HBAR Price Enters Consolidation As Hedera Pulls Away From Bitcoin

Hedera’s HBAR is moving sideways after several days of muted trading, reflecting the broader market’s lack of clear direction. Despite this stagnation, HBAR holders appear increasingly active in shaping momentum, with early signs showing a potential shift away from bearish pressure. Hedera Is Not Willing To Follow The King The Chaikin Money Flow (CMF) indicator

Hedera’s HBAR is moving sideways after several days of muted trading, reflecting the broader market’s lack of clear direction.

Despite this stagnation, HBAR holders appear increasingly active in shaping momentum, with early signs showing a potential shift away from bearish pressure.

Hedera Is Not Willing To Follow The King

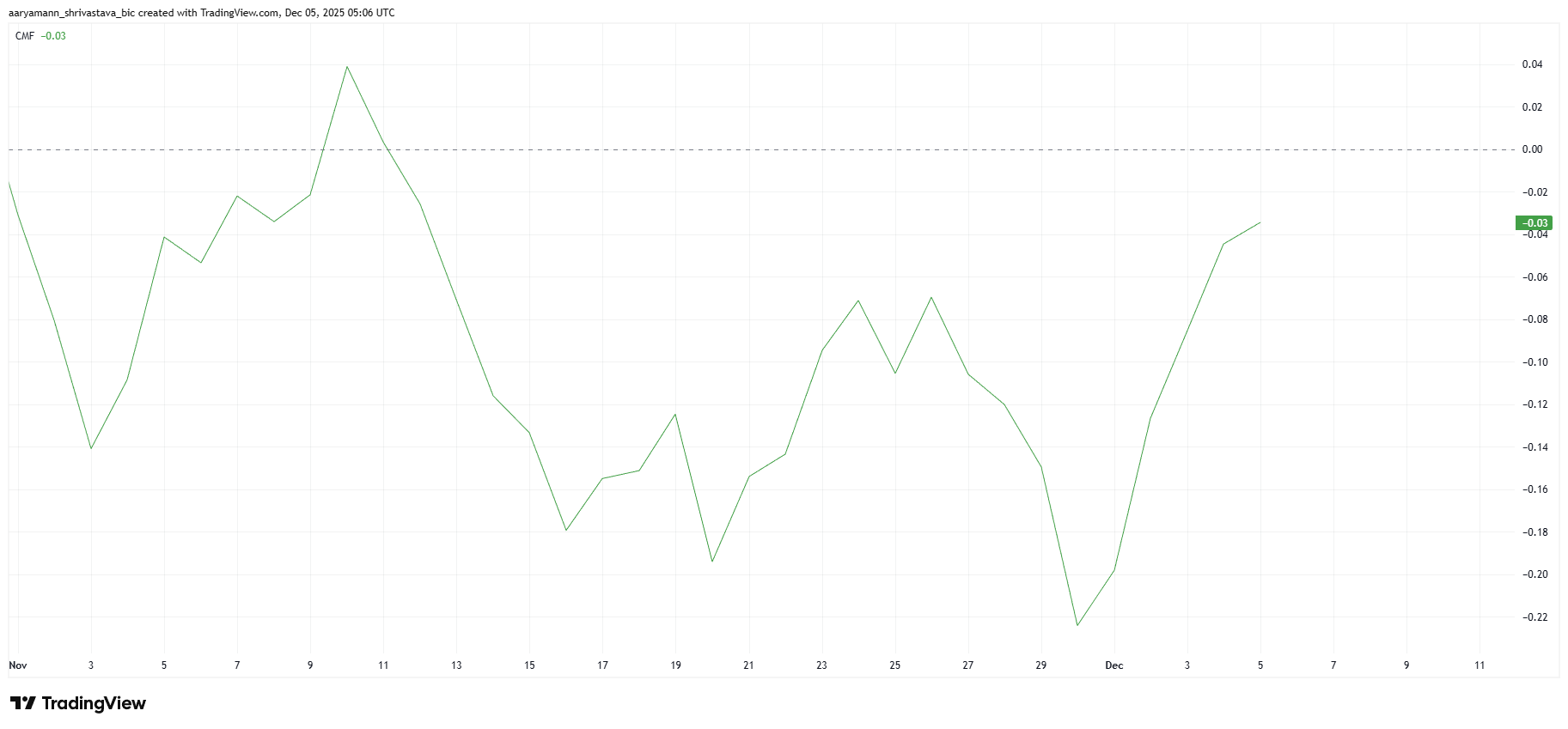

The Chaikin Money Flow (CMF) indicator is showing a sharp uptick, signaling a rapid slowdown in outflows. This trend is notable because it suggests that selling pressure is easing meaningfully. As investors pull back from offloading tokens, sentiment gradually shifts toward a more constructive outlook.

If the CMF continues improving and crosses above the zero line, HBAR will officially register net inflows. Such a shift would highlight renewed confidence among traders and provide fuel for upward price movement. Sustained inflows often coincide with strengthened momentum, which could help HBAR break out of its current range.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR CMF. Source:

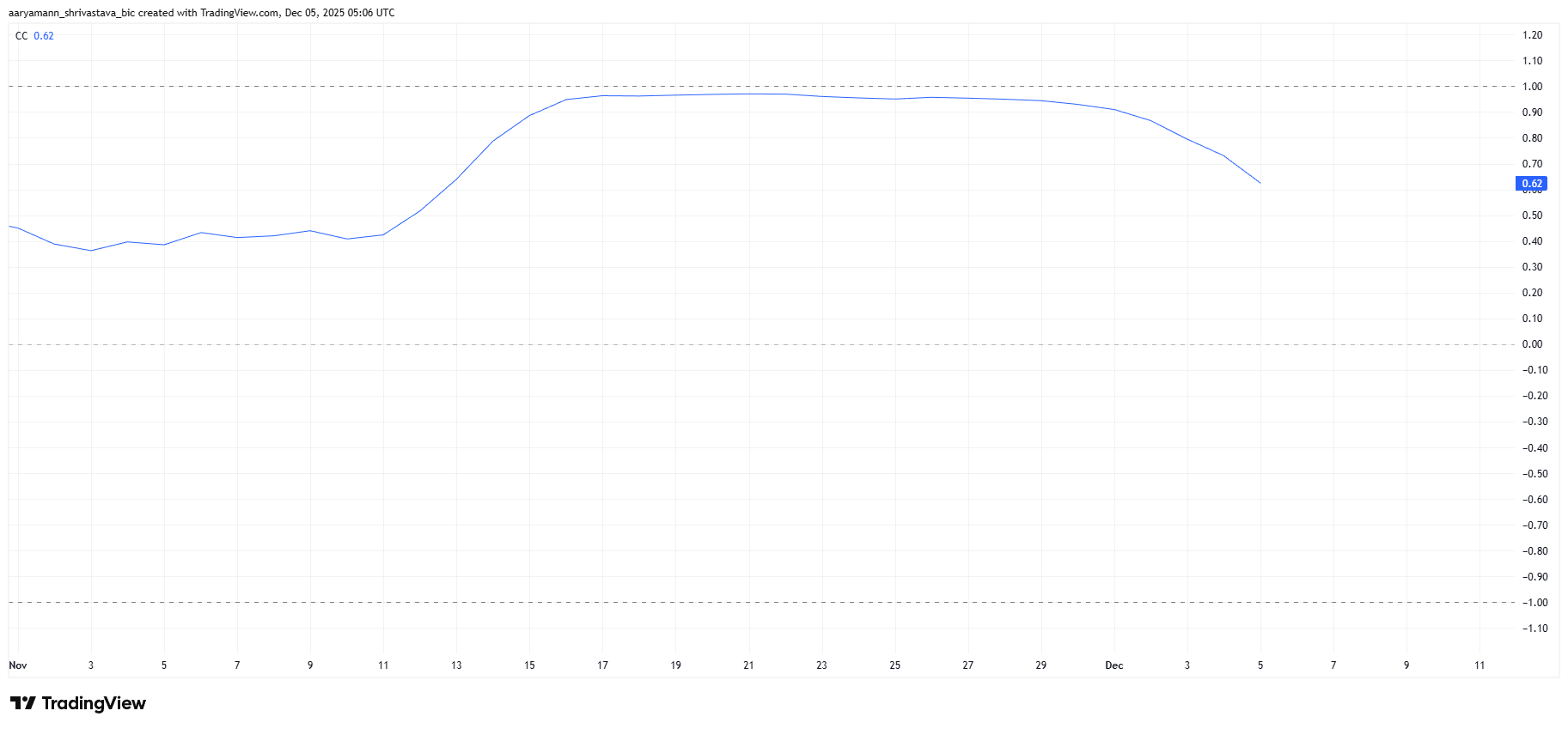

HBAR’s declining correlation with Bitcoin offers another important signal. After remaining tightly correlated with BTC for more than three weeks, the metric has now slipped to 0.62. This decoupling means HBAR is becoming less dependent on Bitcoin’s trend and may be preparing to chart its own direction.

HBAR CMF. Source:

HBAR’s declining correlation with Bitcoin offers another important signal. After remaining tightly correlated with BTC for more than three weeks, the metric has now slipped to 0.62. This decoupling means HBAR is becoming less dependent on Bitcoin’s trend and may be preparing to chart its own direction.

This divergence could prove beneficial because Bitcoin remains directionless and has yet to establish a clear recovery path. If HBAR continues detaching from BTC while investor sentiment improves, the altcoin may outperform the broader market and capture independent upside momentum.

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

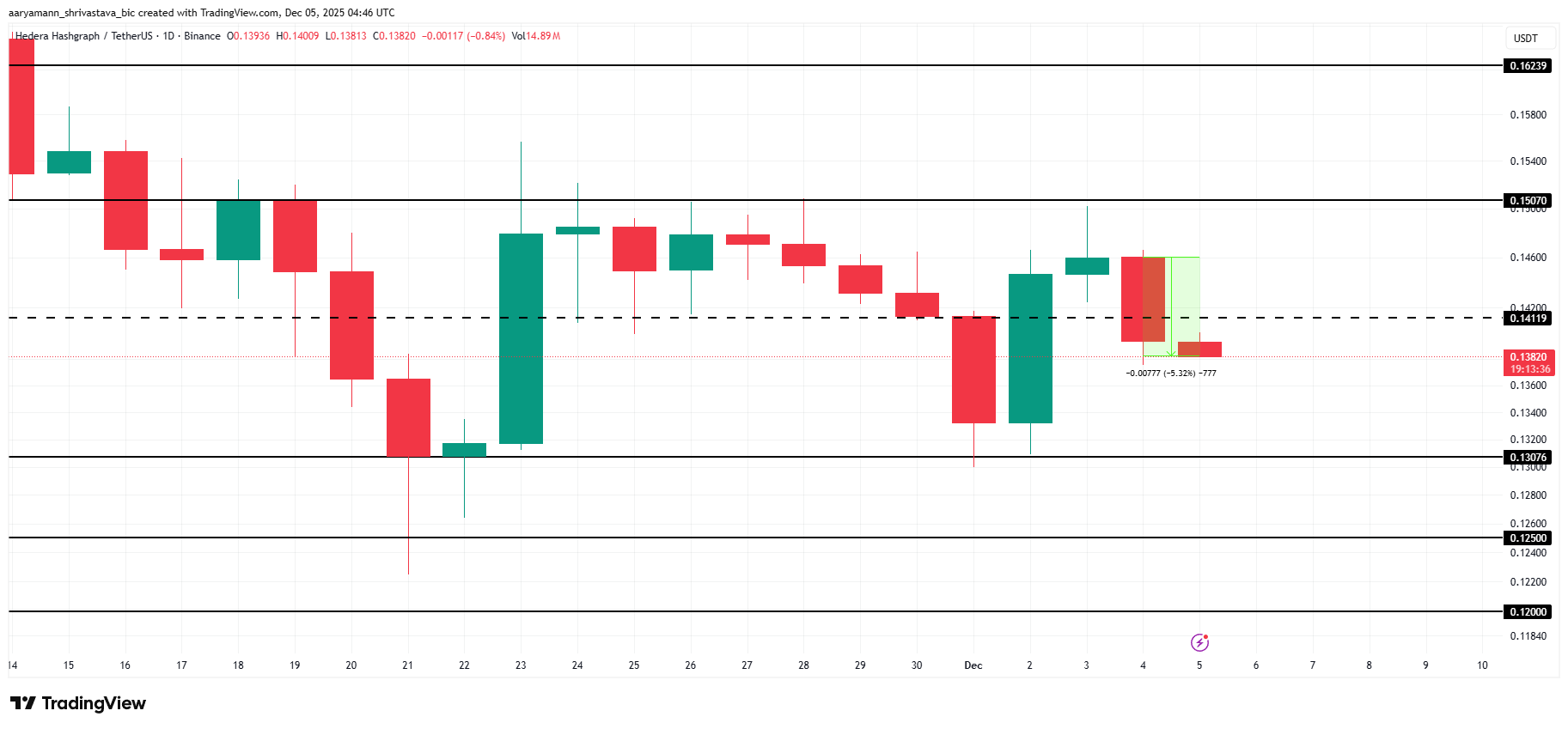

HBAR Price Can Continue Moving Sideways

HBAR’s price is down 5% in the last 24 hours, continuing its rangebound movement between $0.150 and $0.130 for nearly three weeks. This sideways action is likely to persist unless a strong catalyst emerges. Still, the improving CMF signals a potential shift building beneath the surface.

If HBAR capitalizes on strengthening investor support, it could bounce from the $0.141 local support level and retest $0.150. A successful breakout above this barrier would open the path toward $0.162, supported by rising inflows and reduced selling pressure.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if investor confidence weakens again, HBAR may slip toward the key $0.130 support. Losing this level would invalidate the bullish-neutral outlook and expose the price to a decline toward $0.125.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Significant Price Decline in Late November 2025: Is the Market Overreacting or Does This Present a Contrarian Investment Chance?

- ChainOpera AI (COAI) plummeted 90% in late 2025 due to CEO resignation, $116M losses, and regulatory ambiguity from the CLARITY Act. - Market panic and 88% supply concentration in top wallets amplified the selloff, while stablecoin collapses worsened liquidity risks. - Contrarians highlight C3 AI's 26% YoY revenue growth and potential 2026 regulatory clarity as signs of mispriced long-term AI/crypto opportunities. - Technical indicators suggest $22.44 as a critical resistance level, with analysts warning

Hyperliquid (HYPE) Price Rally: An In-Depth Look at Protocol Advancements and Liquidity Trends

- Hyperliquid's HYPE token surged 3.03% amid HIP-3 upgrades enabling permissionless perpetual markets and USDH stablecoin launch. - Protocol innovations boosted liquidity by 15% but failed to halt market share erosion to under 20% against competitors like Aster. - Structural challenges persist through token unstaking, unlocks, and OTC sales, yet HyENA's $50M 48-hour volume signaled renewed engagement. - Whale accumulation of $19.38M near $45-46 and HYPE buybacks aim to stabilize price, though long-term suc

ChainOpera AI Token Plummets Unexpectedly: Is This a Warning Sign for Crypto Investors Focused on AI?

- ChainOpera AI's 96% value collapse in late 2025 exposed critical risks in centralized, opaque AI-driven crypto projects. - 87.9% token concentration in ten wallets enabled manipulation, while untested AI algorithms and lack of audits eroded trust. - Regulatory ambiguity from delayed U.S. CLARITY Act and EU AI Act created fragmented frameworks, deterring institutional participation. - Post-crash trends prioritize decentralized governance, auditable smart contracts, and compliance with AML/KYC protocols fo

Modern Monetary Theory and the Transformation of Cryptocurrency Valuation Models in 2025

- Modern Monetary Theory (MMT) reshaped crypto valuation in 2025, transitioning digital assets from speculative tools to institutional liquidity instruments amid low-yield environments. - Central banks and 52% of hedge funds adopted MMT-aligned CBDCs and regulated stablecoins, with BlackRock's IBIT ETF managing $50B as crypto gained portfolio diversification status. - Regulatory divergence (e.g., U.S. CLARITY Act vs. New York BitLicense) created volatility, exemplified by the Momentum (MMT) token's 1,300%