SEC Grants Fuse No-Action Letter, Boosting Regulatory Clarity for Crypto Token Incentives

Quick Breakdown:

- The U.S. SEC issued a rare no-action letter granting regulatory protection for Fuse’s FUSE token.

- The no-action letter is contingent on the FUSE token being used strictly for network utility and distributed as an incentive for infrastructure maintenance, rather than sold for public speculation.

- The decision is seen as a sign of broader changes and increased openness to crypto projects under the new SEC Chairman.

SEC endorses Utility-Driven token models

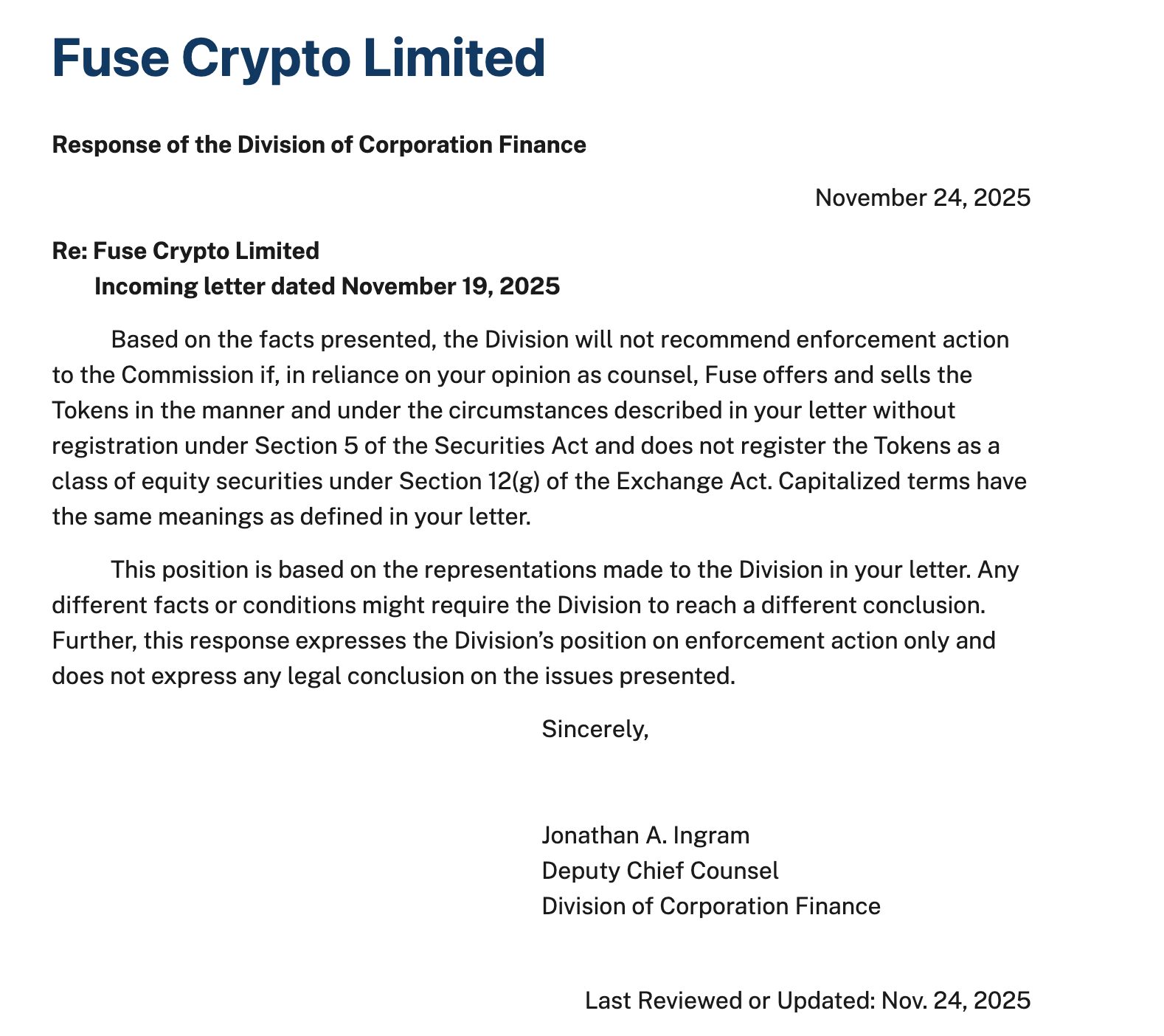

The U.S. Securities and Exchange Commission (SEC) has issued a rare no-action letter to the decentralized physical infrastructure network (DePIN) project Fuse, which operates on Solana. The SEC’s decision confirms that it will not pursue enforcement actions related to the project’s FUSE token so long as it is used strictly for network utility and distributed as an incentive for infrastructure maintenance, rather than sold to the public. This regulatory stance allows Fuse to proceed without fear of immediate legal challenge and offers a precedent for similar token-based ecosystem rewards.

Source:

SEC

Source:

SEC

Fuse’s submission detailed how FUSE tokens are essential to network operations, consumed strictly for technical functions rather than speculation. According to the SEC, as long as Fuse continues to follow this model, network contributors can expect regulatory “cover,” marking a significant shift from earlier periods of regulatory uncertainty.

New SEC leadership signals greater openness to crypto

The no-action letter to Fuse comes amid broader changes at the SEC under new Chairman Paul Atkins, who took office in April. The leadership change has clearly shifted the SEC’s approach, leading to more open dialogue with crypto projects. In recent months, the agency has granted similar relief to DoubleZero , another DePIN project, as well as to crypto custodians that aren’t traditional banks, signalling a broader push toward clearer, more consistent guidance. Legal experts point out that the Fuse case was relatively straightforward from a regulatory standpoint, since the FUSE token is built for functional use within the network, similar to miner rewards in Proof-of-Work systems, rather than for passive investment.

Crypto lawyers and project teams have welcomed the SEC’s shifting stance, saying that no-action letters offer much-needed clarity and help cut down regulatory risk for blockchain startups. Industry observers emphasize that while these decisions do not establish sweeping precedents, they demonstrate a pragmatic shift and a baseline for what network-driven, utility-based tokens must meet to remain outside federal securities laws.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell’s allies make a major statement! Is a Federal Reserve rate cut in December now highly likely again?

Economists point out that three of the most influential officials have formed a strong coalition supporting interest rate cuts, which will be difficult to shake.

The latest SOL proposal aims to reduce the inflation rate, but what are the opponents thinking?

The Solana community has proposed SIMD-0411, which would increase the inflation deceleration rate from 15% to 30%. It is expected to reduce SOL issuance by 22.3 million over the next six years and accelerate the reduction of the inflation rate to 1.5% before 2029.

IoTeX launches the world's first on-chain identity solution ioID designed specifically for smart devices

ioID is revolutionizing identity management for smart devices, allowing DePIN to authenticate devices, protect data, and unlock next-generation application scenarios within a user-owned ecosystem compatible with any blockchain.

Mars Morning News | Last week, global listed companies made a net purchase of $13.4 million in BTC, while Strategy did not buy any Bitcoin last week

Expectations for a Federal Reserve interest rate cut in December have risen, with Bitcoin briefly surpassing $89,000 and the Nasdaq surging 2.69%. There are internal disagreements within the Fed regarding rate cuts, causing a strong reaction in the cryptocurrency market. Summary generated by Mars AI. This summary is generated by the Mars AI model and its accuracy and completeness are still being iteratively updated.