Bitcoin News Update: Hive Invests $300M in ATM to Boost AI Efforts While Stock Drops Amid Doubts

- Hive Digital Technologies launched a $300M ATM equity program to fund its "dual-engine" strategy of Bitcoin mining and AI infrastructure expansion. - The program enables flexible capital raising through 11 underwriters, supporting a renewable-powered data center in Canada and recent 285% revenue growth. - Despite strong financial performance, shares fell to $3.10, reflecting market skepticism about execution risks and competitive pressures in AI infrastructure. - Analysts highlight Hive's 90% renewable e

Bitcoin mining company

This move highlights Hive's "dual-engine" approach, using

The ATM offering gives Hive a flexible way to access additional capital without committing to a set price or timing, differing from conventional public offerings. Shares can be sold through "at-the-market distributions" under Canadian securities laws and Rule 415 of the U.S. Securities Act, which ensures compliance while preserving operational flexibility

Industry analysts see the program as a strategic lever to advance Hive's infrastructure goals. The company's BUZZ HPC segment is becoming increasingly important to its growth story, reflecting a wider industry transformation as mining companies shift from speculative ventures to critical infrastructure providers for AI and cloud services

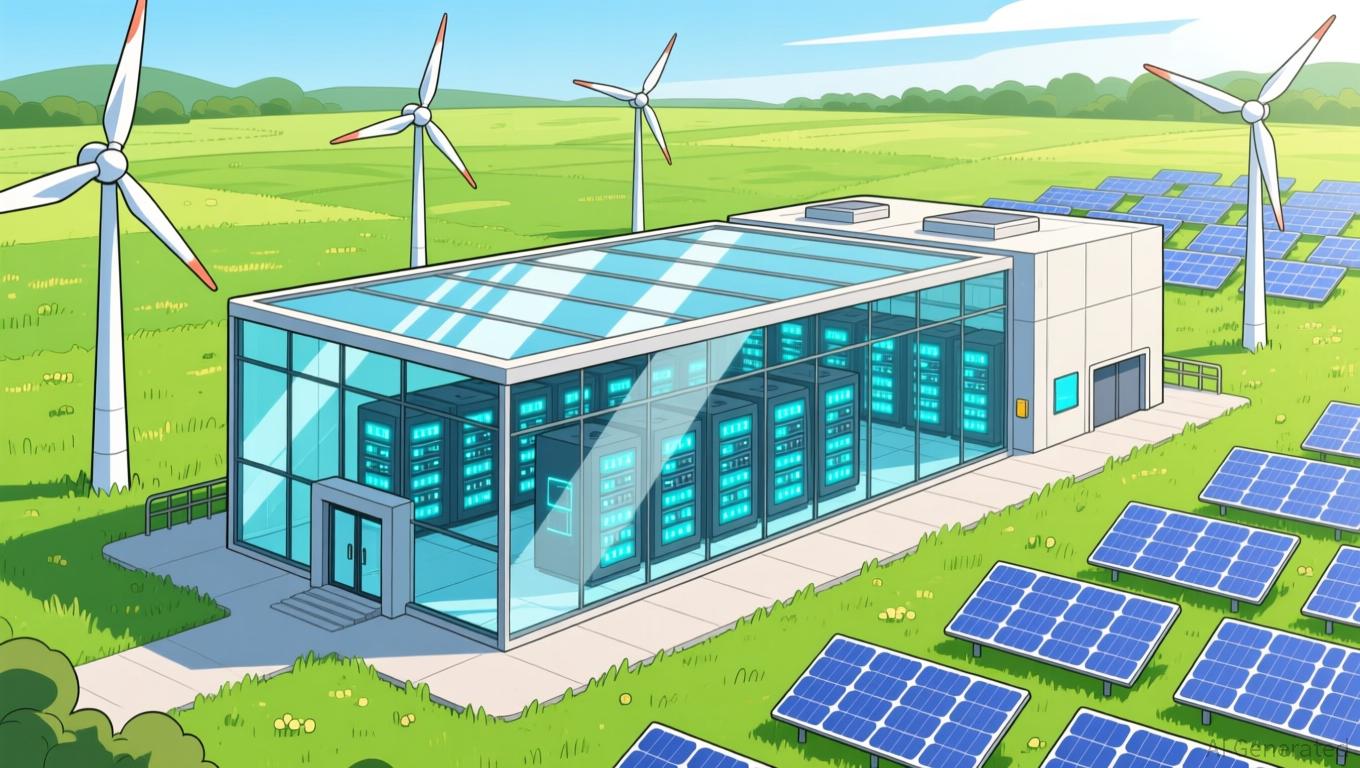

Profit margins from Bitcoin mining and energy expenses are crucial factors in Hive's dual-engine strategy, and the company is keeping a close eye on both operational performance and Bitcoin price swings. Leadership has indicated that the data center's energy mix—90% from renewable sources—will give Hive an edge in both cost efficiency and ESG standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Governments Turn to Cryptocurrency as a Practical Defense Against Inflation and Currency Instability

- Bolivia integrates stablecoins into its financial system to combat 22% inflation, ranking 46th globally in crypto adoption after reversing a prior ban. - Regional efforts include Mexico's 314-petaflop AI supercomputer and Brazil's KuCoin-Pix integration, reflecting Latin America's crypto-driven economic strategies. - UAE's Abu Dhabi approves Ripple's RLUSD for institutional use, while Dubai's regulatory advances position the Middle East as a crypto infrastructure hub. - Challenges persist, including Boli

Ethereum News Update: Large Investors Anticipate ETH and ADA Recovery While Individual Traders Remain Cautious

- Crypto whales increasingly accumulate Ethereum (ETH) and Cardano (ADA) as retail investors withdraw amid market volatility, per on-chain analytics. - Ethereum's institutional accumulation hits records, with 21 million ETH held in large wallets, while Binance's exchange reserves shrink to 3.764 million ETH. - Cardano's recent chain-split incident exposed technical vulnerabilities, yet the network stabilized within 24 hours, prompting post-mortem analysis and treasury loans for ecosystem growth. - Ethereum

Institutions and Infrastructure: Why 2026 Marks the Year Crypto Comes of Age

- Crypto market enters 2026 maturation phase with altcoins and institutional adoption driving growth through presales and $75M+ DeFi fund investments. - Projects like Mutuum Finance ($19M raised) and RLUSD stablecoin highlight infrastructure upgrades and regulatory clarity accelerating institutional participation. - Abu Dhabi's Ripple approval and Nasdaq's Bitcoin ETF expansion signal crypto's integration into traditional finance, despite persistent security risks like Upbit's $36M breach. - 2026 trends pr

The Economic and Infrastructure Boom in Webster, NY: Reasons Investors Should Pay Attention to the Xerox Campus Redevelopment

- Webster , NY's Xerox campus is undergoing a $9.8M infrastructure overhaul via FAST NY grants, repositioning the town as a high-growth industrial hub. - Strategic upgrades to roads, utilities , and mixed-use developments are attracting advanced manufacturing, food processing, and real estate investment. - Median home prices rose 10.1% annually by 2025, driven by improved connectivity and state-backed revitalization projects like the 600 Ridge Road site. - A 2026 timeline for completed infrastructure and m