Monad (MON) Price Cools After Launch Run — Can Whales Keep It Rising?

Monad (MON) is barely 72 hours old on exchanges. From its opening price on November 24, the Monad price climbed about 71% before giving back roughly 13%. Over the past 24 hours, it has been up only about 2% and trades near $0.042. For a new token, this early slowdown can be either healthy digestion

Monad (MON) is barely 72 hours old on exchanges. From its opening price on November 24, the Monad price climbed about 71% before giving back roughly 13%. Over the past 24 hours, it has been up only about 2% and trades near $0.042.

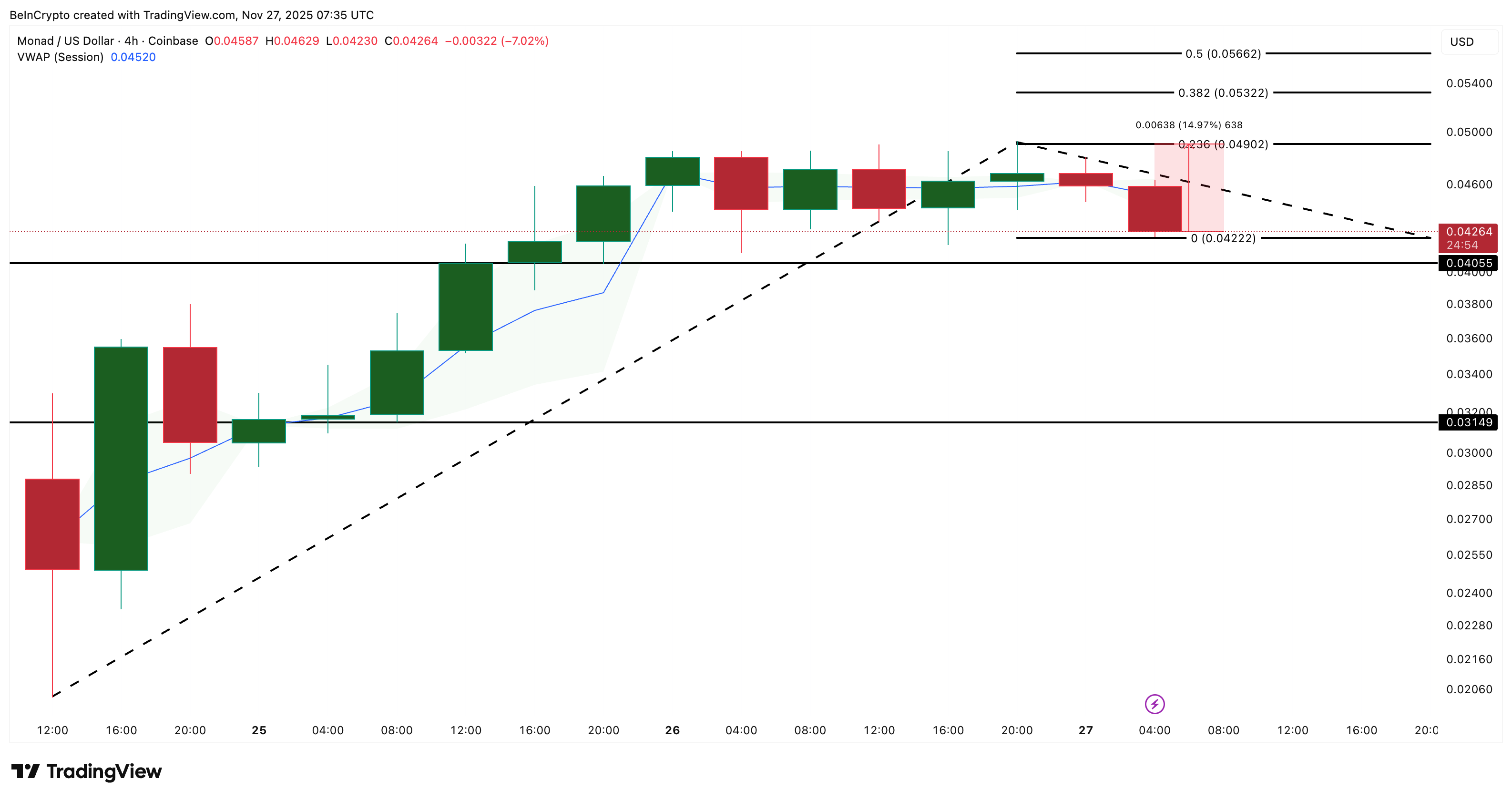

For a new token, this early slowdown can be either healthy digestion or the first sign of a deeper volume fade. The 4-hour chart is the best way to judge that because early listings react fastest on this timeframe.

Volume Signals Look Tired On The 4-Hour Chart

On the 4-hour chart, Monad has slipped under its Volume Weighted Average Price (VWAP). VWAP is the average price traders paid when you factor in volume, so trading significantly below it shows buyers are losing early control.

