Bitcoin News Today: Bitcoin Index Face-Off: Saylor Challenges Convention, Ignites Market Fluctuations

Michael Saylor, who leads

Strategy, which holds more Bitcoin than any other public company—$56 billion in

Saylor has rejected these worries, stressing that Strategy is "not a fund, not a trust, and not a holding company," but rather a "Bitcoin-backed structured finance company" with a $500 million software division and $7.7 billion in Bitcoin-secured credit products

The MSCI verdict, anticipated by January 15, 2026, has already led to market swings. Strategy’s share price is down more than 40% from its peak, and its mNAV ratio is close to 1.0, meaning its market cap now closely tracks its Bitcoin assets

The implications go beyond just Strategy. Experts warn that a delisting could spark a wider sell-off in crypto assets, as passive funds would be forced to liquidate. Bitcoin’s value has already fallen 30% from its October highs,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Investments See $4 Billion Influx Amid Price Drop: Market Adjusts After Recent Surge

- Ripple's XRP ETFs see $128M inflows and regulatory approvals, but prices drop amid market correction. - XRPI and XRPR ETFs fall 8%, while XRPC ETF generates $58.5M in first-day trading, surpassing Solana's debut. - SEC approvals confirm XRP's commodity status, boosting institutional confidence as nine new XRP ETFs target $4B–$8B inflows. - Technical analysis shows XRP-USD above $2.00, with analysts projecting $2.50 by late 2025 if ETF AUM exceeds $8B.

San Francisco Hotel Promotions and Autonomous Taxis Indicate Economic Recovery

- San Francisco's hotel market shows recovery as Newbond and Conversant buy two iconic hotels for $408M, signaling investor confidence amid rising convention bookings. - Tech innovation accelerates with Amazon's Zoox launching free robotaxi trials, competing with Waymo and Tesla in autonomous vehicle testing. - Deutsche Bank raises capital via a 7.125% AT1 bond and revises ESG targets to include 900B€ in transition finance by 2030, reflecting industry decarbonization trends.

TWT's Revamped Tokenomics: Redefining Value for Holders and Ensuring Long-Term Project Viability

- TWT rebranded as Toncoin in 2025, shifting to gamified utility via Trust Premium, emphasizing user engagement and gas discounts. - A 2020 token burn reduced supply by 40%, but liquidity risks persist due to pre-burn circulation and centralized utility dependencies. - Lessons from TNSR's collapse highlight the need for decentralized use cases, as TWT's value relies on recurring incentives and cross-chain liquidity. - Analysts project TWT could reach $15 by 2030, contingent on sustained adoption and addres

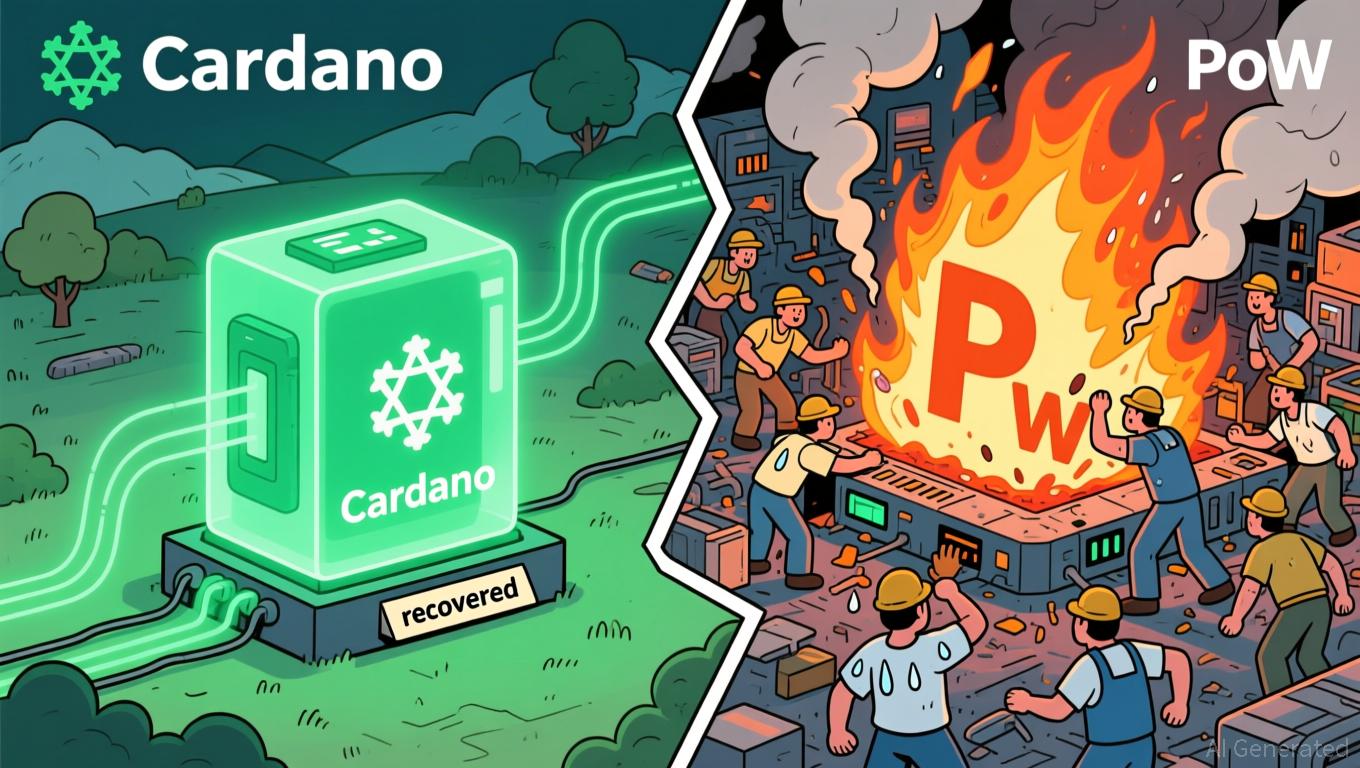

Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv