- The platform suspends trading across futures and FTX instruments.

- That followed a cooling issue at a CyrusOne data center.

- The disruption comes days after CME celebrated a record day for its crypto complex.

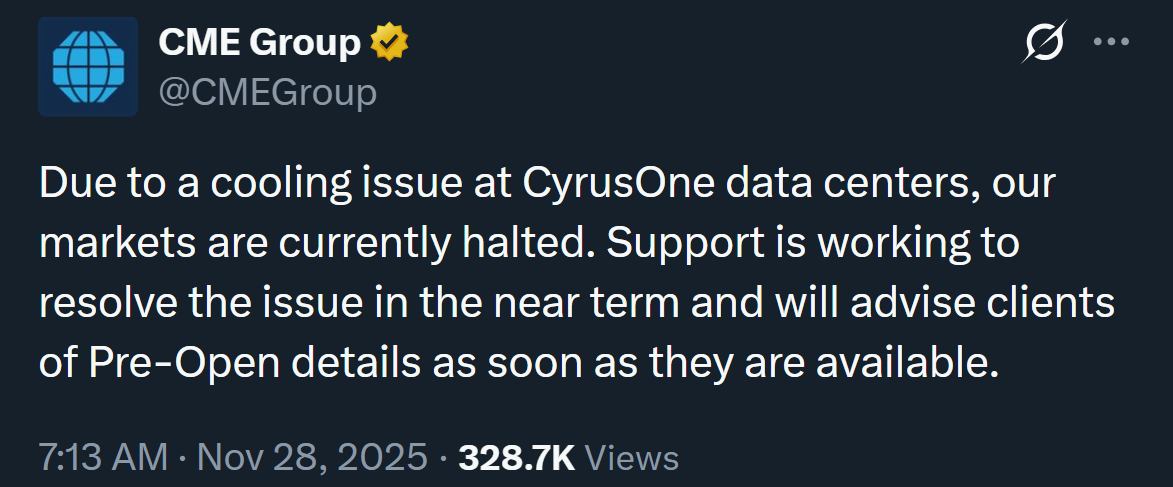

The Chicago Mercantile Exchange executed an unexpected trading pause on Friday after a CyrusOne data center overheated, sending major services and platforms offline. Today’s official X post confirmed:

Due to a cooling issue at CyrusOne data centers, our markets are currently halted.

A routine market session turned into chaos as futures linked to currencies, stock indices, Treasuries, and commodities stopped updating, suspending live price feeds, leaving traders without reliable prices as brokers lacked the data to quote markets.

Notably, the initial alert surfaced on CME’s platform at 02:40 GMT, notifying users of the outages in multiple platforms.

Meanwhile, leading contracts, including Nikkei, S&P 500, and Nasdaq 100, failed to update for several hours as of early Asian sessions.

Also, the currency side experienced issues as CME’s EBS platform stalled, with key pairs such as USD/JPY and EUR/USD offline.

The incident has grabbed the crypto community’s attention as it comes days after the Chicago Mercantile Exchange announced that its Cryptocurrency options and futures suite hit new ATHs in daily volume.

Brokers stranded as price feeds stop

The event left brokers navigating the markets without vital features as live pricing went offline.

Some suspended trading activities, while others switched to internal models or backup sources.

CME’s head of Middle East and Asia, Christopher Forbes, said that he has never seen such an incident in two decades, calling it “a pain in the arse.”

For now, the platform is working to maintain stable pricing using alternative feeds, which can lead to mispricing amid volatile conditions. Forbes stated:

We are now taking a lot of unnecessary risks here to continue pricing. My guess is the market is not going to like this. I think it will be a bit volatile on the open.

Meanwhile, the outage arrived as the market experienced slow activity due to the Thanksgiving holiday.

The timing adds to uncertainty

CME’s outage comes at an awkward time for the trading platform.

Four days ago, on November 24, the team celebrated a crucial breakthrough as its crypto derivatives complex recorded an all-time high in 24-hour volume, signaling renewed momentum for digital currencies.

Commenting on the milestone, CME Group’s Global Head of Crypto Products, Giovanni Vicioso, said :

Amid ongoing market uncertainty, demand for deeply liquid, regulated crypto risk management tools is accelerating. Clients across the globe continue to turn to our benchmark Cryptocurrency futures and options to hedge their risk and pursue opportunities in this complex environment, with both large institutions and retail traders driving record activity across our product suite.

Today, November 28, the narrative is vastly different.

Rather than celebrating increased activity, the exchange operator is fighting to answer questions about the resilience of its infrastructure.

For now, a leading derivatives engine remains offline, idling not due to financial challenges, but an overheated data center that usually runs quietly in the background.