Stellar Quietly Sets New On-Chain Records in December — Is a Strong Price Rally Coming?

The Stellar (XLM) network is quietly experiencing a surge in on-chain activity in December 2025. However, muted price action has caused investors to overlook these new records. These signals may reflect positive fundamentals that could support an upcoming price recovery. So what exactly are these new records? What Do Stellar’s New On-Chain Records Mean for

The Stellar (XLM) network is quietly experiencing a surge in on-chain activity in December 2025. However, muted price action has caused investors to overlook these new records.

These signals may reflect positive fundamentals that could support an upcoming price recovery. So what exactly are these new records?

What Do Stellar’s New On-Chain Records Mean for December?

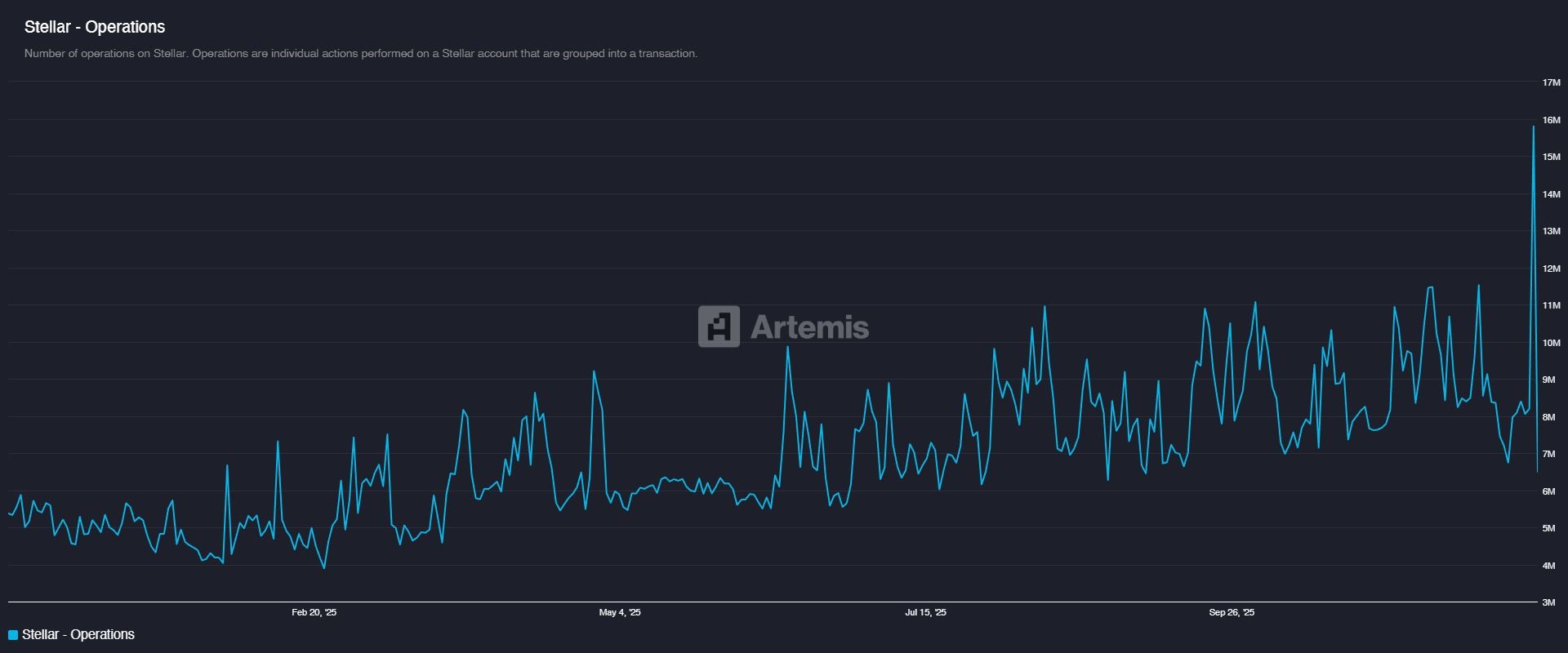

Operations on Stellar represent desired changes on the ledger. They are submitted to the network as grouped components within a transaction.

In December 2025, the number of Operations on Stellar reached the highest level of the year. This milestone marks a notable increase in network activity.

Operations on Stellar. Source:

Operations on Stellar. Source:

Many operations related to Payment or Path Payment indicate a strong flow of cash and assets, increasing the liquidity of the system.

This growth indicates that an increasing number of users, organizations, or applications are processing a greater number of transactions. It signals rising real-world demand.

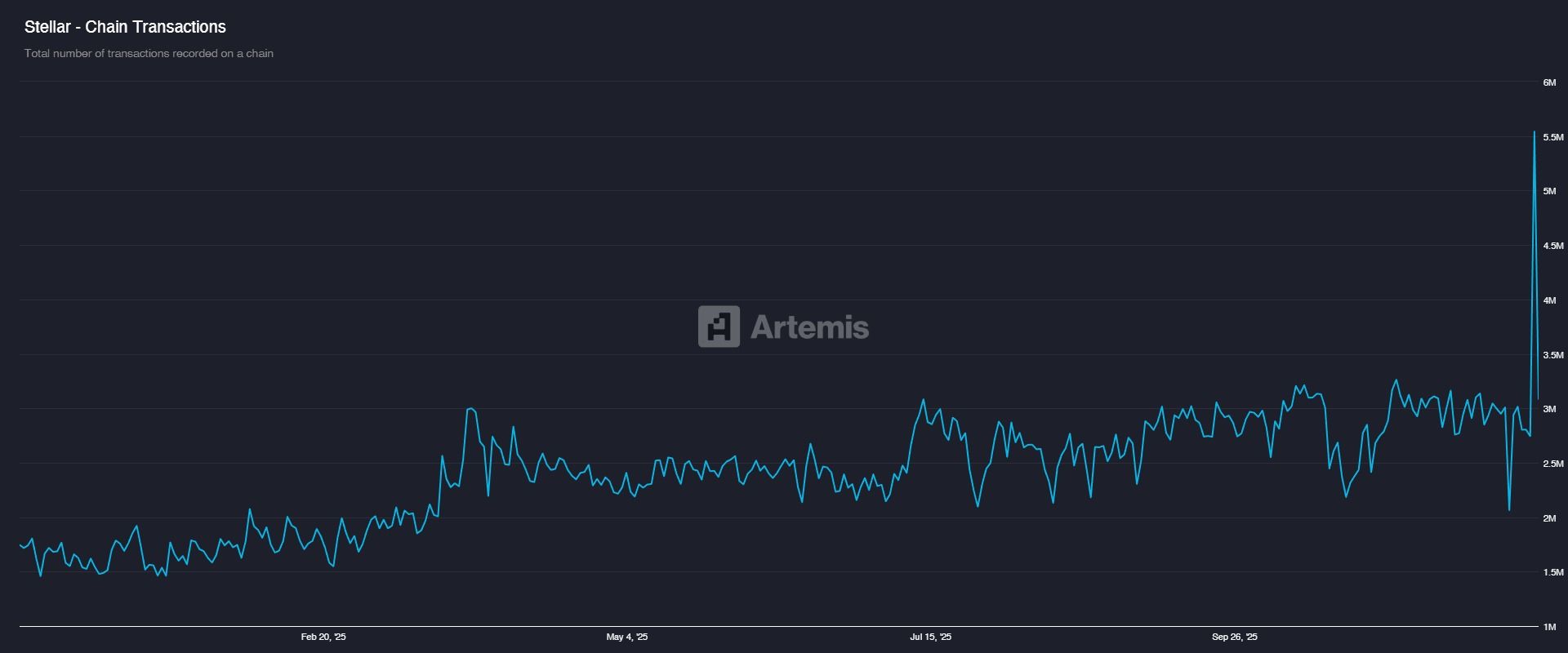

Second, chain transactions are growing steadily and showing signs of a breakout.

Stellar Chain Transactions represent the total number of transactions recorded on the Stellar chain. They include core actions such as asset transfers and smart-contract interactions.

Stellar Chain Transactions. Source:

Stellar Chain Transactions. Source:

Data from Artemis shows that Chain Transactions maintained an upward trend throughout the year. The chart also signals a notable spike in December.

Recently, US Bank — one of the largest commercial banks in the United States — began actively testing stablecoin issuance on the Stellar network. Institutional attention may attract retail interest and boost overall network activity.

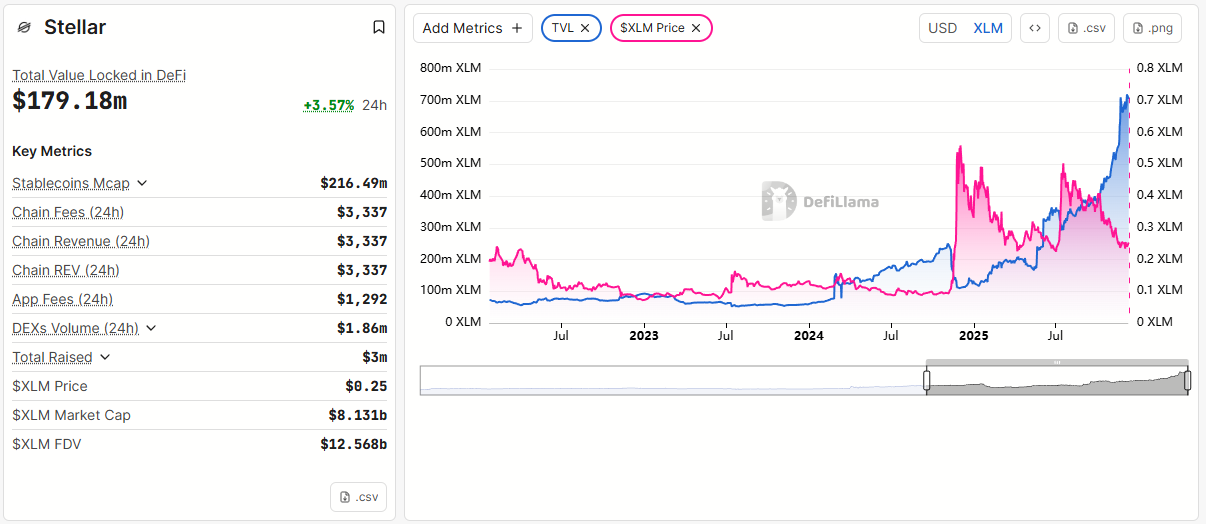

In addition, Stellar’s Total Value Locked (TVL) reached its all-time high in December 2025, surpassing $179.18 million.

Stellar’s Total Value Locked. Source:

Stellar’s Total Value Locked. Source:

TVL increased even though XLM’s price has not recovered. This pattern suggests that investors are locking more XLM into Stellar-based ecosystems.

Despite the strong on-chain activity, XLM currently sits at the most critical support zone of the year. The weekly chart highlights a range of $0.24 to $0.195.

Stellar (XLM) Price Weekly Demand Zone. Source:

Stellar (XLM) Price Weekly Demand Zone. Source:

“XLM/USDT is sitting right at its weekly support — a level that held multiple times in previous market cycles,” analyst CryptoPulse commented.

Analysts view this as an accumulation opportunity for those who expect a wider crypto recovery in late 2025 and early 2026. The next target remains at $0.40–$0.49.

However, fundamental strength does not always move in parallel with price action. Even XRP — an altcoin closely correlated with XLM — has refused to rally despite major developments from Ripple. Therefore, DCA strategies involving capital diversification or waiting until overall market sentiment improves may be less risky options.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How Federal Reserve Policies Influence Emerging Blockchain Assets Such as Solana

- Fed's 2025 rate cuts and liquidity injections initially boosted Solana prices by 3.01% but triggered 6.1% drops during October 2025 liquidations. - Regulatory frameworks like EU MiCA and U.S. GENIUS Act drove 8% institutional ownership of Solana, attracting $101.7M in November 2025 inflows. - 35% of crypto volatility stems from Fed policy shifts, with high-rate environments eroding Solana's appeal as investors favor cash equivalents. - Solana's SIMD-0411 proposal aims to reduce token issuance by $2.9B by

Sustainable Transportation in Cities and the Adoption of Renewable Energy in Developing Economies

- South Africa and India are leading solar-powered transit growth, driven by decarbonization goals and energy security needs in emerging markets. - Solar bus markets project $17.79B value by 2033 (21.6% CAGR), supported by falling solar costs, EV affordability, and policy frameworks in Africa/Asia. - Behavioral economics shapes e-mobility adoption, with South Africa targeting 18,000 tonnes CO₂ reduction via 120 electric buses and India using social nudges to boost EV uptake. - Cross-regional collaboration

A detailed overview of technology layoffs in 2025

PENGU Price Forecast for 2025: Steering Through Regulatory Challenges and Growing Institutional Confidence

- Pudgy Penguins (PENGU) faces regulatory uncertainty from SEC delays and EU MiCA, causing 30% price drops due to compliance risks. - Institutional interest grows with $273K whale accumulation and rising OBV, contrasting retail fear (Fear & Greed Index at 28). - Ecosystem expansion via Pudgy World and penguSOL, plus Bitso partnership, aims to boost utility but depends on user adoption and regulation. - Expert forecasts diverge: $0.02782 (CoinCodex) vs. $0.068 (CoinDCX), with technical analysis highlighting