November Was Bitcoin’s Second Worst Month In 2025

Bitcoin decline was driven by heavy ETF outflows, macroeconomic pressure from tariffs and the US government shutdown, and a spike in short-term holder losses.

Bitcoin is on track to post its second-worst monthly performance of the year after falling 17.28% in November. According to CoinGlass data, that places it just behind February’s 17.39% decline.

Notably, the drop also marks Bitcoin’s steepest November slide since 2022, when it lost 16.23% of its value.

Why Bitcoin Price Struggled This November

According to BeInCrypto data, Bitcoin opened November near $110,000 after a volatile October that delivered a record high of $126,000 but also erased about $20 billion in market value.

The selloff had begun after Donald Trump expanded tariffs on China on October 10, prompting a broad reassessment of risk across global markets.

The choppiness persisted into November, and the record US government shutdown further exacerbated it by tightening liquidity across traditional markets.

Apart from the macroeconomic conditions, BTC was also affected by weakening institutional flows.

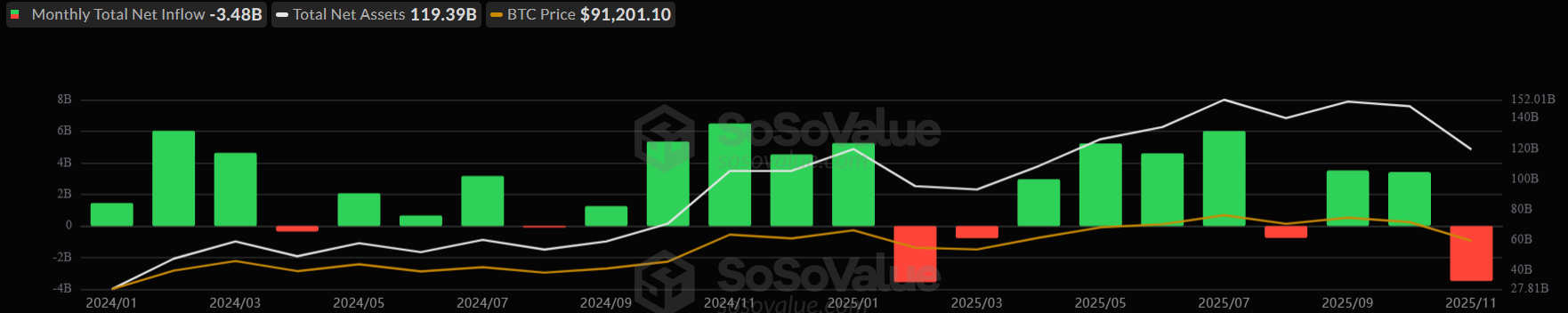

According to SoSo Value data, Bitcoin ETFs recorded $3.48 billion in outflows in November. This marks the second-largest monthly outflow since the products launched in 2024.

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

This outflow trend began quietly in the second half of October. However, it accelerated in November as global markets digested the broader macroeconomic conditions, reducing one of the asset’s most reliable sources of demand.

At the same time, the market stress was amplified by short-term investor capitulation.

According to Glassnode, the realized loss of short-term holders surged, with the 7-day EMA rising to $427 million per day. That level is the highest recorded since November 2022.

The realized loss of short-term holders has surged, with the 7D-EMA reaching $427M/day, the highest level since Nov 2022.Panic selling is elevated & clearly rising, now exceeding the loss levels seen at the last two major lows of this cycle.📉

— glassnode (@glassnode) November 18, 2025

At the time, BTC panic selling was rife, resulting in losses similar to those observed at the previous two major lows of this cycle.

The data suggests that reactive selling, rather than long-term distribution, was the defining pressure point for Bitcoin’s recent decline.

Due to the convergence of these points, BTC’s price briefly fell to a seven-month low of under $80,000 during the month, before rebounding to $90,773 at press time.

This price performance reflected both external pressures and the accumulation of structural stress in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips

U.S. Marine Policy and Blue Economy Prospects: Key Infrastructure and Geostrategic Roles in Oceanic Commerce

- U.S. oceans policy balances geopolitical strategy, deep-sea tech investments, and UNCLOS ratification challenges to secure maritime influence. - Executive actions accelerate seabed mineral extraction while facing environmental criticism and legal risks from bypassing international seabed authority rules. - Offshore energy partnerships with Australia, Japan, and Saudi Arabia aim to diversify supply chains but face geopolitical tensions in chokepoints like the Red Sea. - Maritime security contracts expand

Aster DEX's On-Chain Momentum: Signaling the Future of DeFi

- Aster DEX reported $27.7B daily volume and $1.399B TVL in Q3 2025, outpacing DeFi benchmarks with 2M users. - Institutional whale activity, including CZ's $2M ASTER purchase, drove $5.7B inflows and 800% volume spikes. - Hybrid AMM-CEX model and ZKP privacy tech enabled 40.2% TVL growth, 77% private transactions, and 19.3% perpetual DEX market share. - ASTER's margin trading upgrades and Stage 4 airdrops fueled 30% price surges, while Aster Chain's 2026 launch will integrate privacy-preserving ZKPs. - On

Astar (ASTR) Price Rally: Protocol Enhancements and Ecosystem Growth Drive Long-Term Value

- Astar (ASTR) surged 150% due to protocol upgrades and ecosystem expansion, positioning it as a sustainable value creation case study in blockchain. - Tokenomics 3.0 (fixed 10.5B supply) and Burndrop mechanism created deflationary incentives, supported by Galaxy Digital's $3. 3M OTC investment and Astar's $29.15M buyback. - Cross-chain interoperability with Polkadot/Plaza and Sony's Soneium, plus partnerships with Toyota and Japan Airlines, expanded real-world utility in logistics, identity, and loyalty p