8 Million MONAD Sold By Whales In 24 Hours, Could Price Suffer?

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts. As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead. Monad Whales Turn To Selling

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts.

As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead.

Monad Whales Turn To Selling

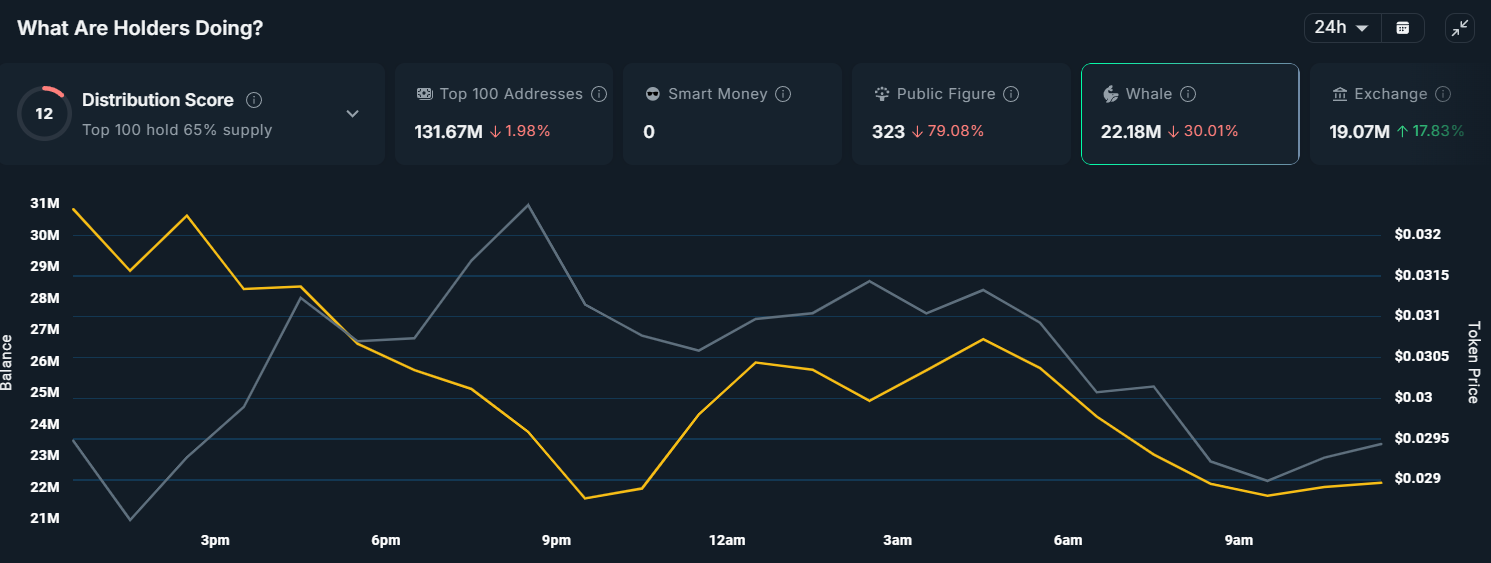

Whale activity has become a major concern for MONAD holders this week. On-chain data shows that large wallets holding more than $1 million worth of MONAD — excluding exchanges — sold over 8 million tokens in just 24 hours. This scale of distribution signals a clear decline in confidence among influential holders, who often drive major price movements.

Their exit from the asset could create additional downward pressure if the trend accelerates.

Such aggressive whale selling typically reflects expectations of further decline or a desire to reduce exposure during periods of volatility. Since these wallets hold a significant supply, their collective moves can sway price direction sharply.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Monad Whale Activity. Source:

Monad network analytics

Monad Whale Activity. Source:

Monad network analytics

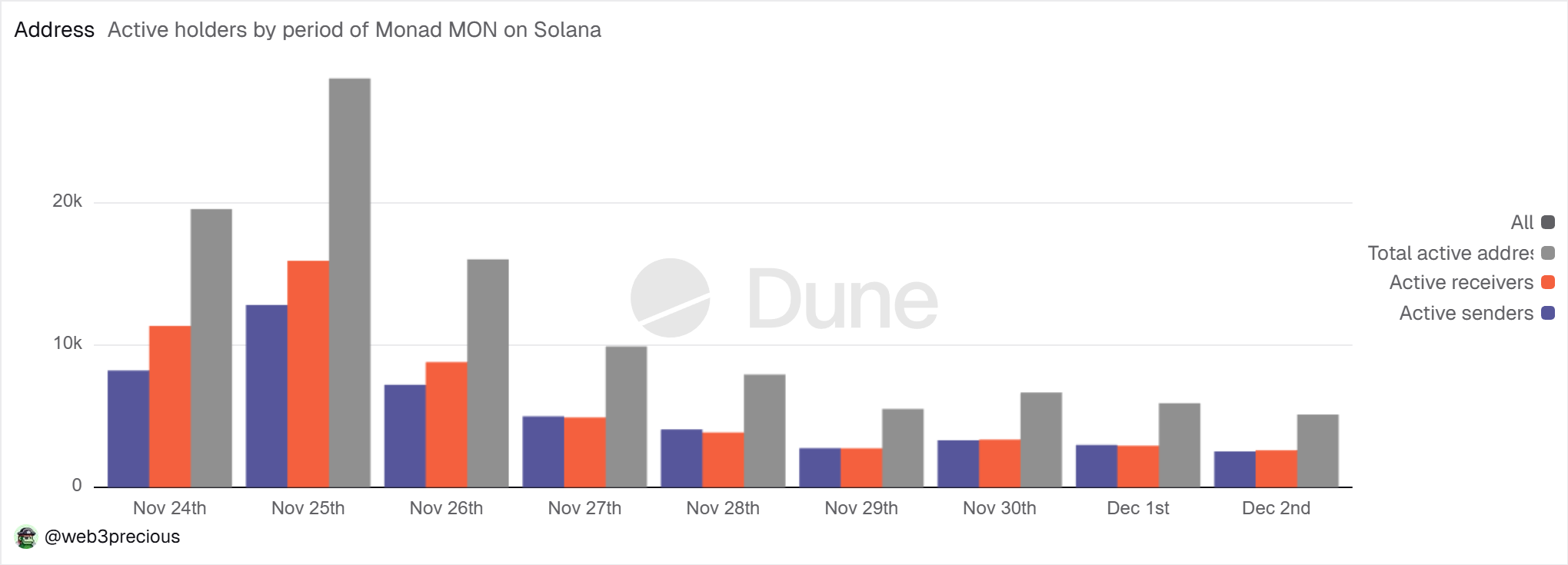

The broader activity on the Monad network also paints a cautious picture. Active addresses have been steadily falling over the past week, with activity nearly flatlining in the last few days. Active addresses represent users interacting with the chain, whether through sending, receiving, or executing transactions.

This drop in activity reflects uncertainty among MONAD holders. As long as market conditions remain unfavorable, user engagement may stay muted, limiting the organic demand needed to support price recovery. A revival in active addresses is essential for regaining momentum.

Monad Active Addresses. Source:

Monad network analytics

Monad Active Addresses. Source:

Monad network analytics

MONAD Price Might See Decline

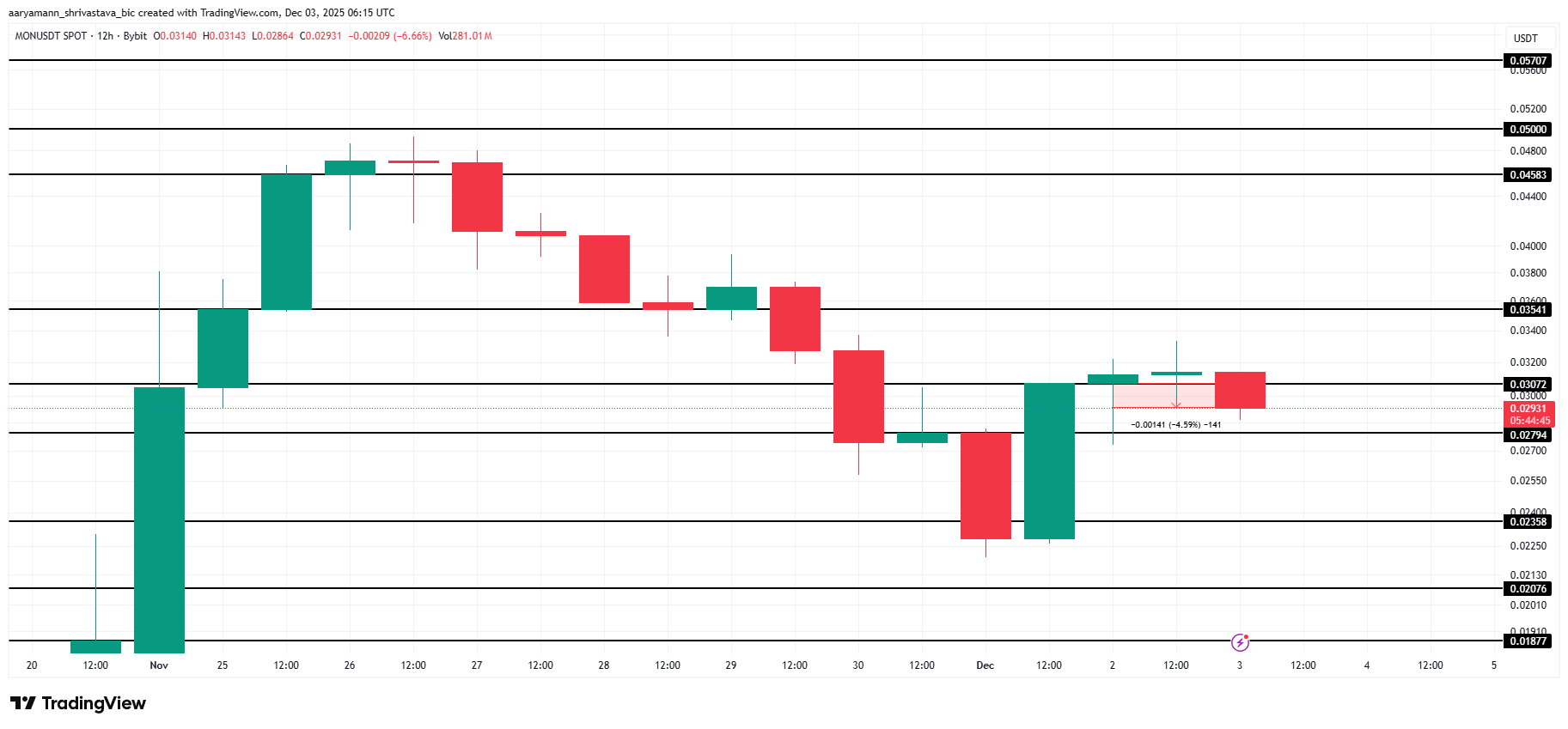

Monad’s price is down 5% in the past 24 hours, trading at $0.029 at the time of writing. The altcoin is attempting to establish short-term support within the $0.027 to $0.030 range as it searches for stability.

However, the pressures highlighted above suggest further downside risk. If whale selling continues and network participation weakens further, MONAD could fall toward the key support at $0.023, deepening losses for holders.

Monad Price Analysis. Source:

Price analytics

Monad Price Analysis. Source:

Price analytics

On the positive side, if bullish momentum returns and whales pause their distribution, MONAD could recover. A bounce from $0.030 would allow the token to target $0.035, with a potential extension to $0.045. A move into this zone would invalidate the bearish outlook and restore investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anthropology and Innovation: Leveraging Cultural Understanding to Propel Technological and Business Advancement

- Anthropology bridges human-technology gaps by decoding cultural patterns in AI, business, and education. - Ethnographic methods enhance product design (e.g., Intel , Adidas) and reduce AI implementation risks via cultural alignment. - Anthropology-driven corporate training boosts ROI 2-3x in cross-cultural communication and diversity initiatives. - Venture capital increasingly uses "predictive anthropology" to forecast markets, though "impact washing" risks persist. - Cross-disciplinary integration of an

AI-Powered Token Fluctuations: Insights Gained from the ChainOpera AI Token Downturn

- ChainOpera AI's COAI token collapsed 90% in late 2025 due to hyper-centralized supply, governance flaws, and regulatory ambiguity. - The crash triggered market instability, exposing vulnerabilities in AI-driven crypto ecosystems reliant on speculative hype rather than intrinsic value. - Anthropological insights and interdisciplinary models like CAVM are proposed to improve governance and valuation frameworks for decentralized AI projects. - Structural safeguards including diversified token supply, hybrid

MMT Token's Latest Price Jump: Temporary Hype or Genuine Breakthrough?

- MMT token surged 1,330% post-Binance listing in late 2025 but fell 37.37% over 30 days amid crypto market weakness. - Market analysis highlights oversold RSI-7 (19.23) and weak buying interest, while Bitcoin dominance rose to 58.13%. - MMT launched buybacks and a perpetual futures DEX to stabilize value, but top 100 holders control 20.4% of circulating supply. - Experts note speculative GME-like retail frenzy alongside DeFi utility, predicting 2025 price range of $0.4342-$0.8212.

Stripe and Paradigm’s Payments-Focused Blockchain Tempo Launches Public Testnet