Date: Thu, Dec 04, 2025 | 03:46 PM GMT

The broader cryptocurrency market continues to lift higher as Ethereum (ETH) trades firmly in green, up over 3% in the last twenty-four hours. That recovery wave has helped several memecoins regain traction — including Fartcoin (FARTCOIN), which is outperforming with a strong 13% daily climb.

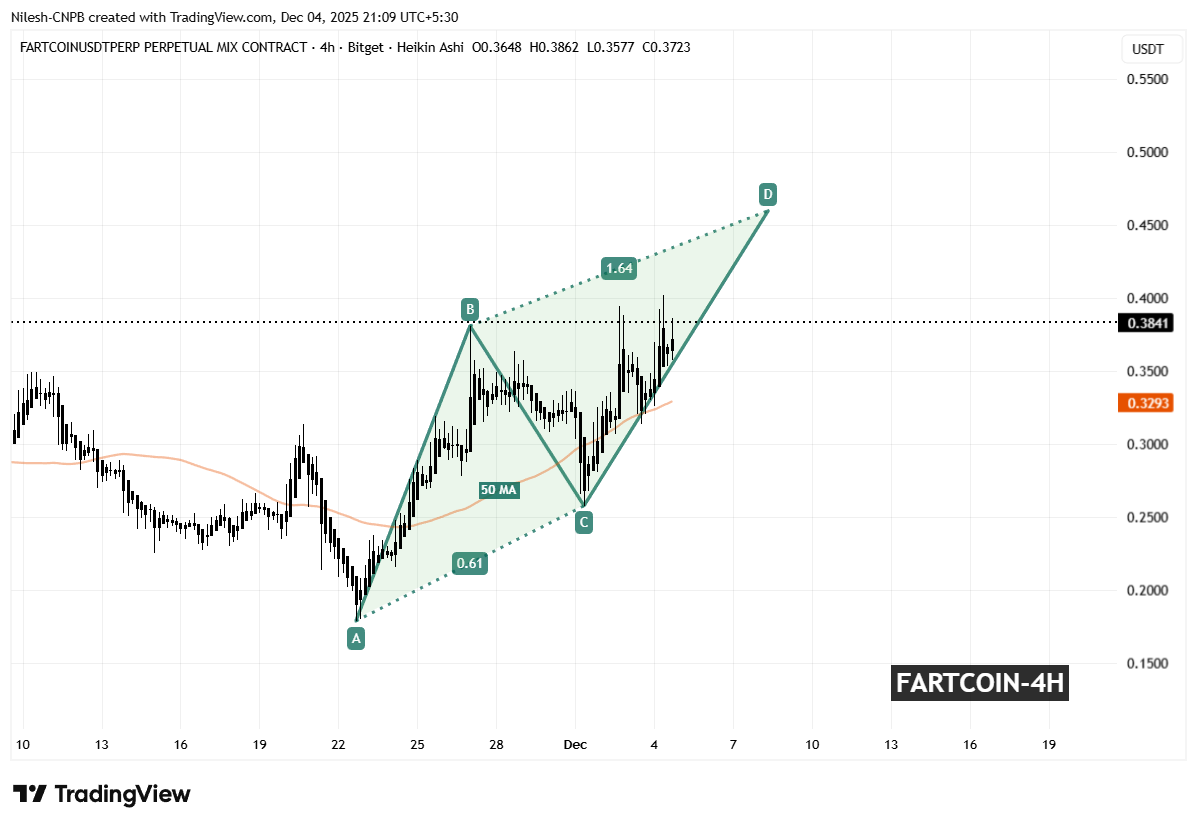

Beyond the price jump, the 4H structure is now displaying a clean harmonic development that suggests this move may not be done yet.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Bullish Continuation

FARTCOIN is currently shaping an ABCD harmonic pattern, with the CD leg expanding to the upside. While harmonics of this nature can eventually mature into a reversal zone, the market usually delivers a final extension burst before the pattern reaches its terminal area. In other words, the same formation that will later cool the trend is first known for fueling its strongest leg.

Point A established itself around $0.18, followed by an aggressive rally toward Point B near $0.3841. After that peak, price entered a healthy retracement cycle, drifting lower into Point C around $0.3293 — perfectly tagging the 50-period moving average. The reaction there was key, as buyers immediately stepped back in, defending the structure and restoring upward pressure.

Fartcoin (FARTCOIN) 4H Chart/Coinsprobe (Source: Tradingview)

Fartcoin (FARTCOIN) 4H Chart/Coinsprobe (Source: Tradingview)

Since rebounding off the MA, the CD leg has accelerated, allowing FARTCOIN to reclaim levels back toward $0.3841. With price now traveling inside the final expansion wave, attention shifts to the completion zone.

What’s Next for FARTCOIN?

If the ABCD structure continues to play out, the CD leg could stretch toward the 1.64 Fibonacci projection of the BC segment, aligning the Potential Reversal Zone (PRZ) near $0.46. This level stands approximately 19% above current prices — a zone where traders often begin preparing for either a short-term pullback or an eventual reversal.

For now, momentum remains aligned with the bullish continuation narrative, as long as the CD leg structure stays intact. The 50 MA at $0.3293 stands out as the immediate line of defense. Losing that area would weaken the harmonic trajectory and could open another corrective sweep before any renewed upside attempt forms.

With the pattern still active and momentum carrying through the completion leg, FARTCOIN is positioned to extend higher, though traders should remain aware of the eventual exhaustion zone as the D-point approaches.