November 27th Market Key Insights, How Much Did You Miss?

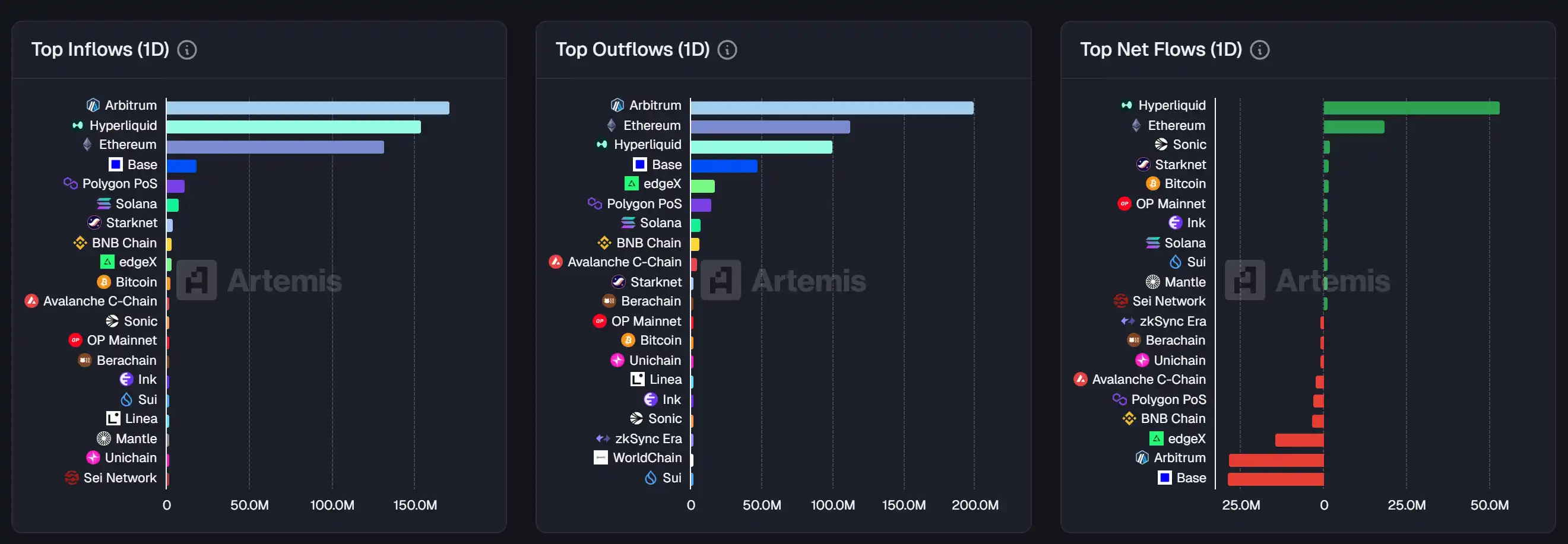

1. On-chain Flows: $53.2M flowed into Hyperliquid today; $28.6M flowed out of Base. 2. Largest Price Swings: $PAPARAZZI, $XION 3. Top News: South Korea's largest crypto platform, Upbit, was attacked and 54 billion KRW was stolen; it will cover all customer losses.

Featured News

1. South Korea's Largest Crypto Platform Upbit Hacked, 54 Billion KRW Stolen, Will Cover All Customer Losses

2. Some Shitcoins Start to Surge, BANANAS31 Surges Over 64% in 24 Hours

3. 52.4% of Monad Airdrop Claimed Addresses Have Cleared Out or Transferred All Allocations

4. On BSC Chain, Meme Coins "Cheesy Penguin" and "BNBHolder" See Continuous Price Decline, Both Down Over 50% from Recent Highs

5. Monad Ecosystem Meme Coin CHOG's Market Cap Briefly Surpasses $10 Million

Featured Articles

1. "The Most Profitable App in the Crypto Community Starts to Decline"

From competing with bonk.fun to conducting and completing one of the largest cryptocurrency fundraising events in history, this year's pump.fun, while not as glorious in terms of making money as last year, is still flourishing. As of today, pump.fun has spent nearly 1 million SOL tokens (approximately $188 million) in transaction fee revenue to repurchase $PUMP, which accounts for 12.227% of the total supply.

2. "On-Chain Recovery, Sniper Tool OCR Sets Another Hundredfold Profit Myth"

It has been 3 days since the Monad TGE and mainnet launch. Finally, last night, a 10M-level Golden Dog $CHOG emerged on this new chain. This is a rather expected Golden Dog, as the Chog image is the mascot of Monad. There was a testnet NFT craze when Monad first launched on the testnet, and this image has always been one of the highest-demand NFT series in the Monad ecosystem, from whitelist giveaways to sky-high prices. What sets the Chog team apart is their CA release method this time. They released it via an official announcement but embedded the CA within an image to avoid many monitoring X sniper bots.

On-chain Data

November 27th Last Week On-chain Fund Flow

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations