XRP Price Bounces, But One “Unlucky 13″% Threat Still Lingers

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough. A critical risk is back on the table

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough.

A critical risk is back on the table — a setup that could push the XRP price down by over 13%.

Momentum Improves, but Volume and Supply Pressure Compete

XRP’s short-term strength starts with On-Balance Volume (OBV). OBV shows whether real volume is entering or leaving the market. XRP’s OBV has finally moved above its short trend line, hinting that buyers are returning.

But this move carries a warning. OBV tried the same breakout on November 18 and failed. That failure triggered a 19% drop between November 18 and November 21.

The latest push above the line is only marginal, not a clean breakout. If it slips again, the same pattern could repeat.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Faces Trendline Risk:

TradingView

XRP Faces Trendline Risk:

TradingView

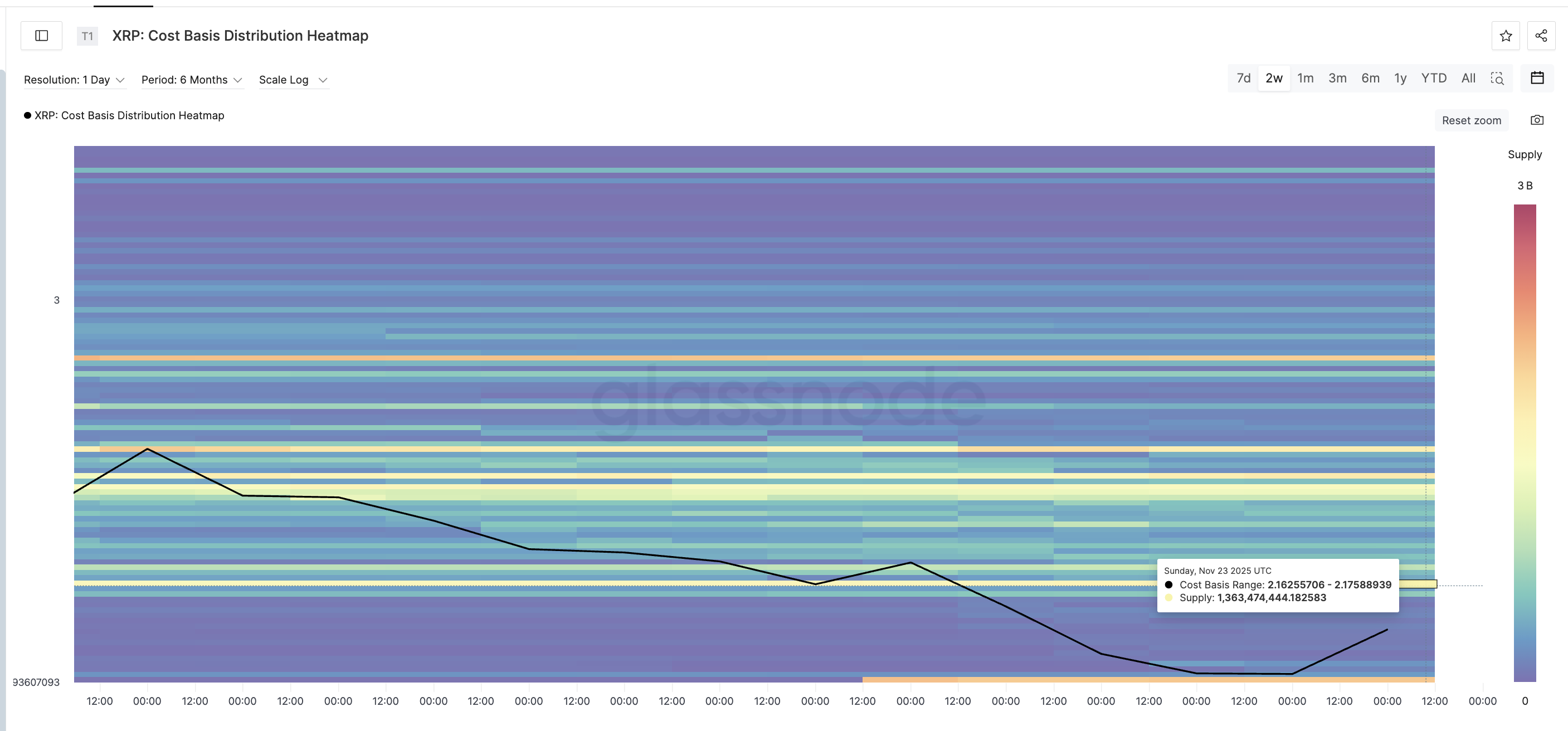

There is also supply pressure overhead. The cost-basis heatmap shows a dense cluster between $2.16 and $2.17, where roughly 1.36 billion XRP sits, worth almost $2.86 billion. These holders sit near breakeven and often sell into small recoveries.

Strong Supply Clusters Sit Overhead:

Glassnode

Strong Supply Clusters Sit Overhead:

Glassnode

If OBV weakens while the XRP price faces this supply zone, the bounce can fade quickly.

Still, OBV moving higher is one of the few positives for now. A decisive break above 6.93 billion on the OBV chart would confirm stronger volume support and improve XRP’s odds of clearing resistance.

XRP Price Action: The Unlucky 13% Risk Still Hangs Over XRP

Even with a mild recovery, the XRP price still trades under the major moving averages. The 100-day exponential moving average (EMA) and the 200-day EMA are both angled down, and the 100-day is now about to cross below the 200-day.

An exponential moving average gives more weight to recent prices, so it reacts faster than a simple moving average. When the 100-day EMA drops under the 200-day EMA, a bearish crossover forms. And it can amplify the downside.

This is the core risk for XRP right now. If the crossover completes, the XRP price could slide toward $1.81, which is the same bottoming zone the recent candles have pointed to. That would be a 13% dip from the current levels. If sellers stay active while the crossover forms, XRP could easily revisit that level. Even the previous OBV breakout failure amplifies the risk of a similar XRP price drop.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

There is one way out, though!

A clean daily close above $2.25 would weaken the crossover setup. That move would also show buyers breaking through the $2.16–$2.17 supply wall, where about 1.36 billion XRP sit. Holding above $2.25 would allow the 100-day EMA to curl upward again and reduce the crossover impact.

Until that happens, the bearish EMA structure keeps the 13% XRP price downside threat alive, even with OBV turning up.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TradFi Develops Blockchain Foundations, Transforming International Financial Systems

- Traditional banks like Standard Chartered and Citi expand crypto custody services, partnering with firms like 21Shares to integrate digital assets into core infrastructure. - Strategic moves include Standard Chartered consolidating custody under its parent bank and Citi enhancing fiat-stablecoin transaction capabilities with Coinbase . - Regulatory developments, such as Japan's proposed reserve rules for exchanges , and $4.65B Q3 2025 crypto VC funding highlight sector maturation and institutional adopti

Zodia Faces an Unclear Path as Standard Chartered Moves Forward with Traditional Finance Crypto Custody

- Standard Chartered partners with 21Shares to offer crypto custody, signaling TradFi's deeper integration into digital assets. - Zodia Custody's uncertain future highlights competitive pressures as crypto-native custodians face challenges from traditional banks. - Legal risks and a credit downgrade complicate Standard Chartered's crypto expansion amid regulatory shifts like Japan's asset segregation rules. - Industry trends show traditional banks leveraging reputation and compliance to compete with crypto

Trump’s ACA Subsidy Proposal Weighs Financial Relief Against Concerns Over Fraud in a Delicate Political Balance

- Trump proposes extending ACA subsidies for two years, raising eligibility to 700% FPL and ending zero-premium plans to combat fraud. - The plan faces bipartisan challenges, with Senate voting in mid-December and House Republicans favoring alternative cost-cutting measures. - Analysts warn premium hikes could destabilize ACA markets, risking coverage for 22 million Americans amid partisan gridlock.

Thiel Turns to Major Defensive Tech Firms Amid Growing Concerns Over AI Bubble

- Peter Thiel's Q3 2025 portfolio reshuffling saw full exit from Nvidia and reduced Tesla holdings , shifting funds to Apple and Microsoft amid AI valuation concerns. - The $166M from sales was partially reinvested into Apple and Microsoft, leaving over $120M in cash reserves, signaling a defensive strategy shift. - Nvidia's 0.33% premarket dip and mixed market reactions highlight institutional sentiment shifts, with analysts debating Thiel's caution versus potential miscalculation. - Thiel's track record