Why Did Bitcoin Drop Below $90,000 Again? A Breakdown of the Latest Sell-Off

Bitcoin slipped back under $90,000 as leverage unwound, ETF flows dried up, and traders braced for U.S. inflation data. A wave of long liquidations, macro tension, and cautious positioning drove the decline, leaving BTC at a critical support zone.

Bitcoin slipped under $90,000 this week as liquidation pressure, weak ETF demand, and macro uncertainty converged.

The fall erased gains from earlier attempts to reclaim the $94,000–$95,000 zone, marking the second major breakdown this month.

Forced Liquidations Across the Market

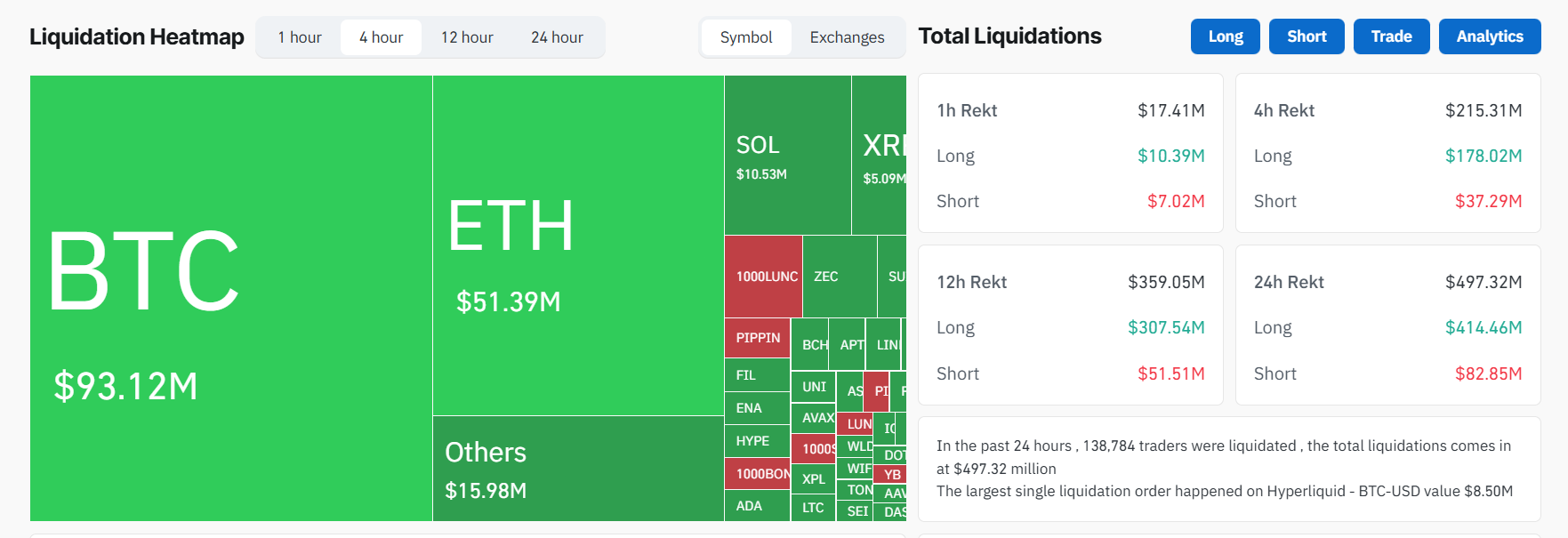

The catalyst was a cascade of forced long liquidations. Nearly $500 million was wiped out across exchanges, including around $420 million in long positions, and over 140,000 traders were liquidated in a 24-hour window.

Crypto Liquidations Today. Source:

CoinGlass

Crypto Liquidations Today. Source:

CoinGlass

ETF flows failed to absorb the selling. BlackRock’s iShares Bitcoin Trust recorded six straight weeks of outflows totaling more than $2.8 billion.

US ETF inflows fell to just $59 million on December 3, signalling fading appetite from institutions.