The pressure increases when you look at On-Balance Volume (OBV). OBV is now moving toward a descending trendline built from a series of lower lows. That pattern signals that every small bounce is backed by weaker volume than the one before it, and one more slip can create a fresh lower low that usually triggers a fast volume breakdown on new listings.

MONAD Price Support:

MONAD Price Support:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Together, VWAP and OBV point to the same message. Price sitting under VWAP shows weak spot strength, and OBV pressing against a lower-low trendline shows fading demand. For a token only three days old, this combination is one of the clearest early warnings that momentum is cooling. It also explains why Monad has barely moved in the past 24 hours despite the early hype.

Whale Buying Offers Support — But Will It Be Enough?

Whale activity is the one factor still keeping the chart alive. Since prices have stabilized after the first burst of volatility, spot flows matter more now.

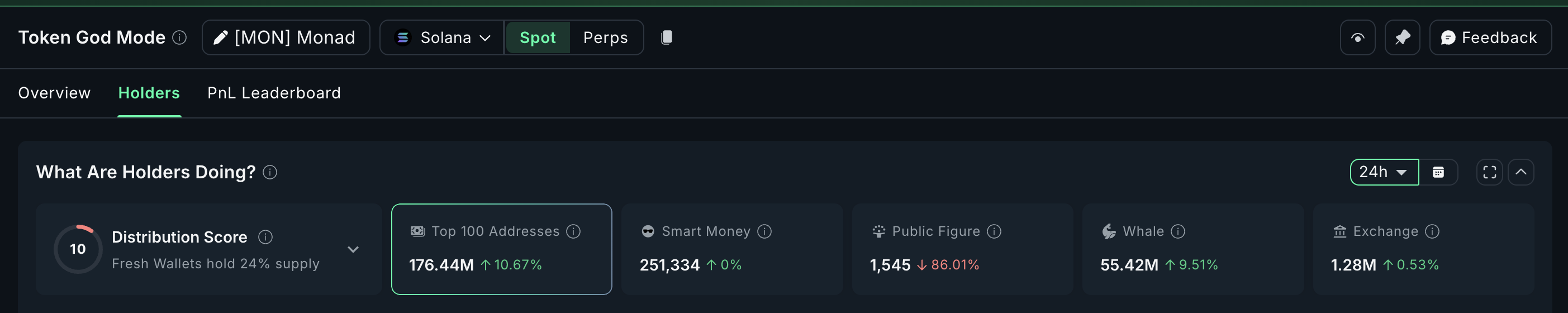

Over the past 24 hours:

- Mega whales increased their holdings by 10.67%, pushing their stash to 176.44 million MON. They added about 17.08 million MON, worth roughly $717,000 at the current price.

- Normal whales increased their stash by 9.51%, reaching 55.42 million MON. They added about 4.80 million MON, worth roughly $202,000.

Whale Buying Intensifies:

Whale Buying Intensifies:

Total whale accumulation is about 21.88 million MON added, roughly $919,000 in fresh spot buying, while the price slowed. A decent sum for a new listing.

This kind of pickup (if it continues) can help OBV avoid breaking below its descending trendline. If whale volume shows up at the right time, OBV can bounce and lift the price back above VWAP. That is the only path that keeps the early uptrend alive.

Key Monad Price Levels Now Decide The Next Move

If whales can pull OBV up and push the MON price above VWAP, the path becomes clear:

- First target: $0.049

- Next levels: $0.053 and $0.056

This is the upside path inside early price discovery. But if $0.042 fails:

- Next support: $0.040

- If that breaks: $0.031, which would reset most of the early listing gains

Monad Price Analysis:

Monad Price Analysis:

For now, the message stays simple. Volume indicators look tired, but whales are buying the pause. Monad’s next move depends on which happens first: a clean OBV breakdown, or whale demand lifting the price back over VWAP and toward $0.049.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Rises 2.52% Despite Fluctuating Short-Term Results

- ALGO rose 2.52% in 24 hours to $0.1421, a short-term rebound amid a broader bearish trend. - Despite a 4.1% monthly gain, ALGO fell 57.49% annually, reflecting altcoin market volatility and macroeconomic pressures. - Analysts predict near-term consolidation as traders assess market conditions and regulatory updates, urging caution and focus on fundamentals for long-term strategies.

The Comeback of Momentum (MMT): Can This Strategy Last?

- Momentum (MMT) price surge driven by social media sentiment and retail investor behavior, mirroring 2021 GameStop frenzy. - Academic studies link social media sentiment to short-term stock price spikes, but warn of disconnect from financial fundamentals. - Overconfidence and herd behavior in retail trading amplify speculative bubbles, risking abrupt corrections when sentiment shifts. - Regulatory scrutiny grows as social media-driven markets challenge traditional finance models and market stability.

Ethereum Open Interest Falls From $12.6B to $6.2B in 3 Months

Only 4 Altcoins Stand Out: Trilemma Leaders Targeting a Potential 3x Rally in 2025.