Key Market Information Discrepancy on November 24th – A Must-Read! | Alpha Morning Report

1. Top News: Bitcoin Surges Above $88,000 This Morning Before Retracing 2. Token Unlock: $SOSO, $NIL, $MON

Top News

1. Bitcoin Surges Above $88,000 This Morning Before Pulling Back

2. Federal Reserve Entering Quiet Period, Institutions Maintain December Rate Cut Expectation

3. Altcoins Recovering, PIPPIN Surges Over 148% in 24 Hours

4. TNSR Surges Over 80% in 24 Hours, Currently Trading at $0.1838

5. $213 Million Liquidated in the Past 24 Hours, Majority of Liquidations on Short Positions

Articles & Threads

1. "Crypto's Strongest Bulls and Bears Dialogue: Has the Four-Year Crypto Cycle Lost Its Edge?"

The 2025 crypto market is at a delicate inflection point: Bitcoin ETF approval, the intertwining of liquidity cycles and debt refinancing periods, AI hype diverting funds, traditional finance and tech giants accelerating blockchain adoption. In such a backdrop, the market structure exhibits anomalies, with a lack of buying interest in small-cap assets, underperformance of high-performance public chains like Solana, and investor sentiment swinging between extreme optimism and panic.

2. "What Have the Mainstream Perp DEXes Been Up To Lately?"

While the entire crypto market seems to be in another "bear market" phase, enthusiasm for new tracks has not diminished much. Especially in the derivatives track of Perp DEX, many traders and community users are focusing more on the high-frequency, structured, and gamified perpetual market. This is why yet-to-launch Perp DEXes can still produce impressive data in a downturn environment.

Market Data

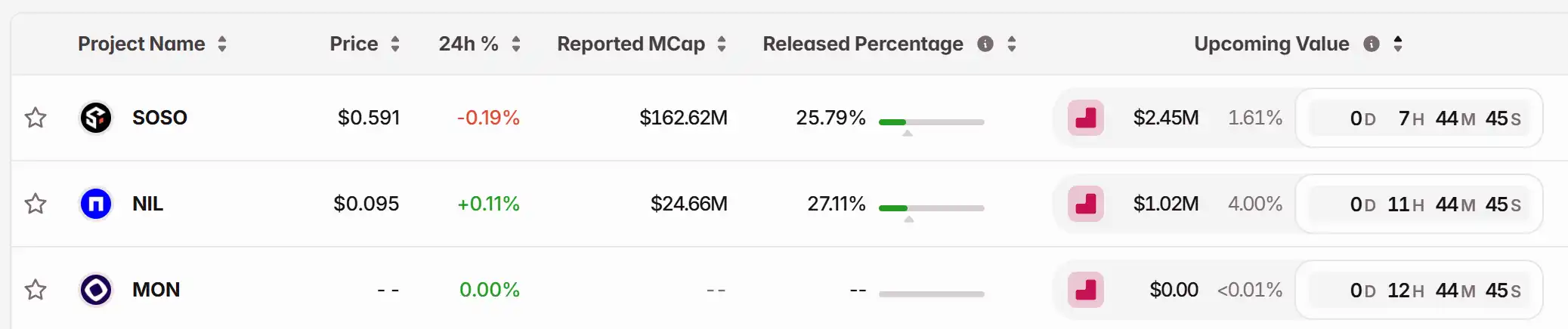

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr