Key Notes

- BONK.fun has redirected 51% of its fees toward BONK accumulation through the BNKK DAT.

- BNKK seeks to secure 5% of BONK’s circulating supply as a strategic reserve.

- A breakout above $0.00001100 could trigger bullish momentum for BONK.

BONK.fun, a Solana meme coin generator, has announced major changes its fee structure. The protocol revealed that 51% of its fees will shift toward BONK BONK $0.000010 24h volatility: 0.4% Market cap: $819.22 M Vol. 24h: $88.37 M accumulation through the BNKK Decentralized Autonomous Treasury (DAT).

Starting today, 51% of the BONKfun fees will be used for the BNKK DAT buying of BONK.

The 51% of fee distribution will come from the prior 35% of Buy/Burn, 4% SBR and 2% from BONKrewards categories and add to the existing 10% currently being used for the BNKK DAT.

With these… pic.twitter.com/pz8e7008vg

— BONK.fun (@bonkfun) December 4, 2025

BONK Gathers Momentum

The share comes from prior fee routes, i.e., 35% from Buy/Burn, 4% from SBR, and 2% from BONK rewards, then merges with the current 10% for BNKK DAT. This change maintains identical net buy pressure on BONK, yet redirects resources for a larger aim.

The BNKK team now focuses on a target of 5% of BONK’s circulating supply for its strategic reserve. However, operations and community budgets stay untouched.

Meanwhile, according to CoinMarketCap data , BONK trades at $0.000009924, down 14% in the past month. However, the meme token still holds a valuation above the $800 million market cap with a trading volume of $93 million.

Also, as per earlier reports, FiCAS AG subsidiary Bitcoin Capital issued a BONK ETP to give both traders regulated access to the meme coin. The ETP went live on Switzerland’s SIX Swiss Exchange.

BONK Price Analysis: Token Near a Possible Shift

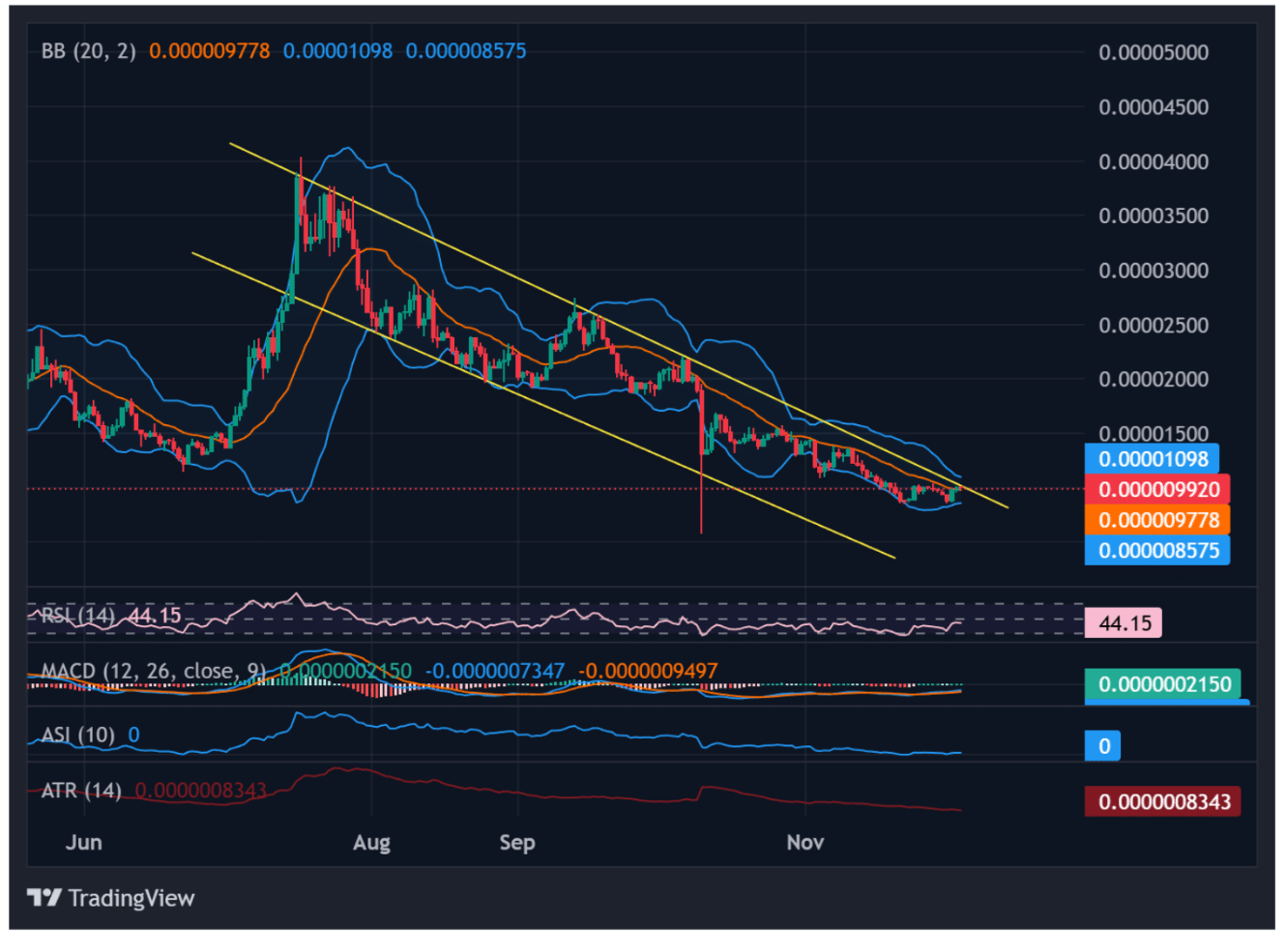

The BONK chart shows that the meme coin is trading deep inside a descending channel that began after the late-summer peak. Current price hovers near $0.00000974 with upper and lower Bollinger values at $0.00001098 and $0.000008576.

Price remains close to the lower Bollinger Band, a zone that often shows exhaustion. The channel lines converge near current prices, hinting at a possible break attempt.

RSI sits at 44.54 while MACD shows values near 0.0000002185 on the signal zone with light positive separation. Volatility stays low as ATR shows 0.0000008307.

BONK inside descending channel | Source: TradingView

From this structure, a bullish breakout would only materialize if BONK breaks out above $0.00001100 and then tests $0.00001500. If BONK crosses above the channel with strong volume, the mid-summer highs may come back into view.

On the other hand, failure to hold $0.00000850 may trigger a drop toward $0.00000700. However, with 51% of fees now directed toward BONK acquisition and BNKK moving toward its 5% supply goal, BONK is one of the best meme coins to buy in 2025 .

next