midnight Network’s NIGHT token surged almost 200% within 24 hours of its December 9 launch, becoming the most-trending asset on CoinGecko and CoinMarketCap.

The token hit a market cap above $1.2 billion and registered more than $320 million in trading volume during its first full day.

Mega Bullish Season For Privacy Coins?

Architecturally, Midnight is conceived as a “partner chain” or sidechain to Cardano. Its initial token and ledger are issued on Cardano (as a Cardano Native Asset).

ICYMI: @IOHK_Charles laid out the upcoming Midnight ecosystem roadmap in his keynote address, which outlines the delivery of core network capabilities over the coming year, organized into four distinct phases. Read more 👇

— Midnight (@MidnightNtwrk) November 17, 2025

The hyped market debut places Midnight Network at the centre of a broader shift in the market. Privacy coins have rallied since October.

Most recently, it has been fueled by regulatory pressure in Europe, tightening surveillance rules, and a renewed appetite for zero-knowledge technology.

Zcash sparked the trend with a tenfold rise between October and mid-November. The surge coincided with the EU’s approval of rules that will bar exchanges from listing privacy coins starting in 2027.

Traders rotated into Dash, Railgun, Decred, and Monero as the sector gained momentum, lifting privacy-token volumes toward $3 billion at peak.

However, the rally has carried tension. Analysts warn that increased regulatory scrutiny may force privacy activity off regulated platforms.

At the same time, controversy around EU surveillance measures and the proposed Chat Control law has strengthened demand for technologies that preserve confidentiality.

Heads up, bitcoin holders:The EU will ban anonymous crypto accounts by July 2027.Every transaction above €1,000 will need your ID.Privacy is becoming extinct. 😔

— Eli Nagar (@EliNagar) May 4, 2025

Against this backdrop, Midnight’s launch arrived at the perfect moment. The project positions itself as a privacy-first network using zero-knowledge proofs and a dual-token model.

NIGHT acts as the primary asset, while DUST funds private transactions. The model offers selective disclosure, making data visible only when required.

This structure aligns with the market’s rotation toward privacy infrastructure rather than simple anonymity tools. It also fits rising concerns over wallet tracking, identity verification requirements, and the future of personal data in digital finance.

Congratulations Midnight

— Charles Hoskinson (@IOHK_Charles) December 9, 2025

Crypto Privacy Narrative Is Taking Off

Trading interest reflected that narrative. NIGHT climbed from around $0.039 to more than $0.085 before easing. Its circulating supply reached 16.6 billion tokens, with investors treating the launch as an entry point into the next phase of the privacy-technology cycle.

Midnight’s NIGHT Token Price Chart. Source:

Midnight’s NIGHT Token Price Chart. Source:

Yet the privacy sector remains volatile. Zcash retraced more than 40% after its November peak, while Dash’s early-December breakout lost momentum.

Analysts expect rotation between leaders to continue as regulation tightens and new privacy-focused projects emerge.

For now, Midnight has captured the strongest launch momentum of any new token this quarter. Its rise illustrates how fast capital is moving into privacy infrastructure as the regulatory environment hardens.

The next test will be whether demand stays high once the initial hype fades and the market shifts its focus from narrative to usage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Financial Wellness Emerging as a Key Investment Trend: Psychological and Structural Factors Shaping Sustainable Wealth Over Time

- 2025 investment trends prioritize financial wellness driven by behavioral economics and systemic factors like inflation and AI-driven tools. - Budgeting apps (YNAB, Mint) and automation platforms (Digit, Acorns) address debt management and savings discipline amid $1.17T U.S. credit card debt. - ETFs like iShares IYG and Global X FINX target financial wellness infrastructure, while Vanguard's inflation-protected ETFs cater to capital preservation needs. - Systemic shifts force "cascading waterfall" financ

Investing for Tomorrow: Eco-Friendly Energy Systems and the Growth of Green Cities

- Global climate-conscious energy infrastructure is accelerating, driven by tech innovation and urban decarbonization needs, with cities accounting for 70% of carbon emissions. - Smart grids and AI are transforming energy systems: grids optimize distribution (e.g., Amsterdam/Singapore), while AI cuts building energy use by 30% via automation and analytics. - Renewable energy investments hit $2.2T in 2025, led by solar (cheapest electricity source), but emerging markets face funding gaps despite hosting 40%

Astar 2.0’s Influence on AI Infrastructure and Cloud Computing Sectors: Evaluating Changes in AI Hardware Requirements and Emerging Investment Prospects

- Astar 2.0's blockchain innovations in cross-chain interoperability and scalability aim to reshape AI infrastructure by optimizing data flow and reducing latency. - Partnerships with Sony and Toyota demonstrate blockchain-enabled AI logistics applications, enhancing transparency and operational efficiency in supply chains. - Deflationary tokenomics and institutional adoption strategies position Astar to capitalize on AI hardware growth, with analysts projecting $0.80–$1.20 ASTR valuation by 2030. - The pl

ZK Technology Experiences Rapid Growth in 2025: Could This Mark a Turning Point for Web3?

- ZK technology is driving Web3 mainstream adoption in 2025 with scalability breakthroughs and institutional adoption. - ZK rollups now exceed $3.3B TVL, proving scalability without compromising security through 43,000 TPS performance. - 35+ institutions including Goldman Sachs and Sony have integrated ZK solutions for confidential transactions and NFT verification. - Developer participation surged 230% in 2025, with ZK Layer 2 market projected to reach $90B by 2031 at 60.7% CAGR. - Investors show cautious