Analyst Forecasts Major Solana Breakout in 2026, Updates Outlook on Bitcoin, Ethereum and BONK

A widely followed trader believes Solana ( SOL ) may be gearing up for massive rallies after retesting the $120 level.

The pseudonymous analyst Inmortal tells his 235,200 followers on X that Solana may experience a parabolic rally similar to what Ethereum ( ETH ) did earlier this year.

“Different structure, similar vibes.”

Source: Inmortal/X

Source: Inmortal/X

ETH went from about $1,550 in April to about $4,900 in September, a more than 216% gain.

The analyst also says that Solana’s $120 level has consistently acted as a support level during market corrections.

“This level has provided support for more than 600 days.”

Source: Inmorta/X

Source: Inmorta/X

Solana is trading for $138 at time of writing, up 1.2% on the day.

Next up, the trader says that Bitcoin ( BTC ) may chop around for months before having an explosive move to new all-time highs around $150,000.

“Imagine.”

Source: Inmortal/X

Source: Inmortal/X

Bitcoin is trading for $88,679 at time of writing, up 1.3% in the last 24 hours.

The trader also says that the meme token Bonk ( BONK ) may be forming a local bottom at a key level around $0.00000900, indicating a potential bullish reversal.

“You only see this type of charts one to two times per year.”

Source: Inmortal/X

Source: Inmortal/X

BONK is trading for $0.000009555 at time of writing, down 1.9% in the last 24 hours.

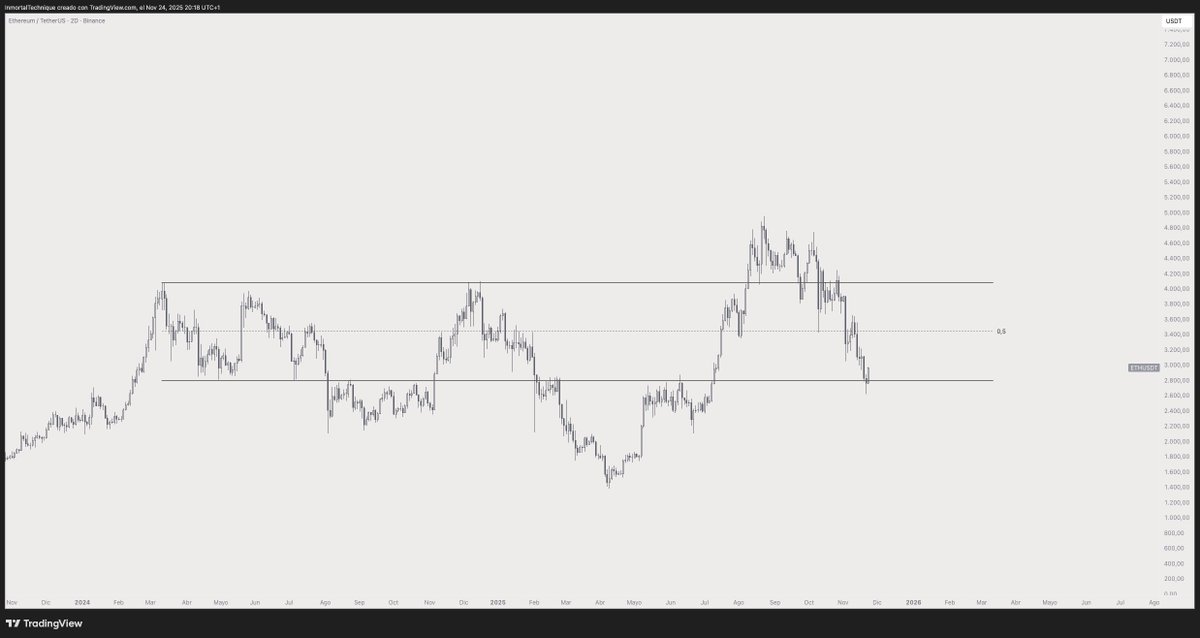

Lastly, the trader predicts that Ethereum ( ETH ) will soon surge more than 18% from its current value, after bouncing off the lower bound of a trading range at around $2,800.

“$3,500: ETH.”

Source: Inmortal/X

Source: Inmortal/X

ETH is trading at $2,963 at time of writing, up about 1% on the day.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Modern Monetary Theory and the Transformation of Cryptocurrency Valuation Models in 2025

- Modern Monetary Theory (MMT) reshaped crypto valuation in 2025, transitioning digital assets from speculative tools to institutional liquidity instruments amid low-yield environments. - Central banks and 52% of hedge funds adopted MMT-aligned CBDCs and regulated stablecoins, with BlackRock's IBIT ETF managing $50B as crypto gained portfolio diversification status. - Regulatory divergence (e.g., U.S. CLARITY Act vs. New York BitLicense) created volatility, exemplified by the Momentum (MMT) token's 1,300%

Financial Wellness Emerging as a Key Investment Trend: Psychological and Structural Factors Shaping Sustainable Wealth Over Time

- 2025 investment trends prioritize financial wellness driven by behavioral economics and systemic factors like inflation and AI-driven tools. - Budgeting apps (YNAB, Mint) and automation platforms (Digit, Acorns) address debt management and savings discipline amid $1.17T U.S. credit card debt. - ETFs like iShares IYG and Global X FINX target financial wellness infrastructure, while Vanguard's inflation-protected ETFs cater to capital preservation needs. - Systemic shifts force "cascading waterfall" financ

Investing for Tomorrow: Eco-Friendly Energy Systems and the Growth of Green Cities

- Global climate-conscious energy infrastructure is accelerating, driven by tech innovation and urban decarbonization needs, with cities accounting for 70% of carbon emissions. - Smart grids and AI are transforming energy systems: grids optimize distribution (e.g., Amsterdam/Singapore), while AI cuts building energy use by 30% via automation and analytics. - Renewable energy investments hit $2.2T in 2025, led by solar (cheapest electricity source), but emerging markets face funding gaps despite hosting 40%

Astar 2.0’s Influence on AI Infrastructure and Cloud Computing Sectors: Evaluating Changes in AI Hardware Requirements and Emerging Investment Prospects

- Astar 2.0's blockchain innovations in cross-chain interoperability and scalability aim to reshape AI infrastructure by optimizing data flow and reducing latency. - Partnerships with Sony and Toyota demonstrate blockchain-enabled AI logistics applications, enhancing transparency and operational efficiency in supply chains. - Deflationary tokenomics and institutional adoption strategies position Astar to capitalize on AI hardware growth, with analysts projecting $0.80–$1.20 ASTR valuation by 2030. - The pl