December 3 Key Market Insights - A Must Read! | Alpha Morning Report

1. Top News: Crypto Market Experiences Rebound with Universal Price Surge, SUI and PENGU Up Over 20% 2. Token Unlocking: $HMX, $GFAL, $WMTX

Featured News

1. Cryptocurrency Market Sees Rebound Rally, SUI and PENGU Surge Over 20%

2. Trump Suggests Hassett Will Succeed Powell as Fed Chair, Criticizes Powell for Not Cutting Rates

3. Vanguard Reverses Course on Navigation Attitude, Bank of America Advises Interested Investors to Allocate 1%-4% to Digital Assets

4. Anthropic Initiates IPO Preparation, Earliest Listing Possible in 2026

5. $3.76 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Short Positions

Articles & Threads

1. "Major Update for Global Social Platform Telegram - Your GPU Can Now Mine TON"

Yesterday, Telegram founder Pavel Durov tweeted the launch of their decentralized privacy-preserving computation network, Cocoon. Anyone can become a worker node and earn $TON by leveraging their GPU. Cocoon enables GPU owners to contribute AI compute power to the TON decentralized network. By running the Cocoon protocol stack on a TEE-supported GPU server, one can provide private, verifiable AI model execution and transparently receive $TON payment for each processed request.

2. "Why Did Japan Hike Rates While Bitcoin Crashed?"

The key reason for the significant market volatility was a speech by the Governor of the Bank of Japan, Haruhiko Kuroda, on December 1st in Nagoya, which was very hawkish. The market interpreted this as Japan preparing to raise interest rates. So why did Japan's interest rate hike cause a Bitcoin crash? To understand all this, we must return to the underlying logic of the capital markets: liquidity.

Market Data

Daily Market-wide Funding Heatmap (based on funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

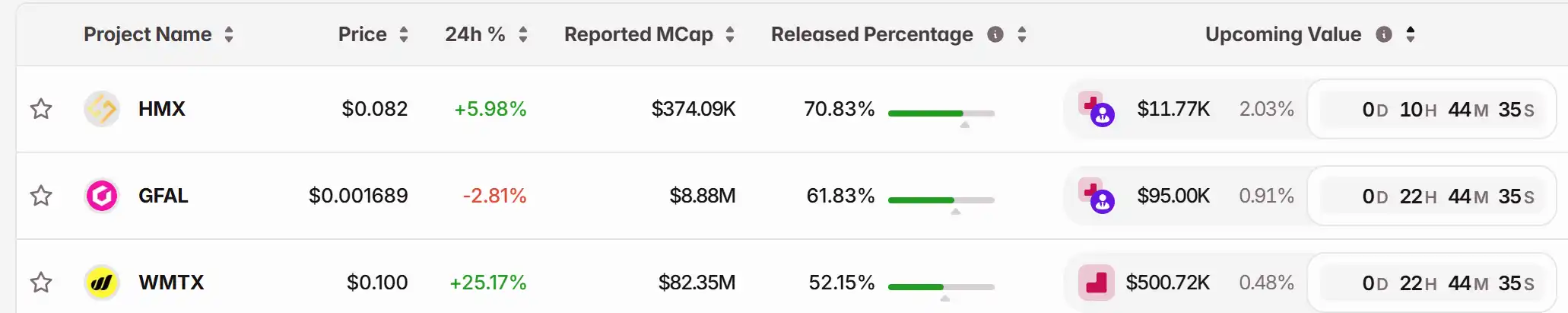

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot

ZEC Rises 4.81% After Major Investor Increases Long Position with 10x Leverage

- ZEC surged 4.81% in 24 hours to $330.5 amid a whale's 10x leveraged long position on HyperLiquid targeting $333.46. - The whale also holds 20x ETH and 5x DYDX longs but faces $2.7M total losses, highlighting risks of leveraged trading during crypto volatility. - Grayscale's ZEC ETF filing and Chainlink's ETF launch signal growing institutional interest in altcoins, potentially boosting ZEC liquidity and demand. - ZEC's 482.71% annual gain contrasts with 27.45% weekly drop, reflecting its cyclical nature

Amazon takes on rivals by introducing on-site Nvidia ‘AI Factories’