Fartcoin price prediction: Momentum builds, but breakout pending

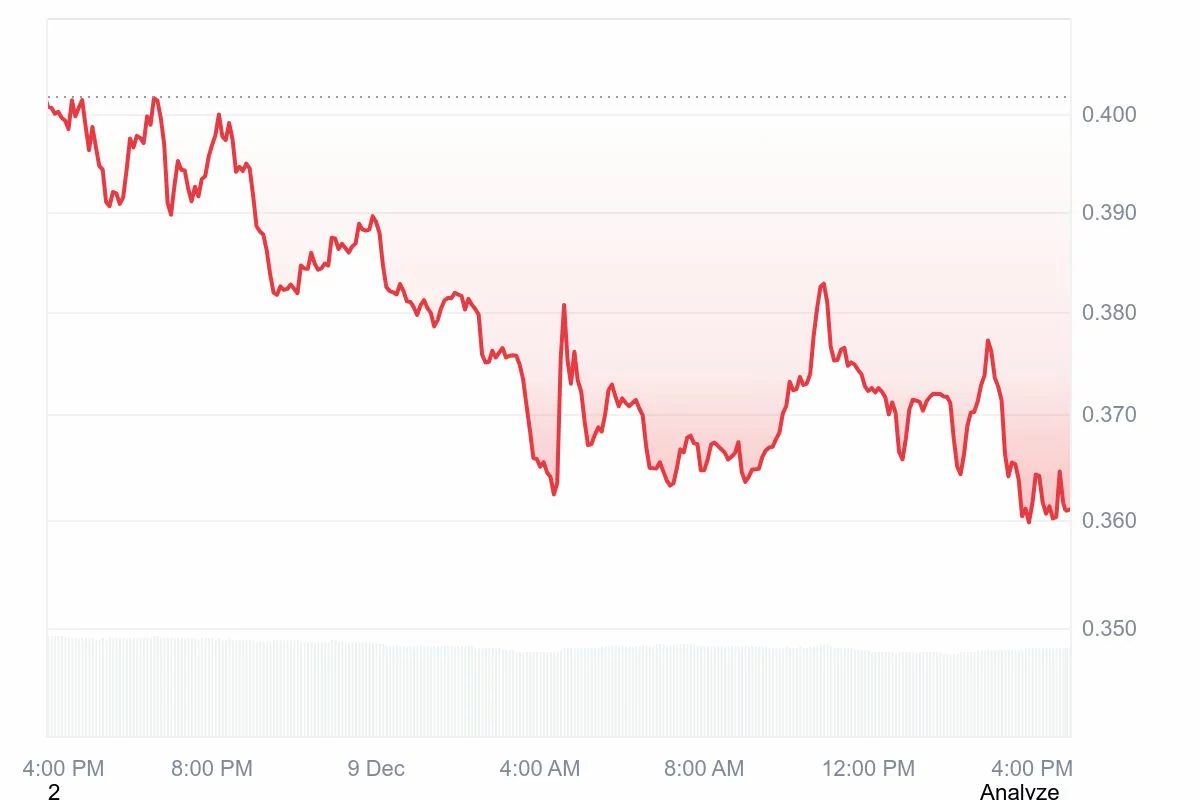

The Fartcoin price has been stuck in a narrow range today, trading between $0.3619 and $0.4035. It’s currently sitting at $0.3616 — more than a 10% drop for the day. Even so, the overall trend hasn’t broken, since Fartcoin is still up 4.3% this week and nearly 15% for the month. What we’re seeing is basically dips being bought while short-term traders take profits at the top.

So, with all that going on, let’s break down the chart and see what the Fartcoin price prediction could be in the short term.

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- Fartcoin price prediction based on current levels

- Fartcoin is trading in a narrow range between $0.36 and $0.40, with support holding around $0.36–$0.37.

- Short-term dips are being bought while traders take profits at resistance, keeping the overall weekly and monthly trend positive.

- A breakout above $0.40–$0.42 could trigger a stronger bullish move toward $0.45.

- A drop below $0.36 could lead to a correction toward $0.32–$0.30.

- The market is at a key decision point, with buyers currently in control but no decisive breakout yet.

Current market scenario

Fartcoin ($FARTCOIN) is managing to protect its $0.36–$0.37 support zone, and every dip into that area has sparked a nice recovery, showing buyers are still active. But higher resistance levels continue to push the price back down, which means the bulls aren’t totally dominating yet.

The price is basically getting squeezed between support and resistance, and that kind of compression usually leads to a strong breakout. The side that wins this battle will set the tone for the Fartcoin outlook.

Upside outlook

From a bullish perspective, things still look pretty promising. As long as the $0.36–$0.37 support holds, the price has space to gather momentum for another upward move. If buyers step up and take back the short-term moving averages, the next target is $0.40–$0.42 — a resistance zone Fartcoin has hit trouble with before.

A solid daily close above that zone would flip sentiment in a big way and support a stronger Fartcoin forecast. With hype building across social platforms and memecoin money moving around, bulls have a realistic chance of heading back to those levels soon.

Downside risks

Even so, sellers still carry some weight here. A clean break below $0.36 would undermine the current support setup and open the door for a deeper correction. If that happens, the price may drift back toward the $0.30 imbalance area that’s still waiting to be filled.

Hitting that zone could shake out the weaker hands and trigger stop-losses, pushing volatility up. It’s a secondary scenario for now, but still worth keeping an eye on — especially if the broader crypto market weakens or Bitcoin drops sharply.

Fartcoin price prediction based on current levels

Considering the recent swings, Fartcoin is sitting at an important decision point. Either direction is still possible.

Bullish scenario: If buyers lift the price above $0.39, targets at $0.42 and possibly $0.45 open up, matching an optimistic Fartcoin price prediction.

Bearish scenario: Losing $0.36 would hand control to sellers, likely dragging the price toward $0.32 or $0.30.

Bulls are in charge for the time being, but a decisive breakout hasn’t happened yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating the Fluctuations of Bitcoin in Late 2025: Adaptive Risk Management Approaches for an Evolving Cryptocurrency Landscape

- Bitcoin's November 2025 price swung between $80,553 and $91,000, eroding 25% of value amid macroeconomic and regulatory pressures. - Volatility stemmed from technical breakdowns, leveraged liquidations, and market makers' gamma exposure shifts below $85,000. - U.S. GENIUS Act and EU MiCA framework provided regulatory clarity, boosting institutional adoption through compliant ETPs and stablecoins. - Investors adopted risk-rebalance strategies: options hedging, macro-adjusted DCA, and diversified crypto tr

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit