Hedge Funds Are Heavily Shorting the USD – What Does It Mean for Crypto?

Hedge funds are piling into one of their biggest anti-dollar bets in years, just as macro signals hint the USD may be nearing a rebound. If the crowded trade snaps, the ripple effects could hit crypto markets faster than investors expect. Hedge Funds Build Extreme USD Shorts—A Repeatable Pattern? Hedge funds are aggressively shorting the

Hedge funds are piling into one of their biggest anti-dollar bets in years, just as macro signals hint the USD may be nearing a rebound.

If the crowded trade snaps, the ripple effects could hit crypto markets faster than investors expect.

Hedge Funds Build Extreme USD Shorts—A Repeatable Pattern?

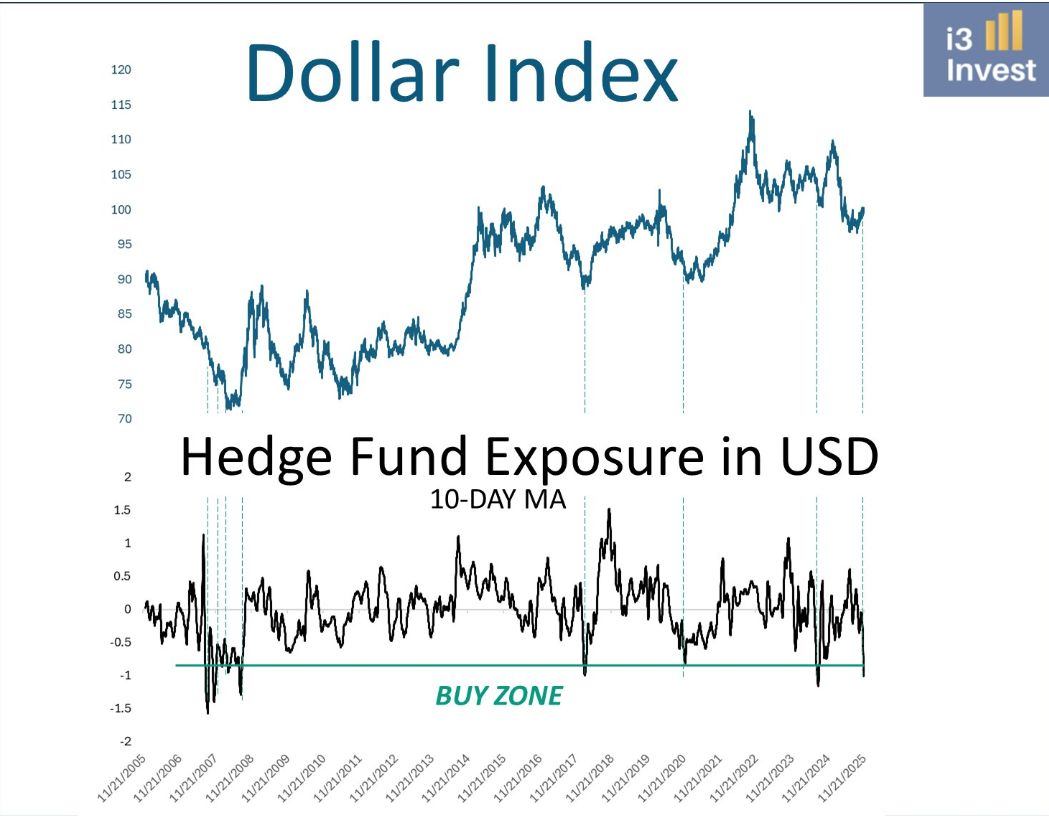

Hedge funds are aggressively shorting the US dollar, reaching one of the most lopsided positioning levels in two decades.

The Positioning Index indicates that funds are deeply entrenched in “extreme short” territory, a zone that has historically preceded a USD recovery rather than a prolonged decline.

Analyst Guilherme Tavares highlighted this setup, noting that the trade has become dangerously crowded.

“Hedge funds are holding significant short positions in the DXY, and historically, similar levels have often preceded solid buying opportunities—at least for a short-term rebound. When a trade becomes too crowded, it’s usually worth considering the opposite side,” he wrote.

Across the past 20 years, every major episode of heavy USD shorting has ended the same way: a dollar bounce that forces fast-money traders to unwind positions.

Hedge Fund Exposure to DXY. Source:

Tavares on X

Hedge Fund Exposure to DXY. Source:

Tavares on X

Macro Tone Doesn’t Support the Anti-Dollar Hype

A similar warning came from EndGame Macro, who pointed out that extreme short positioning rarely appears in calm markets.

They explained that hedge funds are “shorting a weak dollar,” which historically makes the market more vulnerable to even a small shift in sentiment or liquidity.

According to analysts, the broader environment is not as supportive of ongoing USD weakness as traders assume. Treasury markets are pricing future Fed cuts, growth is slowing, and dollar funding markets are tightening, all conditions that make sudden reversals more likely.

“This setup doesn’t guarantee a major dollar bull run, but it does tell you that the downside is probably limited,” said analyst EndGame Macro.

Why Crypto Should Care: A Rising Dollar Is a Threat

Crypto market analysts continue stressing the direct inverse relationship between the DXY and digital assets.

“Dollar up = bad for crypto. Dollar down = good for crypto. If the dollar keeps grinding higher into 2026… you may have to kiss that beloved bull market goodbye,” analyst As Milk Road warned.

The risk is that if the USD rebounds strongly from these crowded shorts, as history suggests, crypto could face sustained pressure during a period when investors were expecting a multi-year bull cycle.

Technical Signals Now Support a USD Reversal

Market technicians are tracking fresh breakout signals on the US Dollar Index. According to Daan Crypto, the DXY has closed above its 200-day moving average for the first time in nearly nine months, positioning the index to break a 7–8 month downtrend.

“This isn’t ideal for risk assets and has been putting pressure on as well… Good to keep an eye on,” he said.

Combined with the yen’s weakness and general derisking behavior after recent market volatility, technical momentum may now be aligning with positioning data to fuel a potential USD resurgence.

If hedge funds are forced to unwind their extreme short positions, the USD could stage a sharp rebound. This could pressure Bitcoin, Ethereum, and risk assets broadly.

The next few weeks of DXY price action, funding conditions, and Fed communication will determine whether crypto’s bullish narrative survives or enters a more defensive phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enlivex Integrates Biotechnology and Blockchain for a Treasury Transformation

- Enlivex Therapeutics raised $212 million to adopt RAIN tokens as its primary treasury asset, becoming the first U.S. public company to use blockchain-based prediction markets. - The investment includes USDT and USD, with RAIN's deflationary design aiming to stabilize value while enabling real-world event trading via AI oracles. - Enlivex's stock surged 85% post-announcement, aligning with growing institutional interest in prediction markets led by firms like Polymarket and Kalshi. - The move faces crypto

Bitcoin Updates: Metaplanet Utilizes Bitcoin-Backed Loan to Expand Portfolio Despite 20% Unrealized Loss

- Tokyo-listed Metaplanet secured a $130M Bitcoin-backed loan to expand BTC holdings despite a 20% unrealized loss on its 30,823 BTC reserves. - The firm maintains "sufficient collateral headroom" amid Bitcoin's $87,000 price, below its $108K average purchase cost, using floating-rate debt and equity financing. - Its hybrid funding model—$500M credit facility plus $5B capital injections—reflects broader industry reliance on crypto-collateralized borrowing amid tightening credit and falling stock prices. -

USDe's total value locked drops by 50% even as onchain activity remains strong, highlighting the vulnerability of DeFi yields

- Ethena's USDe stablecoin TVL fell 50% to $7.6B amid yield compression and unwinding leveraged carry trades, despite rising onchain transaction volume. - The synthetic stablecoin's 5.1% APY now lags Aave's 5.4% USDC borrowing rates, triggering outflows as leverage strategies become unprofitable. - Collapsing 10x leverage loops and maturing perpetual tokens accelerated TVL decline, exposing fragility of yield-bearing stablecoins in risk-off markets. - Chaos Labs recommends lowering Aave V3 stablecoin borro