PIPPIN Price Rally Hits 150%, Will It Continue?

PIPPIN has emerged as one of the strongest performers in the AI Agent token market, rallying sharply over the past few days. The impressive surge has pushed the token into the spotlight, with investors now questioning whether PIPPIN can extend this momentum. PIPPIN Investors Are Showing Skepticism The Chaikin Money Flow (CMF) shows that PIPPIN

PIPPIN has emerged as one of the strongest performers in the AI Agent token market, rallying sharply over the past few days.

The impressive surge has pushed the token into the spotlight, with investors now questioning whether PIPPIN can extend this momentum.

PIPPIN Investors Are Showing Skepticism

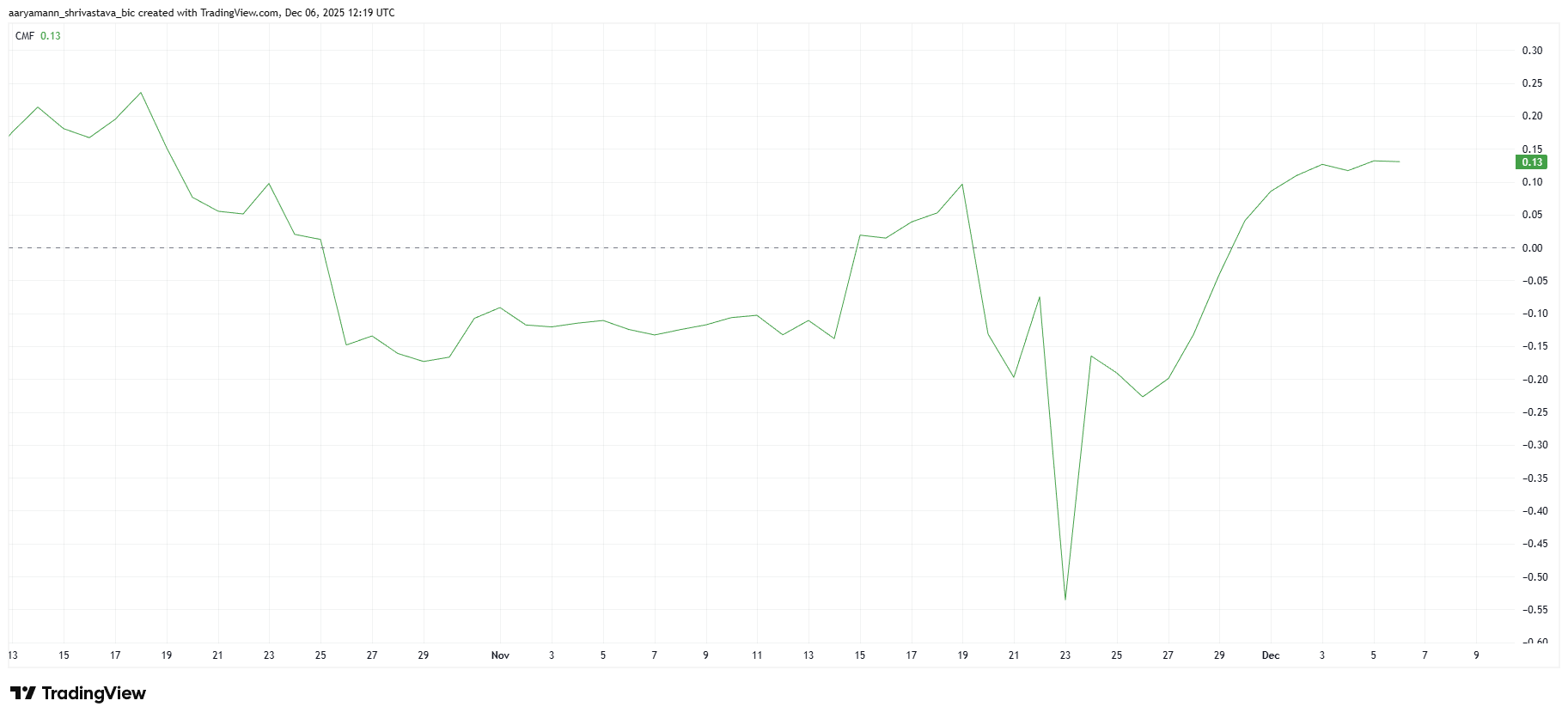

The Chaikin Money Flow (CMF) shows that PIPPIN recently enjoyed a period of strong inflows. This signaled rising confidence and capital entering the market.

Yet the indicator is now flattening, pointing to slowing inflows. A decline in fresh capital could limit PIPPIN’s ability to sustain its rally, making upward movement more difficult.

This shift suggests that investors are becoming more cautious. Without consistent inflow support, PIPPIN may struggle to maintain its current momentum.

The AI Agent token depends heavily on sentiment-driven surges, and the diminishing strength of the CMF could keep the token from climbing further in the near term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

PIPPIN CMF. Source:

PIPPIN CMF. Source:

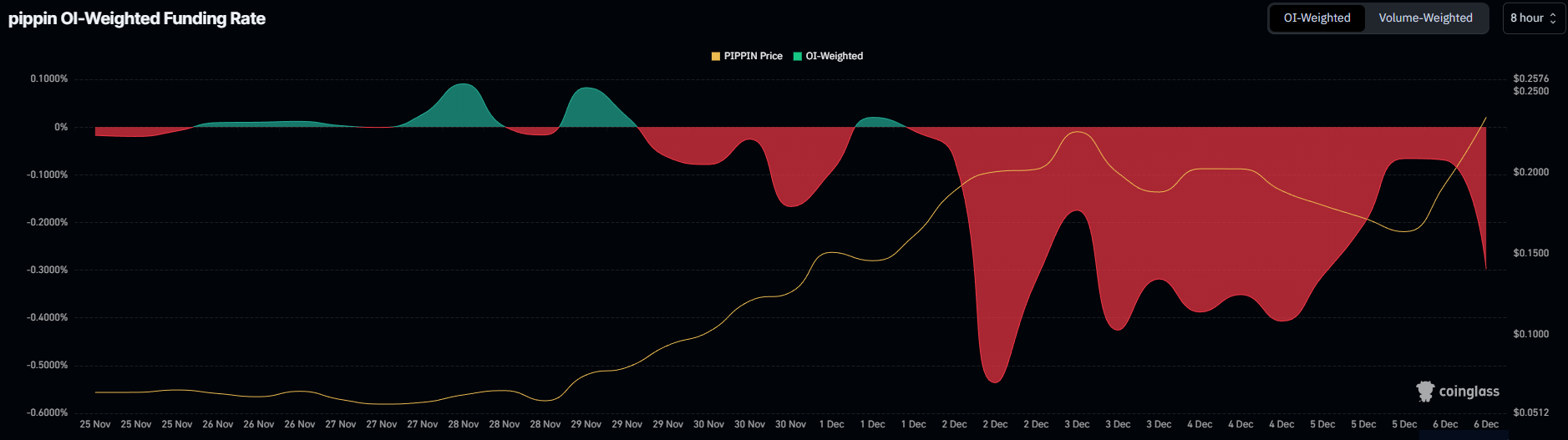

The broader outlook is complicated by the funding rate, which shows a heavily bearish structure. A negative funding rate means that most traders are opening short positions, expecting PIPPIN to fall. This widespread bearish positioning reflects low confidence among derivatives traders.

Such sentiment can weigh down price action, as short sellers often accelerate downward pressure. Unless market conditions flip, this pessimistic stance may become a significant hurdle for PIPPIN and stall any attempt at a long-term rally.

PIPPIN Funding Rate. Source:

PIPPIN Funding Rate. Source:

PIPPIN Price Has Some Barriers To Breach

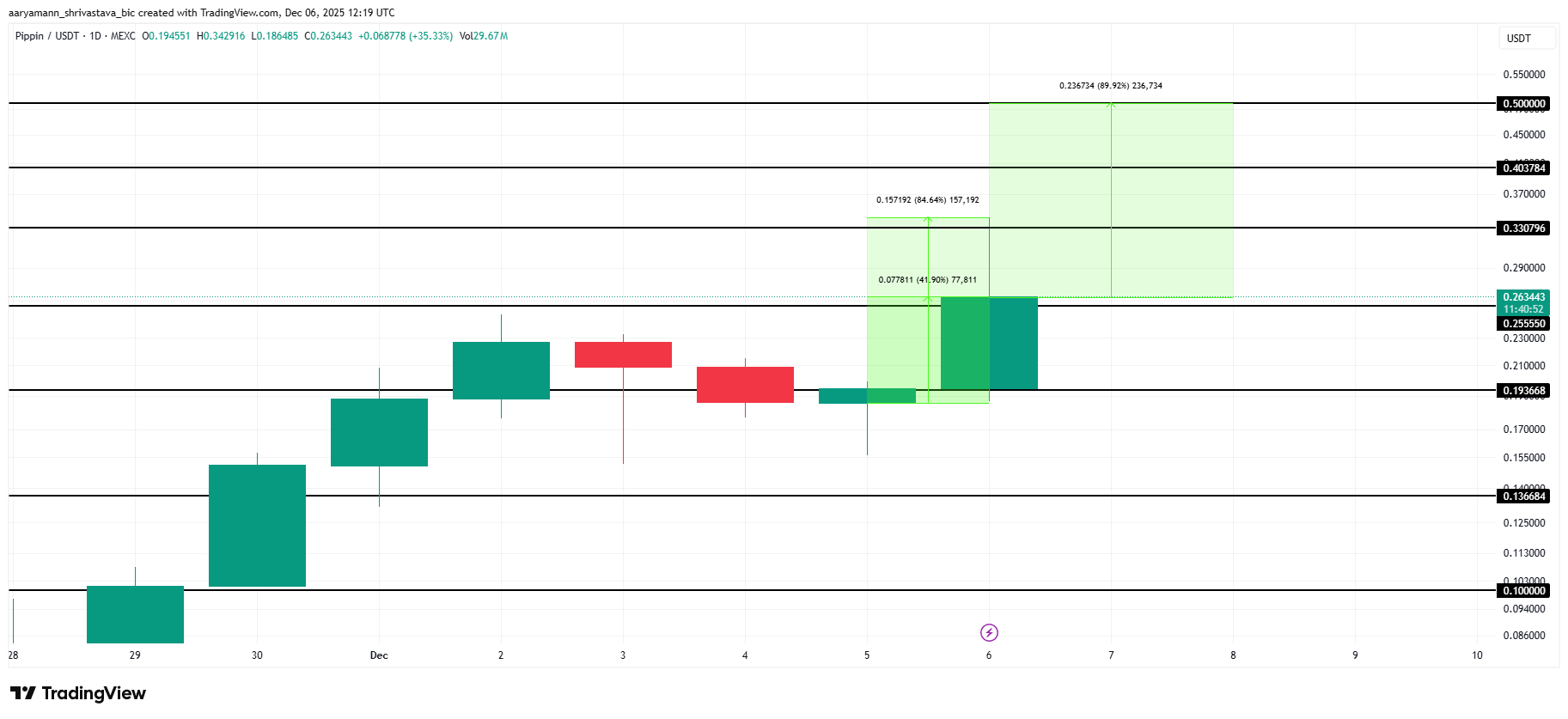

PIPPIN is trading at $0.263, holding just above the $0.255 support level. The AI Agent token is still up nearly 42% today and briefly noted an 84% intra-day rise, reflecting strong volatility. However, breaking higher will require strong conviction from investors.

Reaching $0.500 demands a near 90% rally from present levels. Given slowing inflows and a negative funding rate, this target may be difficult. Instead, PIPPIN could remain closer to the $0.193 support, with a fall toward $0.136 possible if holders begin securing profits.

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source:

But if bullish sentiment returns and fresh capital flows back into the market, PIPPIN could break past the $0.330 and $0.403 resistance levels. Surpassing these barriers would open the path toward $0.500, invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Internet Computer Makes a Comeback: Could This Be the Next Major Force in Web3 Infrastructure?

- Internet Computer (ICP) leverages post-quantum cryptography (PQC) and decentralized governance to position itself as a Web3 infrastructure leader amid quantum computing threats. - By integrating NIST-endorsed lattice-based algorithms and hybrid TLS, ICP addresses "harvest now, decrypt later" risks, outpacing 8.6% of websites in PQC adoption. - Its Network Nervous System (NNS) incentivizes long-term staking through neurons, aligning token holder interests with protocol upgrades and deflationary mechanisms

Crypto News Today: Why Bitcoin Dropped Despite Bullish Institutional Signal

PENGU's Notable 7-Day Price Decline: Analyzing Market Reactions and Key Drivers of Crypto Fluctuations

- Pudgy Penguins (PENGU) fell 4.32% in 7 days and 52.55% in 30 days as of Nov 26, 2025, reflecting crypto market fragility. - A $19B October 2025 liquidity crisis triggered cascading liquidations, amplifying PENGU's 30%+ declines amid memecoin sector weakness. - Fear & Greed Index at 27 (extreme fear) and $50M+ long liquidations highlight panic-driven selling and algorithmic trading dynamics. - Technical indicators show conflicting signals: bearish RSI vs. bullish MACD/OBV, with $0.0235 resistance critical