Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

Members of the Bitcoin community and supporters of Strategy, the largest corporate holder of BTC, are criticizing JPMorgan’s proposed Bitcoin-backed notes, accusing the bank of spreading fear, uncertainty and doubt about Strategy and other crypto treasury firms.

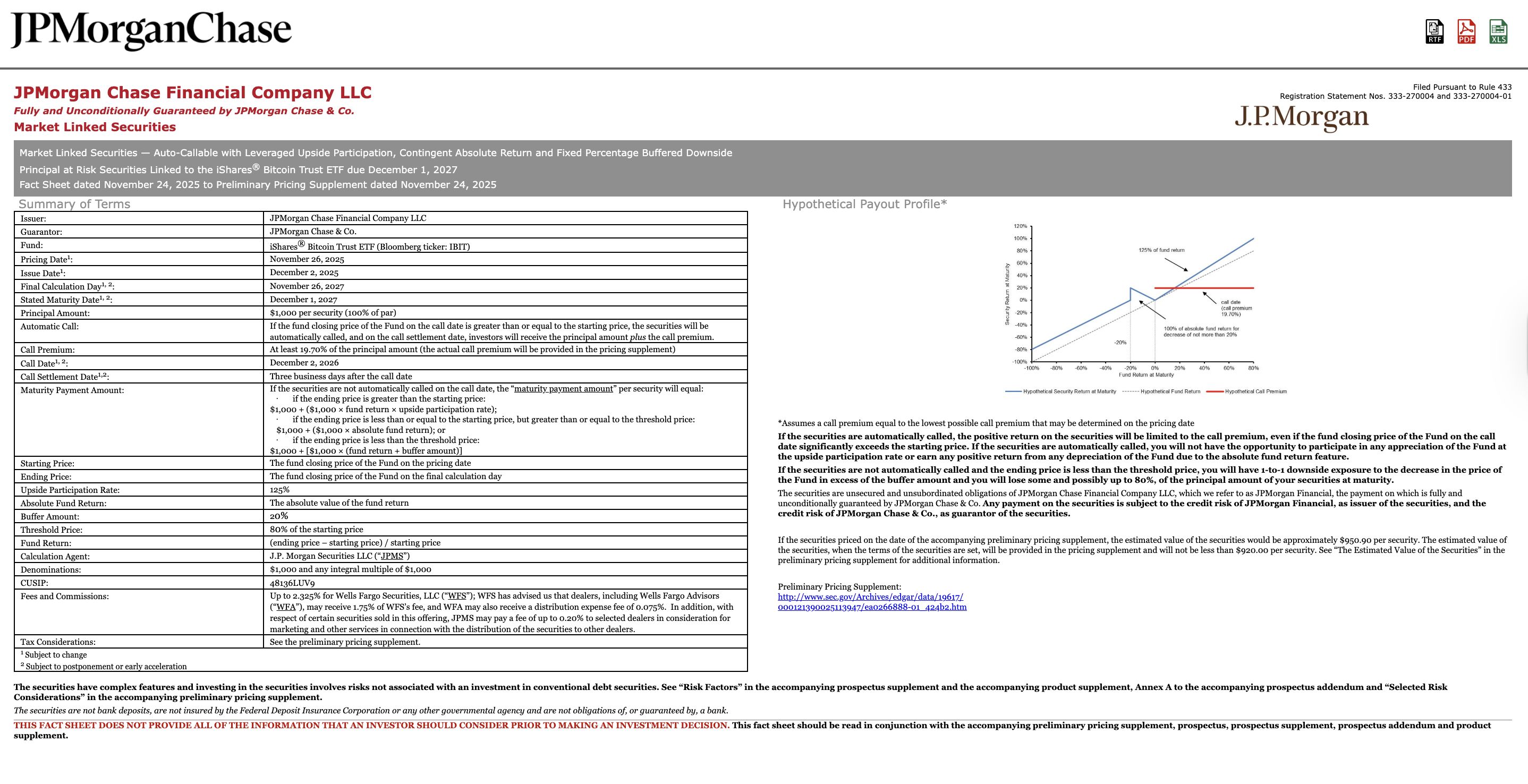

JPMorgan’s notes are a leveraged investment product tied to the price of Bitcoin (BTC). The product tracks BTC but amplifies the outcome, giving holders 1.5 times the gains — or the losses — through December 2028. The notes are slated for a December 2025 launch, according to an SEC filing.

The move drew sharp criticism from the Bitcoin community, with many saying that JPMorgan is now a direct competitor to BTC treasury companies and has an incentive to marginalize companies like Strategy to promote its own structured financial product.

“Saylor opened the door to the $300 trillion bond market and $145 trillion fixed income market. Now, JP Morgan is launching Bitcoin-backed bonds to compete,” said a Bitcoiner on X, adding that “the same institutions attacking MSTR are copying the strategy.”

Bitcoin advocate Simon Dixon also noted that JPMorgan’s upcoming product exists “to trigger margin calls on Bitcoin-backed loans,” claiming that it will “force sell pressure from Bitcoin treasury companies in down markets.”

On X, crypto enthusiasts and Strategy supporters are now calling for a boycott of JPMorgan, encouraging fellow Bitcoiners to close accounts at the financial services giant and sell any shares in the company they might own.

MSCI rule change proposal triggers clash

The backlash against JPMorgan began when MSCI, formerly Morgan Stanley Capital International, a company that manages stock indexes and sets the criteria for index inclusion, proposed a policy shift excluding treasury companies from its products.

The proposed shift, set to take effect in January, bars crypto treasury companies with 50% or more of their assets in cryptocurrencies from inclusion in the index.

JPMorgan shared the proposed policy shift in a November research note, drawing sharp criticism from the BTC community and Strategy investors.

Excluding crypto treasury companies from stock indexes deprives them of passive capital flows and could force these companies to sell off their crypto holdings to qualify for index inclusion, driving asset prices down further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

AI-driven SaaS Revolution: PetVivo Reduces Expenses by 50-90%, C3.ai Collaborates with Microsoft

- PetVivo.ai cuts veterinary client acquisition costs by 50-90% using AI agents, achieving $42.53 per client vs. $80-$400 industry norms. - C3.ai's Microsoft partnership boosts stock 35% as Azure integration enables enterprise AI scalability through unified data operations. - AI-driven SaaS models like PetVivo's $3/lead platform and C3.ai's 19-27% revenue growth highlight AI's disruptive potential in traditional industries. - Both companies face challenges scaling beta results and converting pilots to long

Ethereum News Today: "Turbulence or Trust? $15 Billion in Crypto Options Set Market Dynamics Against Institutional Hopefulness"

- Bitcoin and Ethereum face $15B options expiry on October 31, 2025, risking amplified volatility amid sharp price declines. - Institutional confidence grows as Bitcoin/ETH ETFs see $217.5M inflows, contrasting crypto's 33-45% drawdowns vs. stable tech stocks. - Tom Lee's firm BMNR boosts ETH holdings to 2.9% of supply, betting on $5,500 mid-2025 and $60K+ 2030 targets. - Deribit data shows Bitcoin's bullish positioning (put-call ratio 0.54) vs. Ethereum's balanced approach, with max pain levels at $100K a

VIPBitget VIP Weekly Research Insights

This year's market has been driven primarily by the growth of DATs, ETFs, and stablecoins. Strong institutional inflows indicate that mainstream U.S. capital is now entering the crypto market. However, after the October 11 black swan event, the market underwent a significant correction due to deleveraging. Even so, several indicators now suggest that a bottom may be forming. Our recommended assets are BTC, ETH, SOL, XRP, and DOGE.