Bitcoin Breaks Above $94,000 After Week-Long Stagnation, Here’s Why

Bitcoin has snapped out of a week-long stagnation, breaking above $94,000 after holding between $88K–$92K for days. Whale accumulation, forced liquidations, shifting regulatory tone, and rate-cut expectations appear to have triggered the move as markets brace for the FOMC decision.

Bitcoin has surged sharply above $94,000, ending a multi-day stretch of flat trading between $88,000 and $92,000. The breakout arrived suddenly on December 9, accelerating within minutes and breaking the range that capped the market for nearly a week.

Whale Accumulation and Short-Side Liquidations Drive the Breakout

Trading data shows heavy inflows into major institutional and exchange-linked wallets in the hour leading into the rally.

Several high-volume custodial addresses accumulated thousands of BTC in a short window, indicating deep liquidity buyers moved first before the squeeze took hold.

🚨 BREAKING:HERE'S EXACT REASON WHY BITCOIN JUST PUMPED:BINANCE BOUGHT 7,298 BTCCOINBASE BOUGHT 3,412 BTCWINTERMUTE BOUGHT 2,174 BTCBLACKROCK BOUGHT 1,362 BTCRANDOM WHALE BOUGHT 6,192 BTCTHIS IS THE BIGGEST INSIDER PUMP EVER!!

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) December 9, 2025

The velocity of the breakout suggests order books thinned quickly once demand breached range resistance. A rapid shift in market structure followed, with momentum building as shorts began closing under pressure.

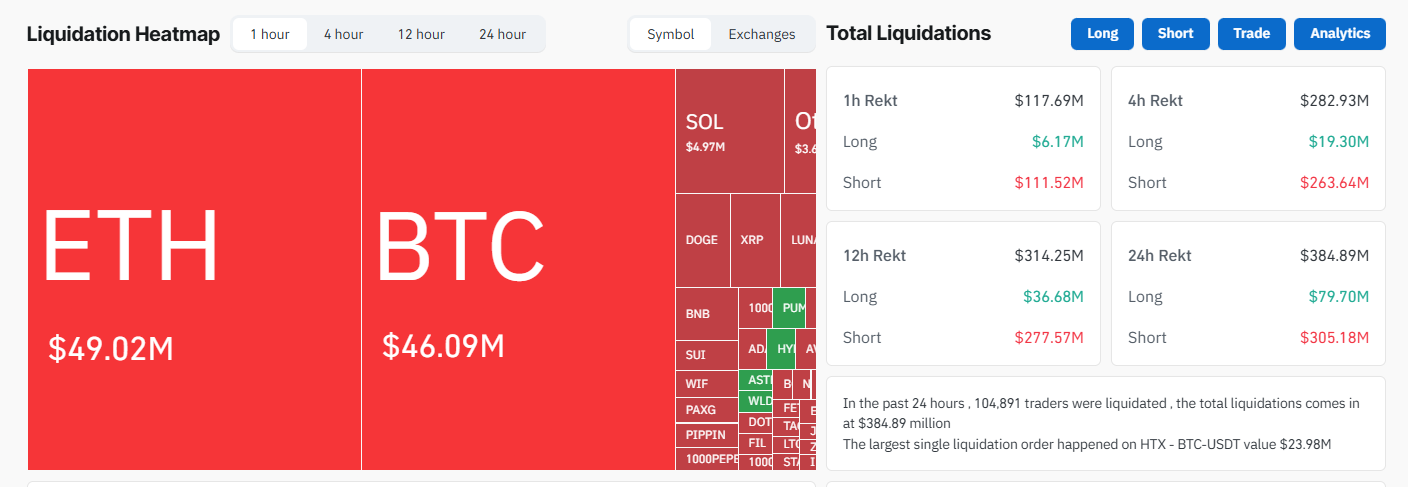

Liquidation data confirms that futures markets absorbed the move aggressively. More than $300 million in total crypto liquidations occurred over the past 12 hours, with Bitcoin accounting for over $46 million and Ethereum above $49 million.

Most liquidations were short positions, signalling that the move was a classic squeeze rather than a gradual trend build.

As cascading stops triggered, price expansion accelerated vertically with little counter-supply present.

Regulatory Support and FOMC Anticipation Fuel Sentiment

The rally followed a notable policy update from the US Office of the Comptroller of the Currency, which confirmed banks may engage in riskless principal crypto transactions. The decision allows regulated institutions to intermediate crypto flow without holding assets directly.

This shift expands potential institutional access, and its timing, just hours before the breakout, may have encouraged positioning.

OCC Interpretive Letter 1188 confirms that a national bank may engage in riskless principal crypto-asset transactions as part of the business of banking.

— OCC (@USOCC) December 9, 2025

With the Federal Reserve rate decision approaching, traders now expect easier liquidity conditions if rate cuts are confirmed.

Bitcoin remains near intraday highs with volatility elevated and funding resetting across derivatives. Markets will watch whether follow-through demand holds into the FOMC announcement or if profit-taking cools momentum at the top.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit

LUNA Falls by 5.77% Over 24 Hours Despite Fluctuating Medium-Term Performance

- LUNA fell 5.77% in 24 hours to $0.1512, but rose 47.52% in 7 days and 105.96% in 30 days. - However, it still faces a 64.14% annual loss, highlighting crypto market volatility and long-term risks for investors. - The price swing reflects sensitivity to macroeconomic shifts and sentiment, with analysts noting ongoing uncertainty in forecasts. - Investors are weighing recent resilience against regulatory challenges and institutional behavior shifts, monitoring if the drop signals a bearish trend or tempora

The Downfall of ChainOpera AI Token: An Alert for AI-Based Cryptocurrency Investments

- ChainOpera AI (COAI) token's 96% collapse in late 2025 highlights systemic risks in AI-driven crypto assets, prompting reevaluation of governance and regulatory frameworks. - Centralized ownership (88% by top 10 holders) and governance flaws at C3.ai exacerbated volatility, undermining decentralization and investor trust. - The crisis triggered sector-wide sell-offs, shifting capital to meme coins, while 2025 regulatory penalties rose 417% to $1.23B, intensifying scrutiny. - Experts warn speculative AI-c