Key Market Information Gap on December 1st, A Must-See! | Alpha Morning Report

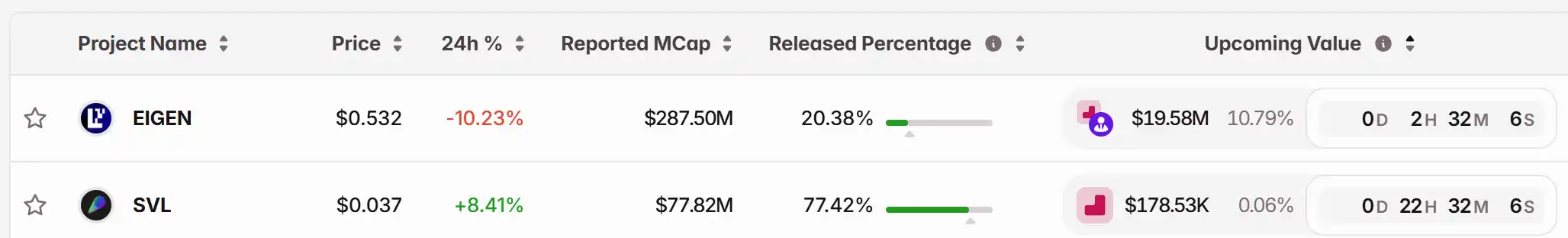

1. Top News: Powell Resignation Rumors Resurface? Will Deliver Speech Tuesday Morning 2. Token Unlock: $EIGEN, $SVL

Featured News

1.Rumors of Powell's Resignation Resurface? Speech to be Given Early Tuesday

2.Kalshi Faces Class-Action Lawsuit, Accused of Conducting Sports Betting Business Without a License

3.SAHARA Experiences Sudden 50% Drop, Market Cap "Halved" to $1.06 Billion

4.GIGGLE Surges Over 17% in 24 Hours, Market Cap Reaches $1.37 Billion

5.PIPPIN Market Cap Surpasses $1.2 Billion, Surging Over 60% in 24 Hours

Articles & Threads

1.《Exclusive: Upbit to List in the US, More Profitable Than Coinbase but Valued at Only 1/7》

On November 27, 2025, a "mini earthquake" occurred in the Korean cryptocurrency community. Upbit, the absolute dominant player in the Korean market, was hit by a hacker attack, and 54 billion Korean won (about $36 million) disappeared. Later, Upbit revised the amount to 44.5 billion Korean won in lost Solana network assets. However, the market's panic was quickly absorbed because based on Upbit's quarterly net profit of about $200 million, Upbit could recover the stolen amount in just 2 weeks.

Market Data

Daily market overall funding heat (reflected by funding rate) and token unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Influence of MMT on Market Fluctuations in 2025

- Modern Monetary Theory (MMT) drives 2025 fiscal expansion, reshaping global markets through deficit-financed AI and infrastructure investments. - U.S. equity markets benefit from MMT-aligned stimulus, while emerging markets show resilience via fiscal reforms and commodity-linked growth. - Commodity volatility rises as MMT-fueled demand clashes with supply constraints, amplified by dollar strength and climate disruptions. - IMF advocates "credible frameworks" to balance MMT's growth potential with inflati

COAI Experiences Sharp Decline in Share Value: Regulatory Oversight and Changing Investor Attitudes Impact India's Cryptocurrency Industry

- India's 2025 crypto crackdown triggered COAI's sharp share price drop as FIU-IND targeted 25 offshore exchanges for AML violations. - SEBI banned finfluencer Avadhut Sathe for ₹601 crore in unregistered investment advice, exposing systemic risks in influencer-driven trading. - Regulatory uncertainty and 30% crypto tax dampened investor confidence, with COAI's decline linked to both enforcement actions and $5.6B forex reserve losses. - Experts warn India's punitive approach risks stifling innovation despi

The Impact of New Technologies on Improving Educational Programs and Boosting Institutional Effectiveness

- Global EdTech and STEM markets are transforming via AI, cybersecurity, and VR/AR integration, driving curricular innovation and institutional scalability. - Farmingdale State College exemplifies this shift, boosting enrollment 40% through AI/cybersecurity programs and securing $75M for a new tech-focused campus center. - AI-in-education market alone is projected to grow from $5.88B in 2024 to $32.27B by 2030, with EdTech overall expected to reach $738.6B by 2029 at 14.13% CAGR. - Government funding and i

Navigating the Fluctuations of the Cryptocurrency Market: Smart Entry Strategies for Individual Investors

- KITE token's 2025 price surge highlights retail-driven volatility, with 72% trading volume from individual investors. - FDV ($929M) far exceeding initial market cap ($167M) fueled FOMO and panic selling amid rapid 38.75% gains followed by 16% corrections. - Strategic approaches like DCA and stop-loss orders are critical for managing risks in speculative crypto markets dominated by emotional trading behavior.