Solana ETFs Hit 20-Day Inflow Streak

Solana is doing something unusual in a shaky market: attracting uninterrupted institutional capital. While traders are still de-risking across the board, the U.S. spot Solana ETFs have just logged their twentieth consecutive day of net inflows, signalling that the deeper pockets are positioning for a longer-term payoff.

What’s driving Solana’s 20-day inflow streak?

Spot Solana ETFs recorded $58 million in inflows on Monday, continuing a straight line of positive momentum since these funds launched in late October. Bitwise’s BSOL led the day with $39.5 million, marking its third-largest daily inflow since going live and the most impressive since November 3.

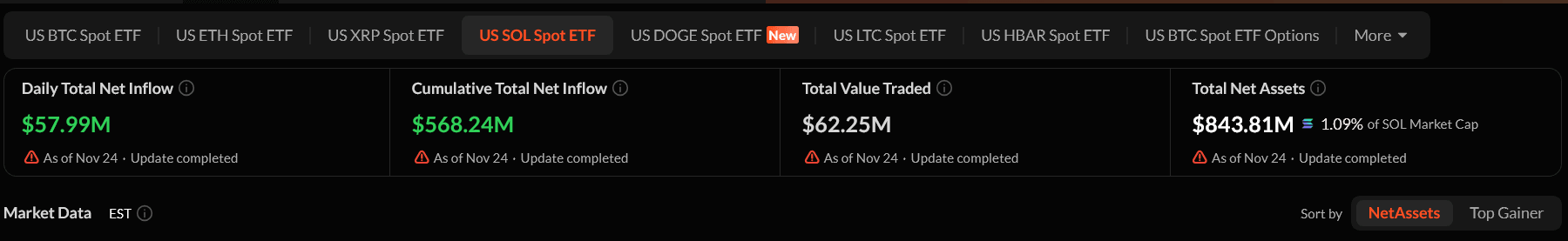

With this, Solana ETFs have now attracted $568.24 million in total inflows across six funds. Collectively, they hold $843.81 million in net assets, representing roughly 1.09 percent of Solana’s entire market cap. For a relatively new ETF class, that’s a serious show of confidence.

Nick Ruck from LVRG Research summed it up well: institutional investors expected a softer response, especially in a declining crypto market, but Solana’s ETFs beat those expectations. The consistency of these inflows points to Solana’s growing maturity as a blue-chip asset that can sit alongside Bitcoin and Ethereum in institutional portfolios.

Why are institutions choosing Solana right now?

What this really means is that Solana is carving out a practical role in the tokenization and DeFi infrastructure race. Jeff Mei from BTSE noted that traditional financial institutions are actively choosing Solana for tokenization use cases, including products like xStocks that bridge U.S. equities and digital asset rails.

That institutional vote of confidence matters. It reinforces the idea that Solana’s ecosystem isn’t just thriving on speculation; it’s being integrated into real-world financial products.

Will these inflows lift Solana’s price?

Solana’s token price is still falling in line with the wider market downturn. Selling pressure is visible across almost every layer of crypto, and ETFs are not immune to macro sentiment.

But these inflows do something important beneath the surface. They create a tightening effect on circulating supply and establish a reliable cushion of demand. Once the broader de-risking phase slows down, the ETF flows can play a crucial role in kick-starting a recovery.

Ruck believes this foundation sets up Solana for a rebound once the market stabilizes. And historically, persistent ETF inflows have been a reliable precursor to medium-term price strength.

XRP and Dogecoin ETFs also saw movement

While Solana captured the spotlight, $XRP ETFs logged $164 million in net inflows on Monday, their second-highest day ever after the November 14 record of $243 million. Both Grayscale and Franklin Templeton ETF products pulled over $60 million each.

On the other side, Grayscale launched the first spot Dogecoin ETF (GDOG) . Its opening day saw zero net flows, though trading volume hit $1.41 million. Markets are watching closely to see whether DOGE can build the same consistency as Solana or XRP.

Solana’s twenty-day streak sends a clear message: institutional investors haven’t lost confidence. In fact, they’re doubling down. The price may not show it right now, but ETF flows are often a leading indicator rather than a trailing one.

If the market shakes off its current risk-off mood, $SOL is positioned to be one of the earliest and strongest rebounders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Tether Faces Scrutiny Over Stability—S&P Issues Caution While Crypto Community Responds

- S&P Global Ratings downgraded Tether's USDT to "weak," citing high-risk Bitcoin exposure and reserve transparency concerns. - Tether criticized the rating as "misleading," defending its 1:1 dollar peg and $135B Treasury holdings as evidence of stability. - The downgrade highlights regulatory tensions as USDT faces scrutiny under new laws requiring stablecoins to be fully backed by low-risk assets. - Despite risks, USDT maintains $184B market cap and $76B daily volume, underscoring its critical role in cr

Bitcoin Updates: Tether’s Gold Holdings Confront U.S. Regulations, Drive Gold Prices Up by 50%

- Tether , issuer of USDT , now holds 116 tons of gold ($12.9B), surpassing reserves of central banks like South Korea and Hungary. - Its 26-ton Q3 gold purchase (2% of global demand) boosted gold prices 50% YTD, while Bitcoin reserves ($9.9B) challenge U.S. liquidity rules. - The firm plans to launch gold-free USAT for U.S. compliance, but S&P downgraded its dollar-peg stability due to non-liquid assets and transparency concerns. - Tether's $300M gold royalty investments and XAU₮ token ($2.1B market cap)

Robinhood’s Tokenized Shares Transform Global Finance, Approaching $10M RWA Ceiling

- Robinhood tokenized major stocks (GOOGL, NVDA , TSLA) on Arbitrum One, pushing RWA market cap toward $10M. - Arbitrum's low-cost layer-2 infrastructure enables seamless blockchain-traditional finance integration via tokenization. - Hybrid portfolios blending RWAs and meme tokens emerge, with DeFi collateralization and fractional ownership expanding use cases. - Platform blurs trading boundaries, risking amplified volatility while demonstrating blockchain's potential for financial accessibility. - Regulat

Cardano News Today: Cardano's Prospects for a 2026 Breakthrough Strengthen Thanks to Ecosystem Growth and Technological Advances

- Cardano's ADA token nears $0.50 as open interest rises 6%, supported by on-chain buy-side dominance and positive derivatives funding rates. - Technical indicators show RSI recovery and bullish MACD convergence, with $0.49 breakout potential triggering wedge pattern targets. - Founder Charles Hoskinson outlined 2026 roadmap including privacy token NIGHT, Kenya/Uganda microloan platform RealFi, and cross-chain scaling via Leios/Hydra. - Strategic focus on DeFi integration, TVL growth, and multi-chain inter