Date: Thu, Dec 04, 2025 | 03:18 AM GMT

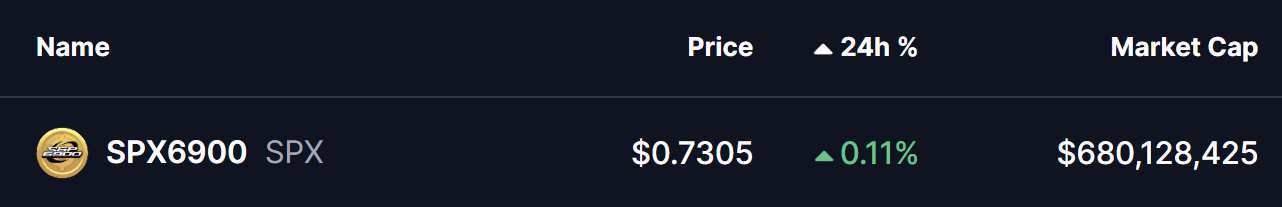

The broader cryptocurrency market is showing notable upside momentum as both Bitcoin (BTC) and Ethereum (ETH) trade in strong green. ETH is up more than 6% in the last 24 hours, helping several memecoins recover — including SPX6900 (SPX).

SPX is showing modest gains today, but more importantly, the chart is printing a classic bullish pattern that could support a powerful upside continuation if a breakout occurs.

Source: Coinmarketcap

Source: Coinmarketcap

Inverse Head and Shoulders Pattern in Play

On the daily chart, SPX has formed a clean inverse head and shoulders — widely viewed as one of the most dependable bullish reversal patterns.

The left shoulder formed early last month, followed by a deeper move down toward the $0.4344 region to establish the head. From there, bulls regained control, creating a higher low at $0.5830, marking the right shoulder. Since then, SPX has pushed higher and is now trading directly inside the neckline resistance band around $0.7275–$0.7509.

SPX6900 (SPX) Daily Chart/Coinsprobe (Source: Tradingview)

SPX6900 (SPX) Daily Chart/Coinsprobe (Source: Tradingview)

This neckline has been tested multiple times but has yet to give way. The zone has acted as a stubborn supply region for over a month. A decisive daily close above $0.7509 would confirm the inverse head and shoulders structure and could serve as the ignition point for a strong bullish expansion.

What’s Ahead for SPX?

If SPX successfully breaks above the neckline at $0.7509, the inverse head and shoulders target points toward a move toward $1.0674, representing a potential 46% rally from the breakout level.

A clean breakout followed by a retest of the neckline would offer the strongest confirmation of trend reversal. This move would also align with the broader market’s improving sentiment as liquidity continues returning to altcoins and memecoins.

For now, all eyes remain on the neckline. A decisive push above it could open the door for SPX’s next major leg higher.