Key Market Information Discrepancy on November 25th, a Must-See! | Alpha Morning Report

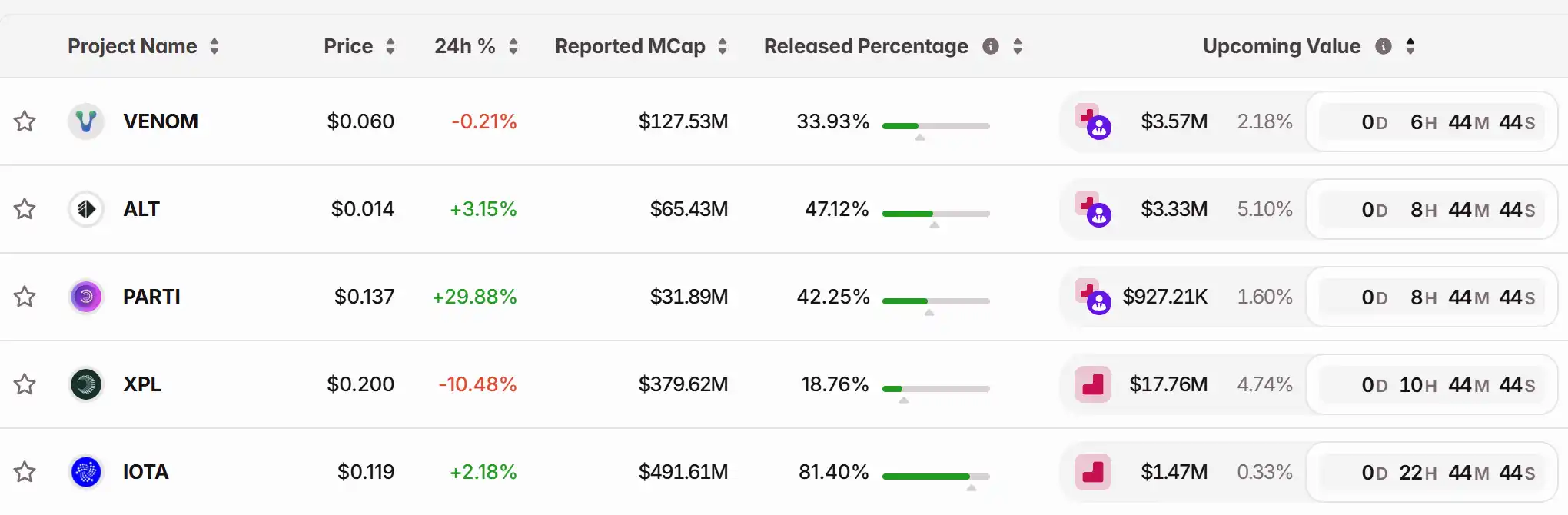

1. Top News: Fed's December Rate Cut Expectation Rises, Bitcoin Briefly Breaks $89,000, Nasdaq Surges 2.69% 2. Token Unlock: $VENOM, $ALT, $PARTI, $XPL, $IOTA

Featured News

1.Fed's December Rate Cut Expectation Rises, Bitcoin Briefly Surpasses $89,000, Nasdaq Surges 2.69%

2.MON Surges to $0.038 Early Today Before Falling Back to $0.0303

3.US Stocks Rise at Market Open, Crypto Stocks Rally, COIN Up 2.57%

4.Trump Orders Launch of 'Genesis Mission' to Propel AI Research Revolution

5.$368 Million Liquidated Across the Network in the Past 24 Hours, Mainly Short Positions

Articles & Threads

1.《Hunting Down Polymarket Bots》

On November 22, 2025, a silent showdown unfolded on a Polymarket prediction market. One side of the showdown was a mysterious trader named @totofdn. The other side was an automated arbitrage bot named sunshines. It all began with an insignificant order. The arbitrage bot was outsmarted and drained by the trader

2.《The B-Side of US AI: Working for Chinese Bitcoin Miners》

At the end of 2025, a Chinese crypto equipment company, Bitcontinental, was added to the US national security review list. On November 21, the US Department of Homeland Security launched Operation Red Sunset, putting Bitcontinental on the review table citing national security reasons. The accusation terms cut to the bone: investigating whether their equipment has remote backdoors and whether it could deal a lethal blow to the US power grid in extreme times. Why would a Chinese mining company be accused of potentially endangering the US grid? This stems from US extreme anxiety over core resources. At this moment in Silicon Valley, the most expensive 'silent' act in tech history is unfolding.

Market Data

Daily Marketwide Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u

Visa and AquaNow Upgrade Payment Infrastructure through Stablecoin Integration

- Visa partners with AquaNow to expand stablecoin settlement in CEMEA via USDC , aiming to cut costs and settlement times. - The initiative builds on a $2.5B annualized pilot program, leveraging stablecoins to modernize payment infrastructure. - Visa's multicoin strategy aligns with industry trends, as regulators and competitors like Mastercard also explore stablecoin integration. - Regulatory progress in Canada and risks like volatility highlight evolving opportunities and challenges in digital asset adop

Bitcoin Updates: Large Holder Liquidations and Retail Investor Anxiety Lead to a Delicate Equilibrium in the Crypto Market

- A long-dormant crypto whale sold 200 BTC after a 3-year hibernation, intensifying market scrutiny over investor sentiment and liquidity shifts. - Bitcoin struggles above $92,000 amid weak technical indicators, mixed ETF flows ($74M inflow for BTC vs. $37M ETH outflow), and diverging institutional/retail behaviors. - Whale activity highlights fragile market balance: large holders accumulate BTC while retail investors liquidate, with over $557M in BTC moved from Coinbase to unknown wallets. - Technical bea