Ripple Wins Singapore Approval as XRP Whales Drive Market Shift

Ripple has secured expanded regulatory approval in Singapore, strengthening its payments business in Asia just as XRP whale activity surges across spot markets. The move arrives during a challenging week for XRP’s price, but on-chain data suggests institutional-scale traders remain active. Ripple Gains Wider MAS Approval for Regulated Payments Ripple announced on December 1 that

Ripple has secured expanded regulatory approval in Singapore, strengthening its payments business in Asia just as XRP whale activity surges across spot markets.

The move arrives during a challenging week for XRP’s price, but on-chain data suggests institutional-scale traders remain active.

Ripple Gains Wider MAS Approval for Regulated Payments

Ripple announced on December 1 that the Monetary Authority of Singapore (MAS) approved an expanded scope of payment activities under its Major Payment Institution (MPI) license for its subsidiary, Ripple Markets APAC Pte. Ltd.

“With this approval, Ripple can broaden its regulated payment offerings and deliver greater value to customers in Singapore,” the company said in its statement.

Monica Long, President of Ripple, praised MAS’s regulatory clarity. She explained that MAS has set a leading standard for regulatory clarity in the digital asset sector.

This expanded license, she said, would enable Ripple to continue investing in Singapore. It would also power the firm’s capacity to build the infrastructure that financial institutions need to move money efficiently, quickly, and safely.

Huge news from Singapore: The @MAS_sg has approved an expanded scope of payment activities for our Major Payment Institution license – enabling us to deliver end-to-end, fully licensed payment services to our customers in the region. 🇸🇬

— Ripple (@Ripple) December 1, 2025

The upgrade reinforces Ripple’s long-standing presence in Singapore, which has been home to its Asia-Pacific headquarters since 2017. MAS remains a global reference point for digital asset regulation, helping institutions scale adoption under clear compliance standards.

Recently, MAS delayed the implementation of Basel crypto capital rules to January 2027 or later, giving banks more time to strengthen their risk and disclosure systems.

Ripple emphasized that its payments suite, leveraging digital payment tokens (DPTs) such as RLUSD and XRP, offers fast, compliant cross-border settlement.

The company highlighted three core benefits:

- End-to-end digital payments

- Single onboarding for global flows

- Simplified access to digital assets

“The Asia Pacific region leads the world in real digital asset usage… With this expanded scope of payment activities, we can better support the institutions driving that growth,” read an excerpt in the announcement, citing Fiona Murray, Vice President & Managing Director for APAC.

RLUSD Gains Ground in the UAE as Institutional Use Accelerates

The Singapore approval follows Ripple’s recent progress in the UAE. On November 27, Abu Dhabi’s Financial Services Regulatory Authority (FSRA) greenlisted RLUSD, classifying it as an Accepted Fiat-Referenced Token.

This enables FSRA-licensed institutions to use RLUSD for:

- Collateral on exchanges

- Lending

- Prime brokerage activities

Jack McDonald, Ripple’s SVP of Stablecoins, called the recognition a signal of trust:

“The FSRA’s recognition of RLUSD… reinforces our commitment to regulatory compliance and trust,” he stated.

XRP Price Slips, but Whale Activity Tells a Different Story

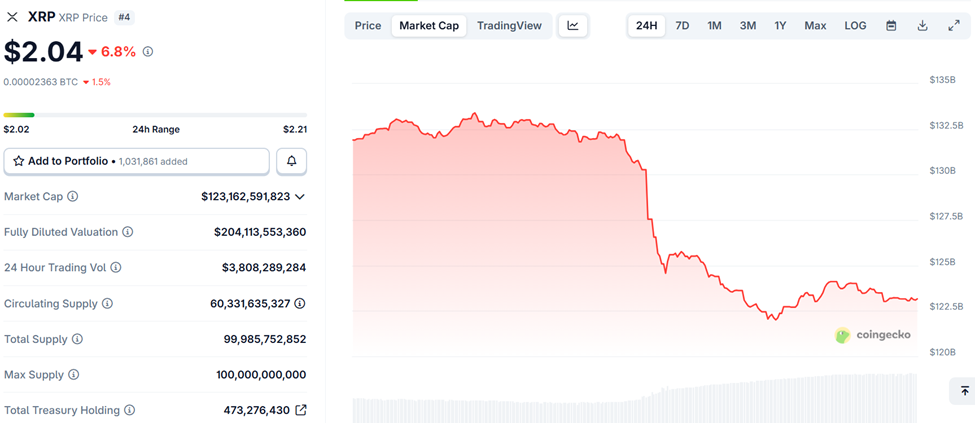

Despite the regulatory momentum, XRP fell nearly 7% in the past 24 hours, sliding toward the $2 level amid a broader market pullback.

Ripple (XRP) Price Performance. Source:

CoinGecko

Ripple (XRP) Price Performance. Source:

CoinGecko

However, on-chain data paints a contrasting picture, showing significant whale-sized orders favoring XRP.

Spot Average Order Size charts indicate that large traders have consistently led XRP activity for months, suggesting underlying accumulation even as prices soften.

💥BREAKING:$XRP LEDGER DATA SHOWS MASSIVE WHALE-SIZED ORDERS DOMINATING SINCE LATE 2024.

— STEPH IS CRYPTO (@Steph_iscrypto) November 30, 2025

Ripple’s strengthened regulatory position in Singapore and Abu Dhabi sets the stage for deeper institutional adoption across the APAC and Middle East regions.

With XRP whales still active despite market volatility, investors will watch whether expanding licensed payment corridors and rising RLUSD utility translate into renewed price momentum in December and early 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit

LUNA Falls by 5.77% Over 24 Hours Despite Fluctuating Medium-Term Performance

- LUNA fell 5.77% in 24 hours to $0.1512, but rose 47.52% in 7 days and 105.96% in 30 days. - However, it still faces a 64.14% annual loss, highlighting crypto market volatility and long-term risks for investors. - The price swing reflects sensitivity to macroeconomic shifts and sentiment, with analysts noting ongoing uncertainty in forecasts. - Investors are weighing recent resilience against regulatory challenges and institutional behavior shifts, monitoring if the drop signals a bearish trend or tempora