BitMine (BMNR) Stock Jumps 15% But Misses Critical Recovery Signal By Inches

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January. The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January.

The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Continues To Accumulate ETH

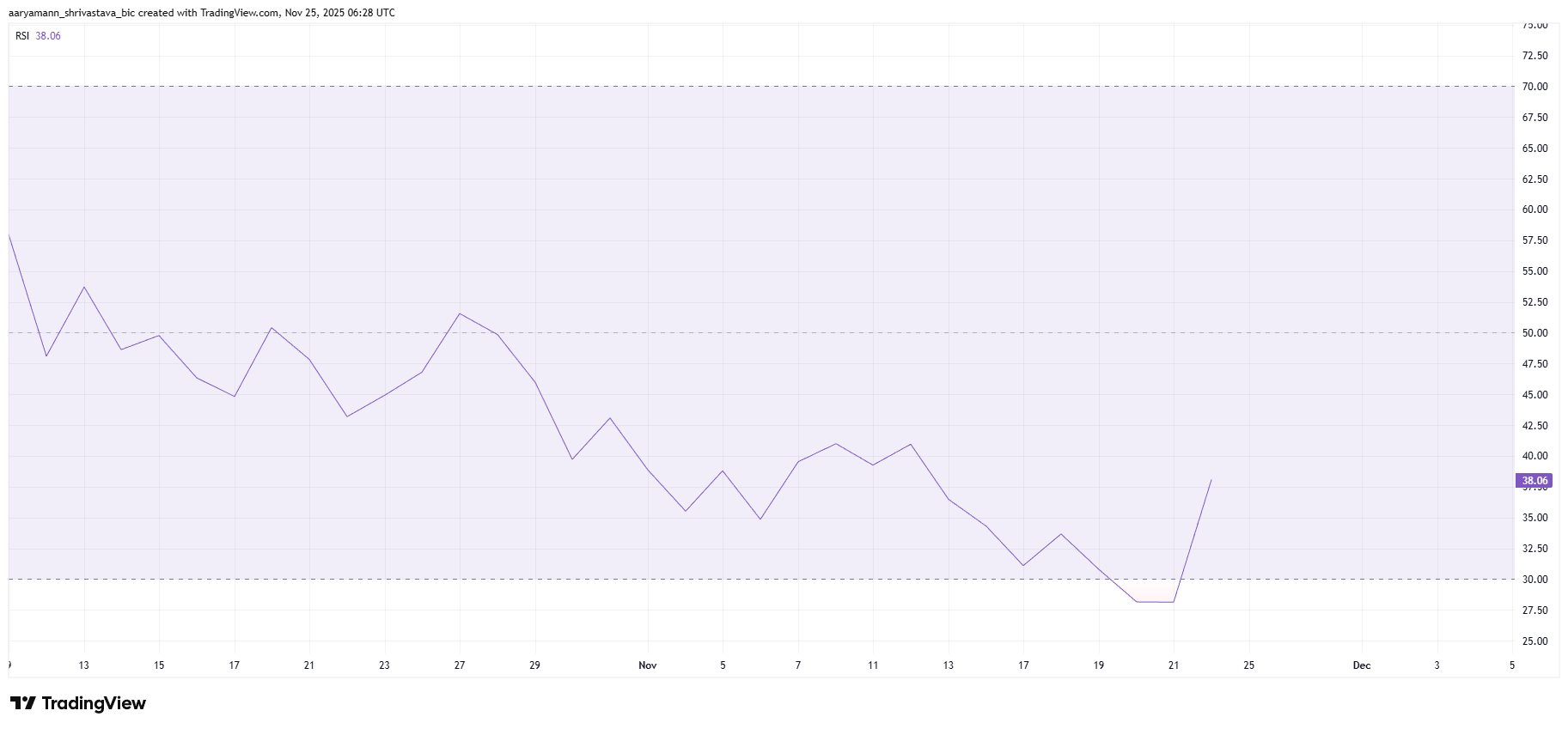

The relative strength index is showing a sharp uptick following BitMine’s major ETH acquisition. The purchase, equivalent to roughly 3% of Ethereum’s total circulating supply, sent a clear signal of confidence from the company. This triggered widespread optimism among investors and lifted the RSI out of oversold territory, a zone that typically precedes trend reversals.

However, the RSI alone cannot confirm a sustained bullish shift. While the indicator’s rise suggests improving sentiment, BMNR still requires consistent buying pressure to support a full recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

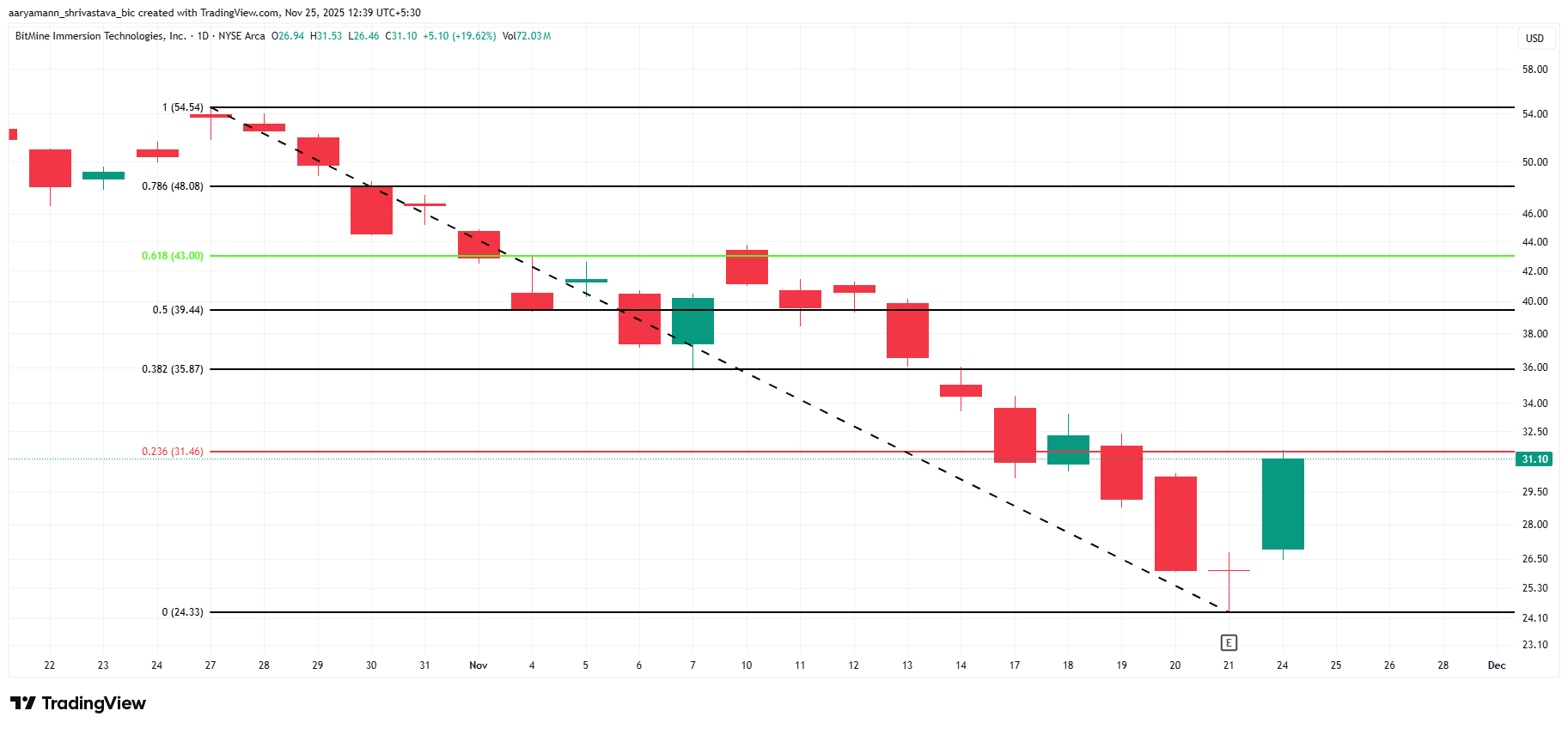

Macro momentum indicators highlight another critical area to watch. The Fibonacci Retracement tool shows that BMNR is approaching the 23.6% Fib line, a historically important support level during bearish phases. This threshold, positioned at $31.46, represents a potential pivot point for the stock.

Reclaiming this level as support would strengthen BitMine’s recovery outlook and enable a more convincing bounce. However, the stock remains just below this threshold and still requires stronger bullish participation to break through.

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Price Reclaims $30

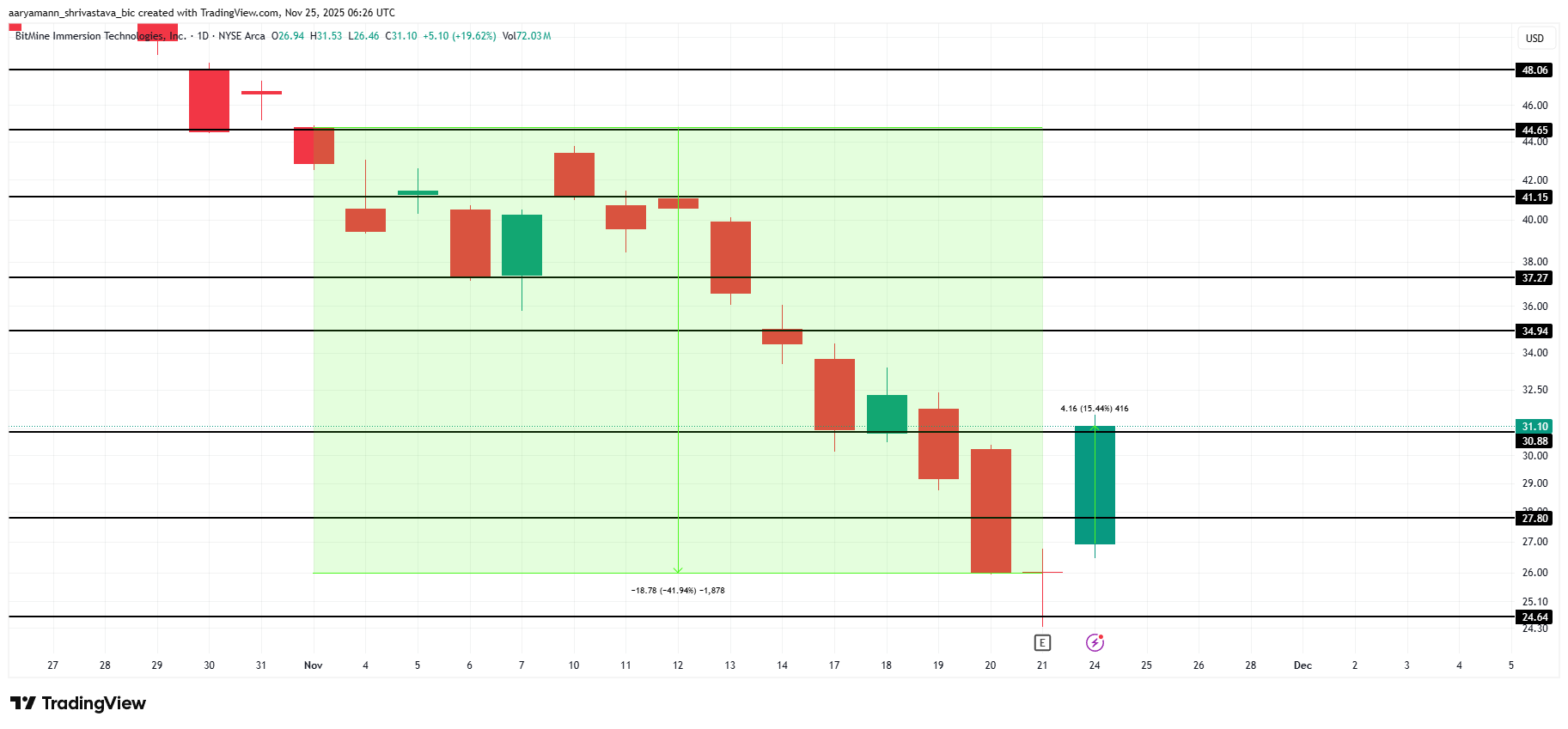

BMNR is trading at $31.10, hovering above the crucial $30.88 support zone. Despite the recent ETH-driven rally, the stock remains down nearly 42% for the month. This positions Monday’s surge as an important—but not yet decisive—step toward recovery.

If bullish momentum persists, BMNR could climb toward the $34.94 resistance level. A break above this barrier may pave the way for further gains toward $37.27 and beyond. This is especially true if investor confidence strengthens around BitMine’s aggressive accumulation strategy.

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

If uncertainty prevails and the company fails to capitalize on the excitement surrounding its ETH purchase, BMNR risks losing the $30.88 support. A breakdown could send the stock to $27.80 or even $24.64. This would invalidate the bullish thesis and signal continued weakness in the short term.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Steep Price Drop: Opportunity for Contrarian Investors or Red Flag for Junior Gold Mining Stocks?

- COAI refers to both ChainOpera AI and junior gold miners' index, with this analysis focusing on the latter's market dynamics. - Junior gold miners (GDXJ ETF) fell 27% in six months amid dollar strength, inflation fears, and overbought conditions after a 128.8% rally. - Technical indicators show bearish signals: broken trend channels, negative volume balance, and RSI divergence, though long-term bull trends persist. - GDXJ's 163.9% surge outpaced gold bullion gains, creating valuation gaps, while ChainOpe

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac