Zcash Price Struggle Below $400 Is Down To Bitcoin, Here’s How

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400. The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again. Zcash Pulls Away

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400.

The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again.

Zcash Pulls Away From Bitcoin

The correlation between Zcash and Bitcoin has been slipping in recent days, dipping back below the zero line. A negative correlation means ZEC is no longer moving in tandem with BTC’s price direction.

While this may initially seem neutral, it introduces an unusual risk dynamic. If Bitcoin rallies, Zcash may fail to benefit from broader market optimism.

Conversely, if Bitcoin falls sharply, ZEC could unexpectedly move higher, but with no guarantee of sustained strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC Correlation To Bitcoin. Source:

ZEC Correlation To Bitcoin. Source:

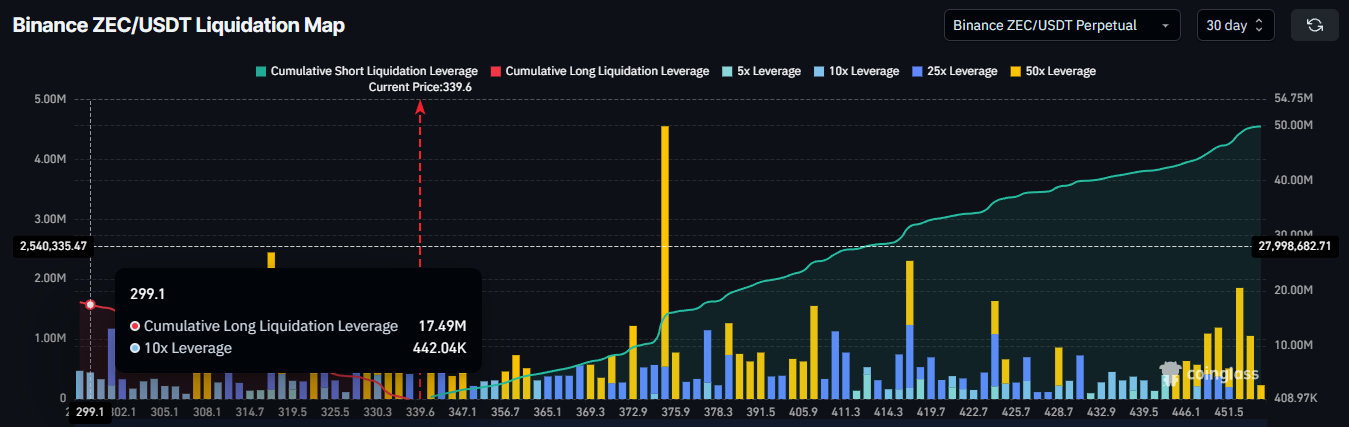

The liquidation map adds another layer of caution for ZEC holders at the moment. Long traders are facing elevated liquidation risk, with nearly $17.49 million in long contracts exposed if ZEC drops to $300 or below.

These potential liquidations represent a major pressure point for bullish sentiment.

If prices approach this threshold, cascading liquidations could accelerate downward movement. Such events often prompt traders to exit long positions and discourage new long exposure, contributing to a feedback loop that reinforces bearish momentum.

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

ZEC Price Faces Resistance

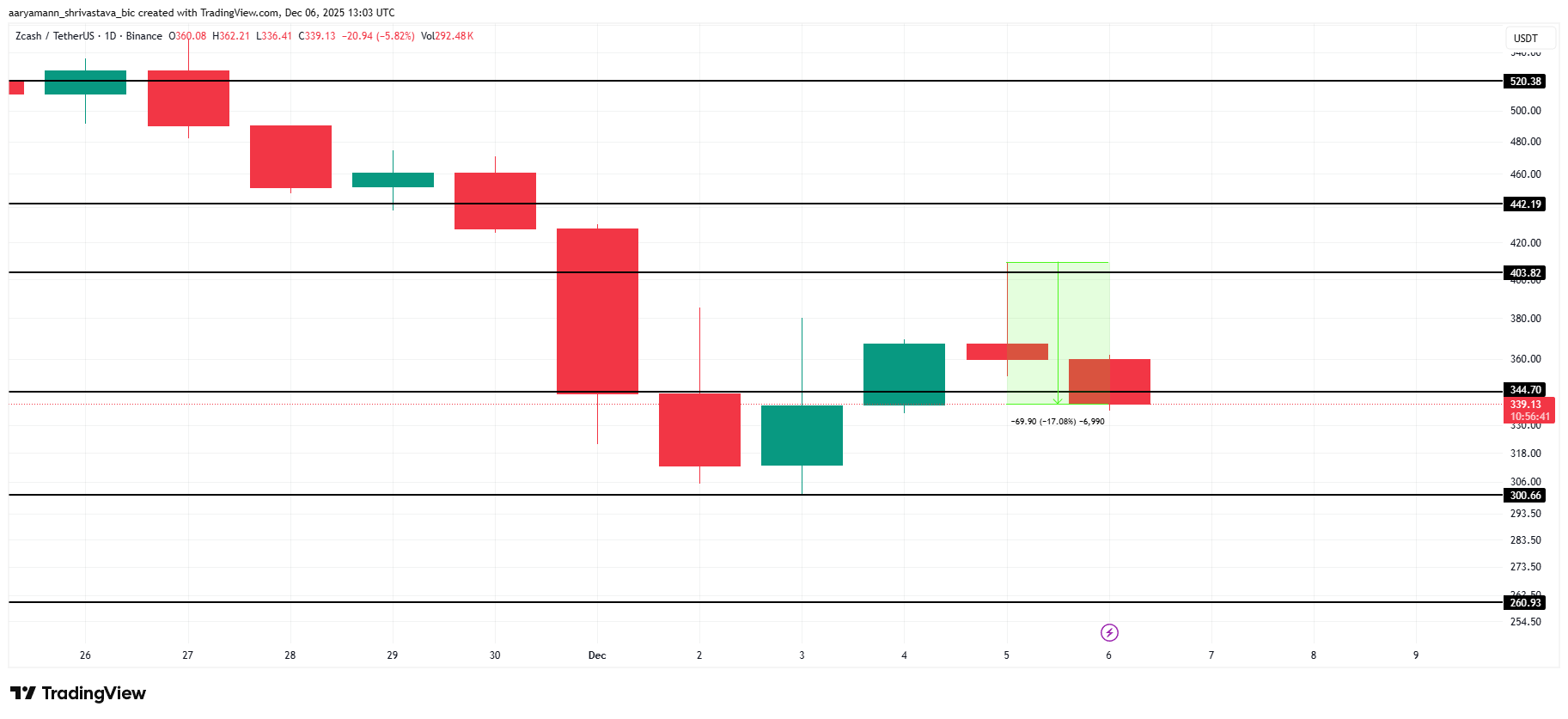

ZEC is trading at $339 and is hovering around the $344 support level after its steep decline from intra-day highs. The sharp sell-off and weakening market structure suggest that further downside is possible in the near term.

If bearish momentum continues, ZEC could fall toward the critical $300 support. Losing this level would likely trigger the $17.49 million liquidation cluster. This could potentially push the price down to $260 as forced selling intensifies.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, if momentum shifts and buyers return, ZEC could stabilize at $344 and attempt a recovery toward $403. A successful breakout above this level would invalidate the bearish thesis and restore confidence among long traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit

LUNA Falls by 5.77% Over 24 Hours Despite Fluctuating Medium-Term Performance

- LUNA fell 5.77% in 24 hours to $0.1512, but rose 47.52% in 7 days and 105.96% in 30 days. - However, it still faces a 64.14% annual loss, highlighting crypto market volatility and long-term risks for investors. - The price swing reflects sensitivity to macroeconomic shifts and sentiment, with analysts noting ongoing uncertainty in forecasts. - Investors are weighing recent resilience against regulatory challenges and institutional behavior shifts, monitoring if the drop signals a bearish trend or tempora