US Bitcoin ETFs Saw Nearly $195 Million Outflow on December 4, 2025. Source:

SoSoValue

US Bitcoin ETFs Saw Nearly $195 Million Outflow on December 4, 2025. Source:

SoSoValue

Macro Pressure Added Fuel to the Drop

The macro backdrop turned hostile. The Bank of Japan signaled a possible rate hike, threatening the carry-trade liquidity that helped sustain global risk assets.

Traders also derisked ahead of the US PCE inflation release, forcing Bitcoin into a cautious $91,000–$95,000 holding pattern.

BREAKING: Bitcoin pumped $1500 on the lower than expected PCE data. But then it crashed -$3500 in 60 minutes.This wiped out $155 million worth of long positions in last 1 hour.There is no negative news or sudden FUD which could cause this type of sudden dump.It appears that… pic.twitter.com/G3twQw0Yud

— Bull Theory (@BullTheoryio) December 5, 2025

The latest US PCE data arrived broadly in line with expectations, showing cooling core inflation but still above the Federal Reserve’s target.

Markets reacted cautiously, interpreting the print as evidence that inflation continues to ease, but not fast enough to guarantee rapid rate cuts.

Corporate signals amplified the fear. MicroStrategy warned it may sell Bitcoin if its treasury-valuation ratio weakens, triggering a 10% decline in its stock.

Miner stress increased as energy costs rose, hashrate fell, and high-cost operators began liquidating BTC to remain solvent.

On-chain flows reflected split sentiment. Matrixport moved more than 3,800 BTC off Binance into cold storage, suggesting accumulation among long-term holders.

However, analysts estimate that a quarter of all circulating supply remains underwater at current prices.

Matrixport has withdrawn 3,805 $BTC($352.5M) from #Binance over the past 24 hours.https://t.co/GLzqCvlogX pic.twitter.com/54whKSsISy

— Lookonchain (@lookonchain) December 5, 2025

Community Sentiment Shows Fear — With Pockets of Optimism

Traders on social platforms debated whether the move was natural or manipulated. Market analysts largely blamed excess leverage, thin liquidity, and macro-hedging rather than coordinated price intervention.

Others pointed to long-term optimism, citing JPMorgan’s fresh $170,000 price model for 2026.

Bitcoin now trades near a critical pivot. Liquidation clusters between $90K and $86K leave the market vulnerable without renewed ETF inflows or easing macro pressure.

A move back above $96,000–$106,000 is needed to confirm recovery momentum.

For now, volatility rules the tape. Bitcoin has fallen, rebounded, and broken again — and traders are watching for the next decisive move.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Token Crypto: High-Risk Speculation or the Future Breakthrough?

- HYPE token's 2025 speculative surge stems from strategic partnerships, on-chain utility expansions, and mixed market signals. - Hyperion DeFi's Felix collaboration and $30M repurchase program aim to boost HYPE's institutional appeal and staking value. - Price volatility saw $53-$71 highs in December 2025, followed by sharp declines to $28.81 amid bearish technical indicators. - Risks include 10M token unlocks, limited exchange listings, and reliance on internal value mechanisms amid market sentiment shif

Hyperliquid's Growing Popularity Among the Public and Its Impact on the Structure of the Crypto Market

- Hyperliquid dominates 73% of 2025 decentralized derivatives market with $320B July trading volume and 518K+ user addresses. - HIP-3 Growth Mode slashes taker fees by 90%, enabling hybrid liquidity models that blend DeFi transparency with CEX speed. - Institutional adoption and 97% fee buybacks drive HYPE token's 380% surge, while $4.9M manipulation loss highlights retail-driven risks. - Platform's two-tier market structure and tokenomics reshape liquidity dynamics, but regulatory scrutiny and volatility

Momentum ETF (MMT) and the Intersection of Retail Hype and Institutional Backing in November 2025

- Momentum ETF (MMT) surged 1,330% in Nov 2025 due to retail frenzy and institutional validation. - Binance airdrop and Sui-based perpetual futures DEX boosted retail demand through liquidity and yield incentives. - $10M HashKey funding and $600M TVL validated MMT's institutional credibility under CLARITY Act/MiCA 2.0 frameworks. - ve(3,3) governance model and token buybacks created flywheel effects, aligning retail/institutional incentives. - Q1 2026 Token Generation Lab aims to expand Sui ecosystem proje

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips