Former a16z Partner Releases Major Tech Report: How AI Is Eating the World

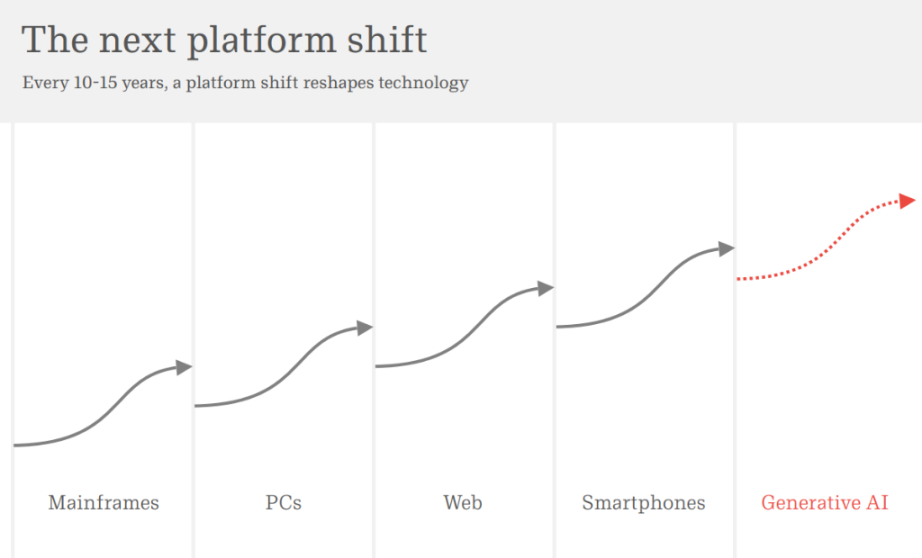

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.

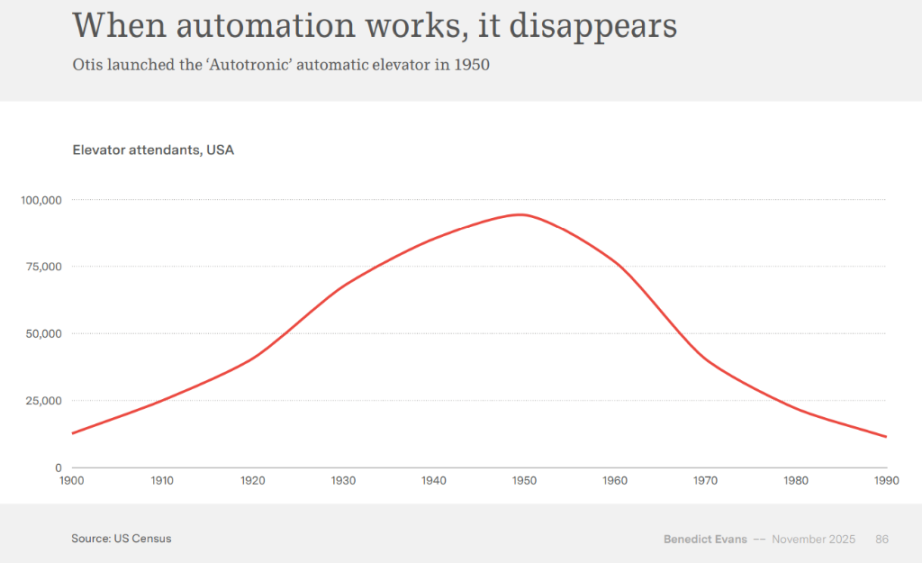

Former a16z partner Benedict Evans points out that generative AI is triggering yet another ten-to-fifteen-year platform migration in the tech industry, but its final form remains full of uncertainty. He cites the 1956 U.S. Congressional automation report and the disappearance of elevator operator jobs as a reminder: when technology truly takes root, it quietly becomes infrastructure and is no longer called "AI."

Written by: Bu Shuqing

Source: Wallstreetcn

"AI is devouring the world, and we haven't even seen what it looks like yet."

In the latest "AI eats the world" report, renowned tech analyst and former a16z partner Benedict Evans makes a judgment that could shake the entire tech world: generative artificial intelligence is triggering a once-in-a-decade-or-fifteen-years platform migration in the tech industry, and we still don't know where it will ultimately go.

Evans points out that from mainframes to PCs, from the Internet to smartphones, the tech industry's foundation is completely rewritten every decade or so, and the sudden emergence of ChatGPT in 2022 is likely the starting point of the next "fifteen-year transformation."

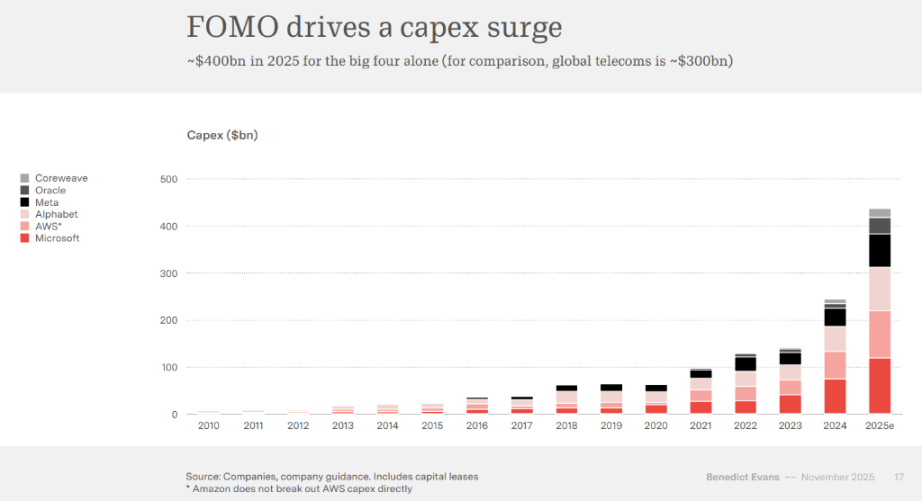

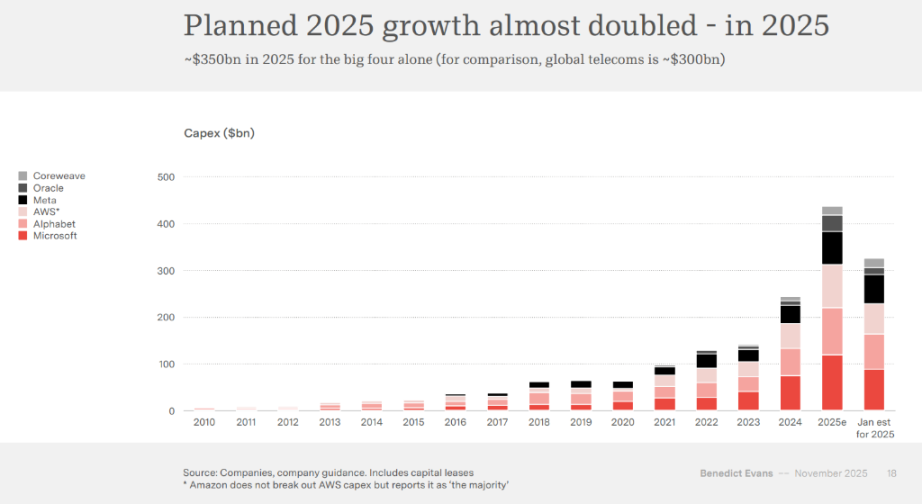

Global tech giants are pouring into an unprecedented investment race. The capital expenditure of Microsoft, Amazon AWS, Google, and Meta is expected to reach $400 billions in 2025—this figure exceeds the global telecom industry's annual investment of about $300 billions.

"The risk of underestimating AI is far greater than the risk of over-investing," said Microsoft CEO Sundar Pichai, as quoted in the report, revealing the essence of the industry's anxiety.

The report also cites the 1956 U.S. Congressional automation report and the disappearance of elevator operator jobs as a reminder: when technology truly lands, it quietly becomes infrastructure and is no longer called "AI."

Another Fifteen-Year Shift: The Historical Pattern of Platform Migration

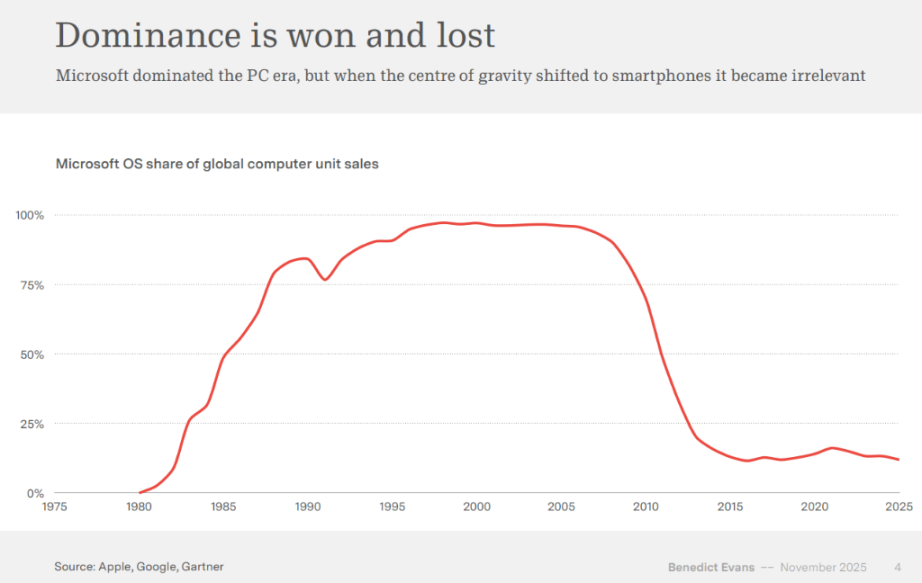

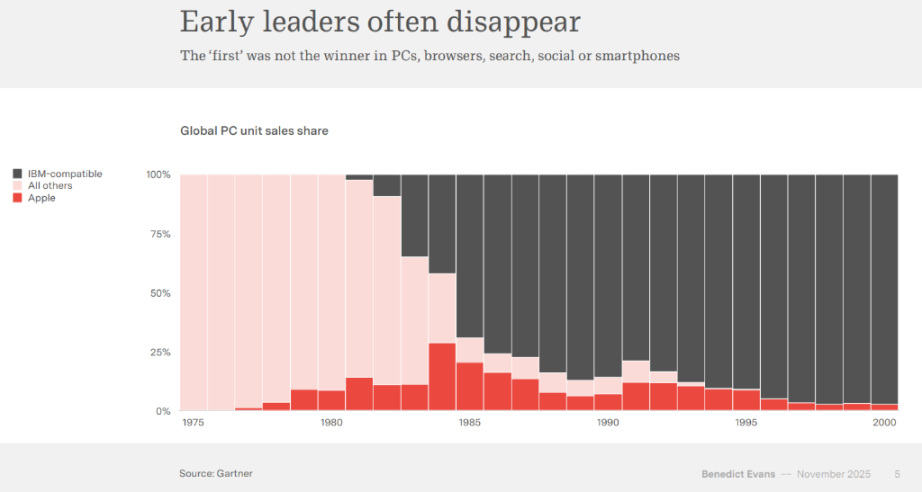

Evans points out in the report that the tech industry undergoes a platform shift about every ten to fifteen years, from mainframes to personal computers, from the World Wide Web to smartphones, and each shift reshapes the entire industry landscape. Microsoft's case proves the cruelty of such shifts: the company once held nearly 100% of the operating system market share in the PC era, but became almost irrelevant when the focus shifted to smartphones.

Data shows that Microsoft's operating system share in global computer sales dropped sharply from its peak around 2010, falling to less than 20% by 2025. Similarly, Apple, which dominated the early PC market, was once marginalized by IBM-compatible machines. Evans emphasizes that early leaders often disappear, which seems to be an iron law of platform migration.

But three years on, little is still known about the form this shift will take. Evans lists failed ideas from the early days of the Internet and mobile Internet, such as AOL, Yahoo portals, and Flash plugins. Now it's generative AI's turn, and the possibilities are equally dazzling: browser form, agent form, voice interaction, or some entirely new user interface paradigm—no one really knows the answer.

Unprecedented Investment Frenzy: A $400 Billion Gamble

Tech giants are investing in AI infrastructure at an unprecedented scale. In 2025, the capital expenditure of Microsoft, AWS, Google, and Meta is expected to reach $400 billions, compared to the global telecom industry's annual investment of about $300 billions.

Even more noteworthy, this 2025 growth plan has nearly doubled within the year.

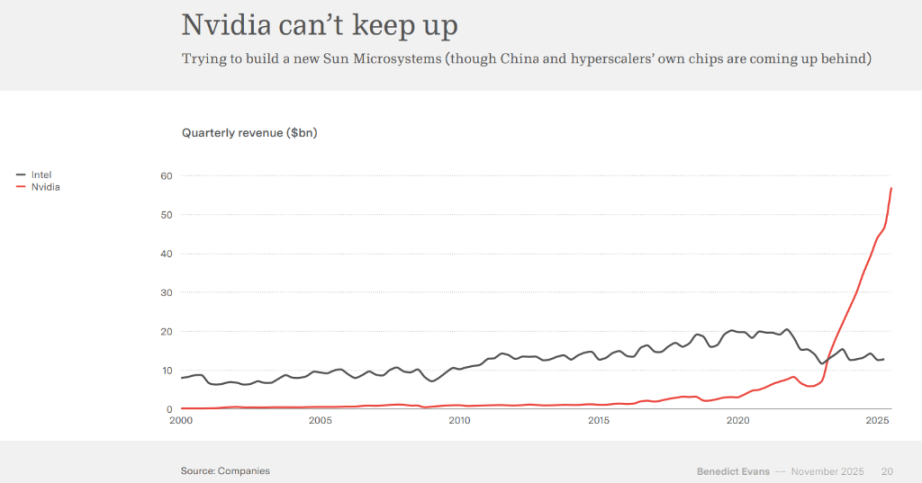

U.S. data center construction is surpassing office building construction in scale, becoming the new driver of the investment cycle. Nvidia is facing supply bottlenecks due to its inability to keep up with demand, and its quarterly revenue has surpassed Intel's years of accumulation. TSMC is also unable or unwilling to expand capacity fast enough to meet Nvidia's order demand.

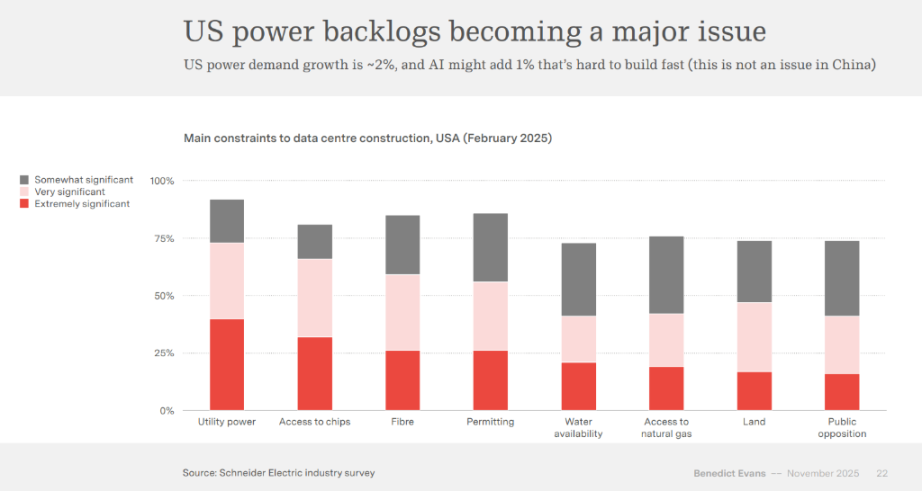

According to Schneider Electric's industry survey, the main limiting factor for U.S. data center construction is public power supply, followed by chip acquisition and fiber access. U.S. electricity demand is growing at about 2%, and AI may add an extra 1% demand. This is not a problem in China, but it is difficult to build quickly in the U.S.

Model Convergence: Moats Disappear, AI May Be "Commoditizing"

Despite huge investments, the gap between top large language models on benchmark tests is narrowing to single-digit percentages. Evans warns:

If model performance converges highly, this means large models may be turning into "commodities," and value capture will be reshuffled.

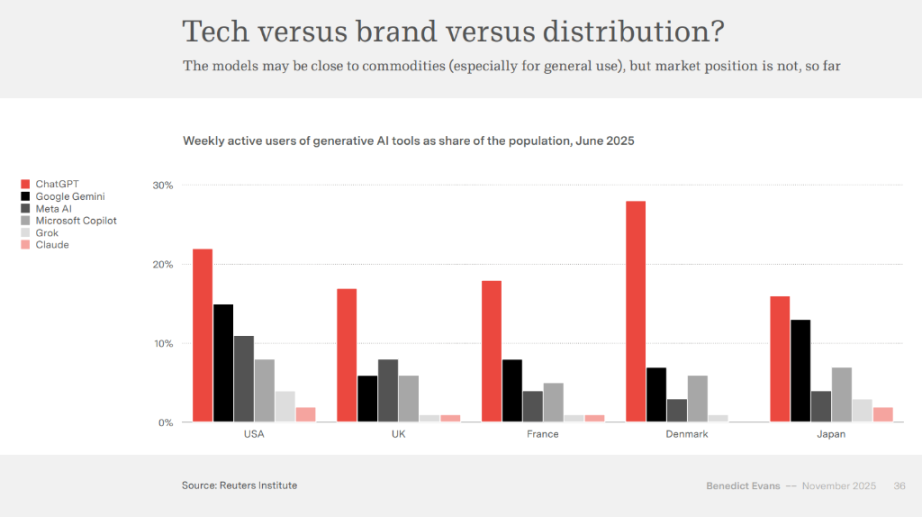

In the most general benchmark tests, the gap between leaders is already very close, and model leadership changes weekly. This suggests models may be becoming commodities, especially for general-purpose use.

Evans points out that after three years of development, there has been more progress in science and engineering, but there is still a lack of clear understanding in market form. Although models are still improving, with more models, participation from Chinese companies, open-source projects, and new technical acronyms, the moat is not obvious.

In his view, AI companies must re-establish moats in computing power scale, vertical data, product experience, or distribution channels.

User Engagement Dilemma: ChatGPT's 800 Million Weekly Active Users Can't Hide the Lack of Real Stickiness

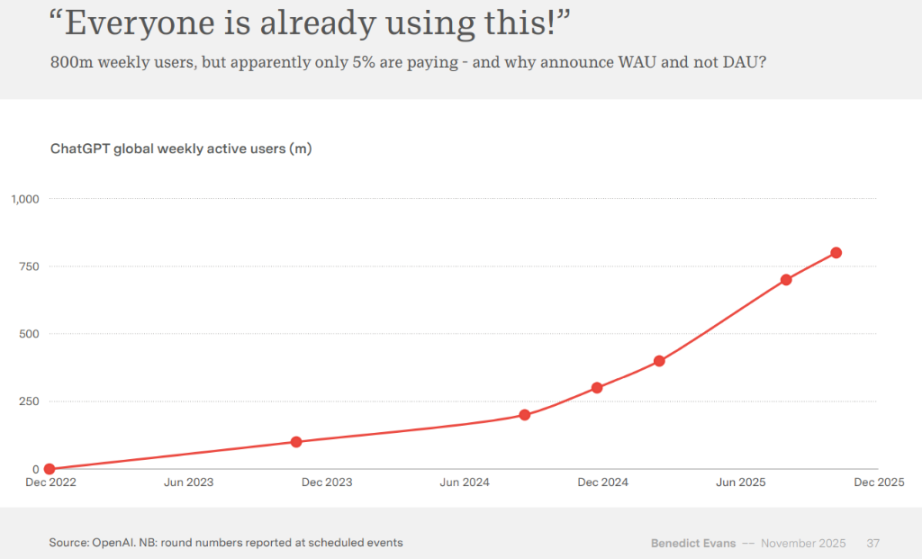

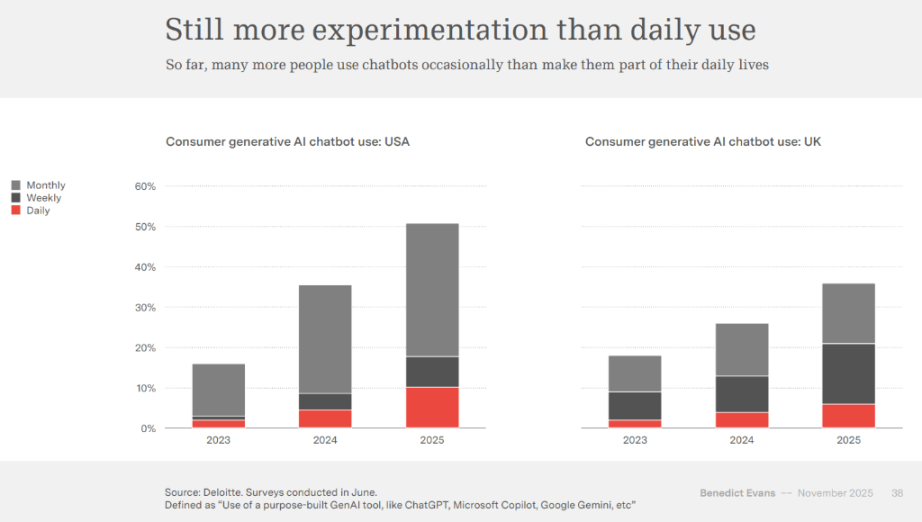

Although ChatGPT claims to have 800 million weekly active users, user engagement data paints a different picture. Multiple surveys show that only about 10% of U.S. users use AI chatbots daily, with most people still in the occasional trial stage.

Deloitte's survey data shows that the number of people who occasionally use AI chatbots is much greater than those who use them daily.

Evans calls this a typical "engagement illusion": AI penetration is astonishingly fast, but it has not yet become a daily tool for everyone.

He analyzes the reasons for this engagement dilemma: how many use cases are obvious and easy to adapt? Who has a flexible work environment and consciously seeks optimization? For others, does AI need to be wrapped into tools and products? This reflects a significant gap between technical capability and actual application.

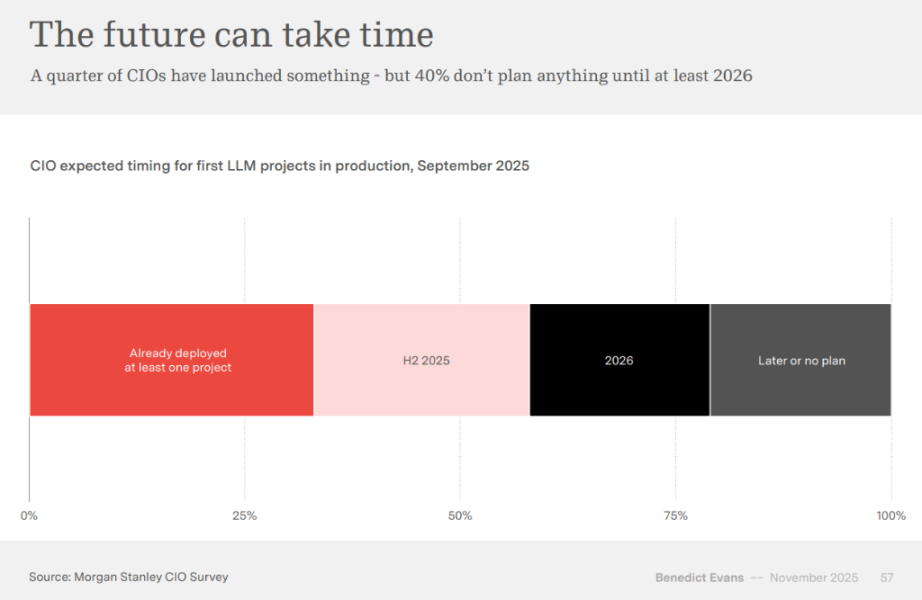

Enterprise deployment is also slow. The report cites surveys from several consulting firms showing that although enterprises are enthusiastic about AI, few projects have truly entered production environments.

- Deployed: 25%

- Planned for deployment in the second half of 2025: about 30%

- Deployment not until at least 2026: about 40%

Current success stories are still concentrated in the "absorption phase," such as programming assistance, marketing optimization, and customer support automation, and are still some distance from true business restructuring.

Advertising and Recommendation Systems Face Disruptive Rewrite

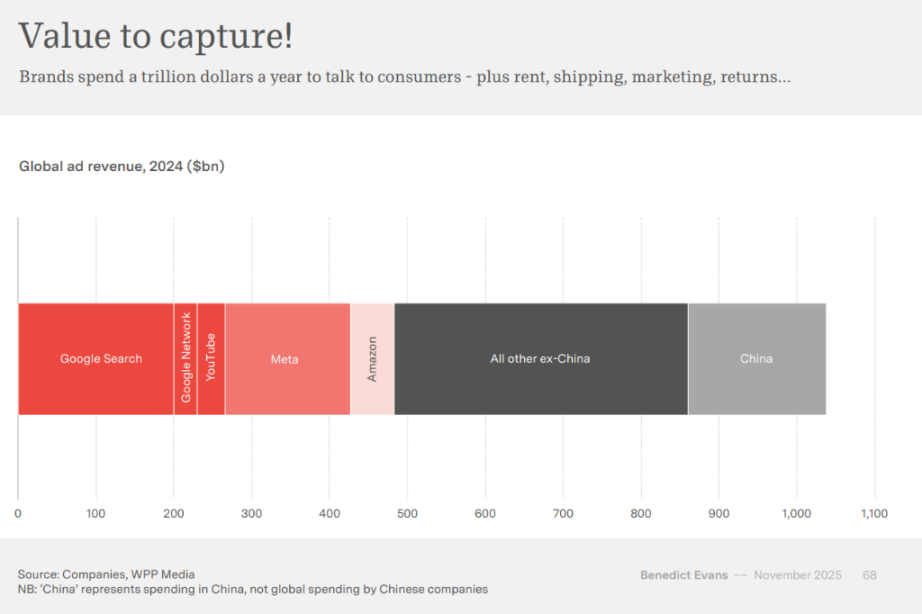

Evans believes that the area where AI will change most rapidly is advertising and recommendation systems.

Traditional recommendations rely on "relevance," while AI can understand "user intent" itself. This means:

The underlying mechanisms of the trillion-dollar advertising market may be rewritten.

Google and Meta have already disclosed early data: AI-driven advertising can bring a 3%–14% increase in conversion rates. The cost of ad creative production, which is currently about $100 billions per year, may also be further reshaped by automatic generation technology.

Historical Lesson: When Automation Succeeds, It Is No Longer Called "AI"

Evans brings the perspective back to the 1956 U.S. Congressional automation report, pointing out that every wave of automation triggers huge social discussion, but ultimately quietly integrates into infrastructure.

The disappearance of elevator operators, the inventory revolution brought by barcodes, the Internet turning from a "new thing" into infrastructure... all prove:

When technology truly lands and becomes universal, people no longer call it "AI."

Evans emphasizes that the future of AI is both clear and vague: we know it will reshape industries, but we don't know the final product form; we know it will be ubiquitous in enterprises, but we don't know who will dominate the value chain; we know it requires massive computing power, but we don't know where growth will stop.

In other words, AI is becoming the protagonist of the new fifteen-year cycle, but the direction of the whole play has yet to be written.

We may be standing on the fault line of the next technological earthquake.

The Future of Value Capture: From Network Effects to Capital Competition

For research-intensive and capital-intensive commoditized products, value capture becomes a key issue. If models become commodities and lack network effects, how will model labs compete?

Evans proposes three possible paths: expand downstream to win by scale, expand upstream to win through network effects and products, or find new dimensions of competition.

Microsoft's case shows the shift from competition based on network effects to competition based on capital acquisition capability. The company's capital expenditure as a percentage of sales revenue has risen sharply from historical lows, reflecting a fundamental change in the competitive model.

OpenAI has adopted a "say yes to everything" strategy, including infrastructure deals with Oracle, Nvidia, Intel, Broadcom, and AMD, e-commerce integration, advertising, vertical datasets, as well as diversified layouts such as application platforms, social video, and web browsers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin final leverage flush below $80K is possible, warns analyst

Four reasons why Ethereum price remains bullish above $2,800

Bitcoin analysis sees $89K short squeeze with S&P 500 2% from all-time high

Bitcoin price risks decline below $80K as fears of ‘MSTR hit job’ escalate