Ethereum’s Recovery to $3,000 Could Be Challenged by New Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment. That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move. Ethereum Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment.

That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move.

Ethereum Holders Have Mixed Feelings

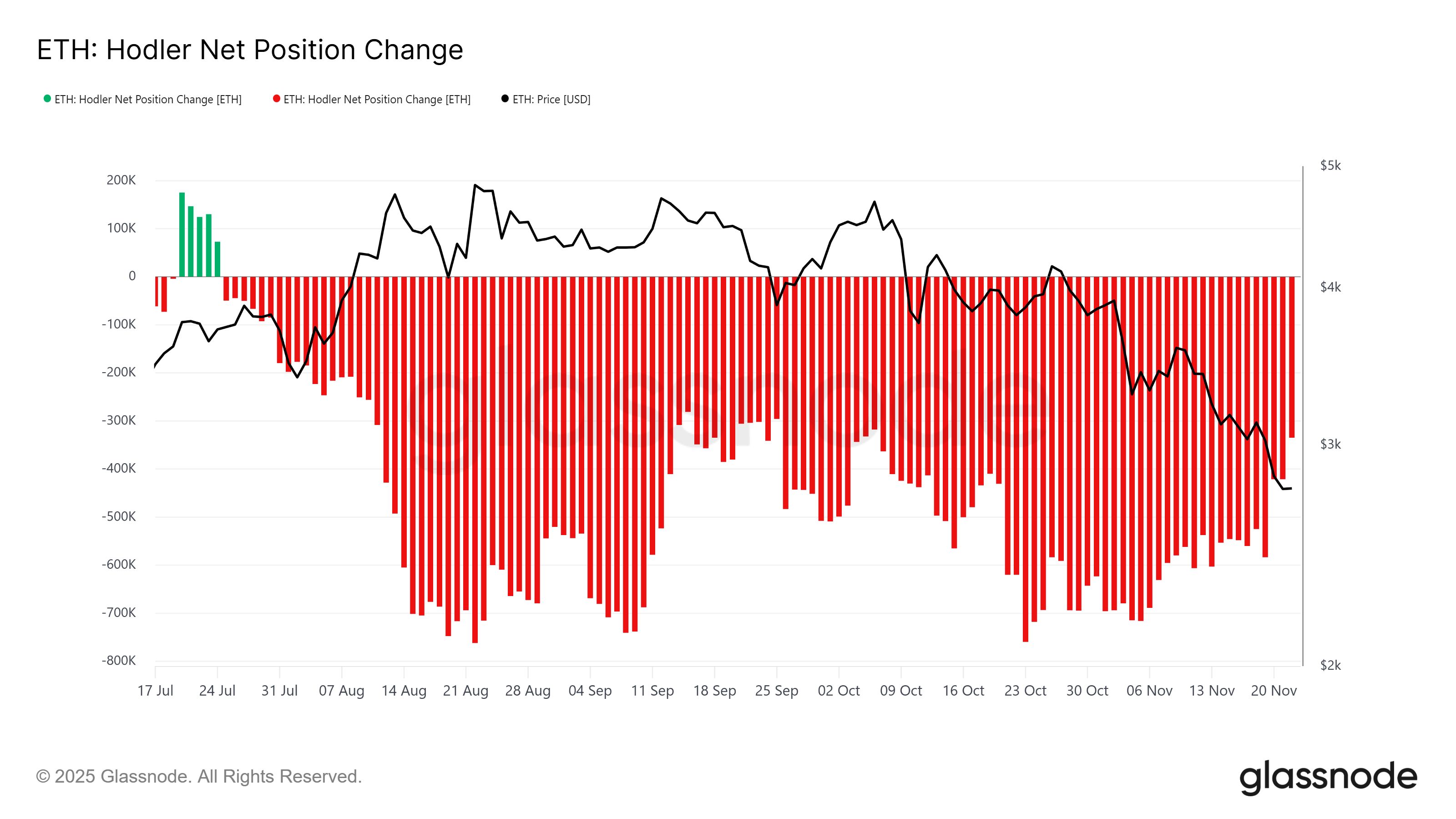

The HODLer Net Position Change indicator is showing a steady incline, signaling improving confidence among long-term holders. This metric measures the movement of ETH within LTH wallets, and the current rise from the negative zone suggests that outflows are slowing. Historically, a shift like this often precedes renewed accumulation.

As long-term holders reduce selling, the market gains stability. Their conviction in Ethereum’s recovery strengthens the asset’s foundation even during volatile conditions.

If this trend continues, LTHs may soon transition from holding to accumulating, providing meaningful support for ETH’s next upward push.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum HODLer Net Position Change. Source:

Glassnode

Ethereum HODLer Net Position Change. Source:

Glassnode

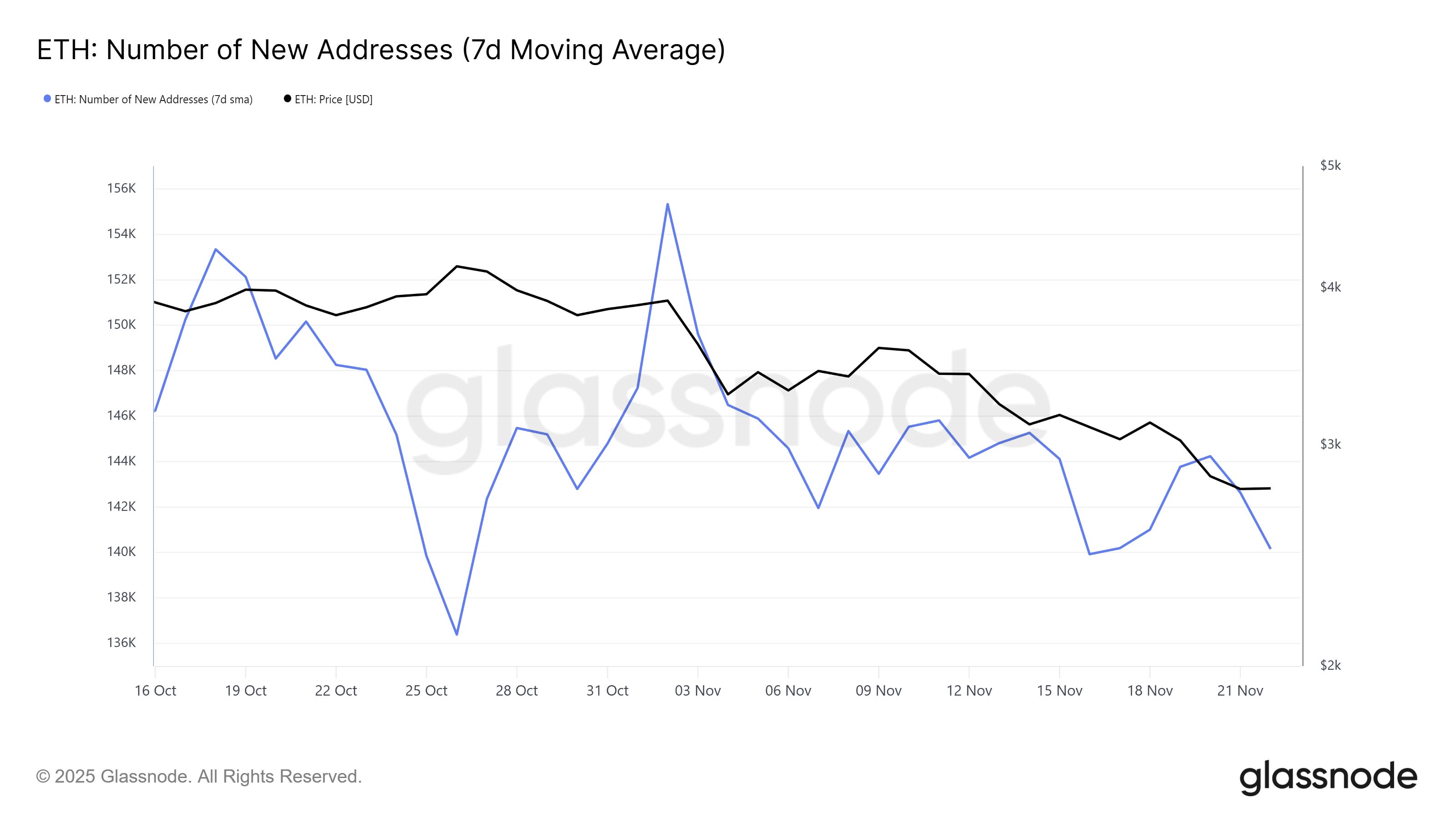

Despite improving sentiment from long-term holders, broader macro momentum remains mixed. The number of new Ethereum addresses is moving sideways, indicating weak interest from potential new investors.

This stagnation is concerning because fresh demand is a critical component of sustained price recovery.

Without an increase in new market participants, inflows may not be strong enough to propel ETH toward the $3,000 mark. Even with solid support from existing holders, a lack of external capital could delay or weaken any meaningful rally.

Ethereum New Addresses. Source:

Glassnode

Ethereum New Addresses. Source:

Glassnode

ETH Price Needs To Recover

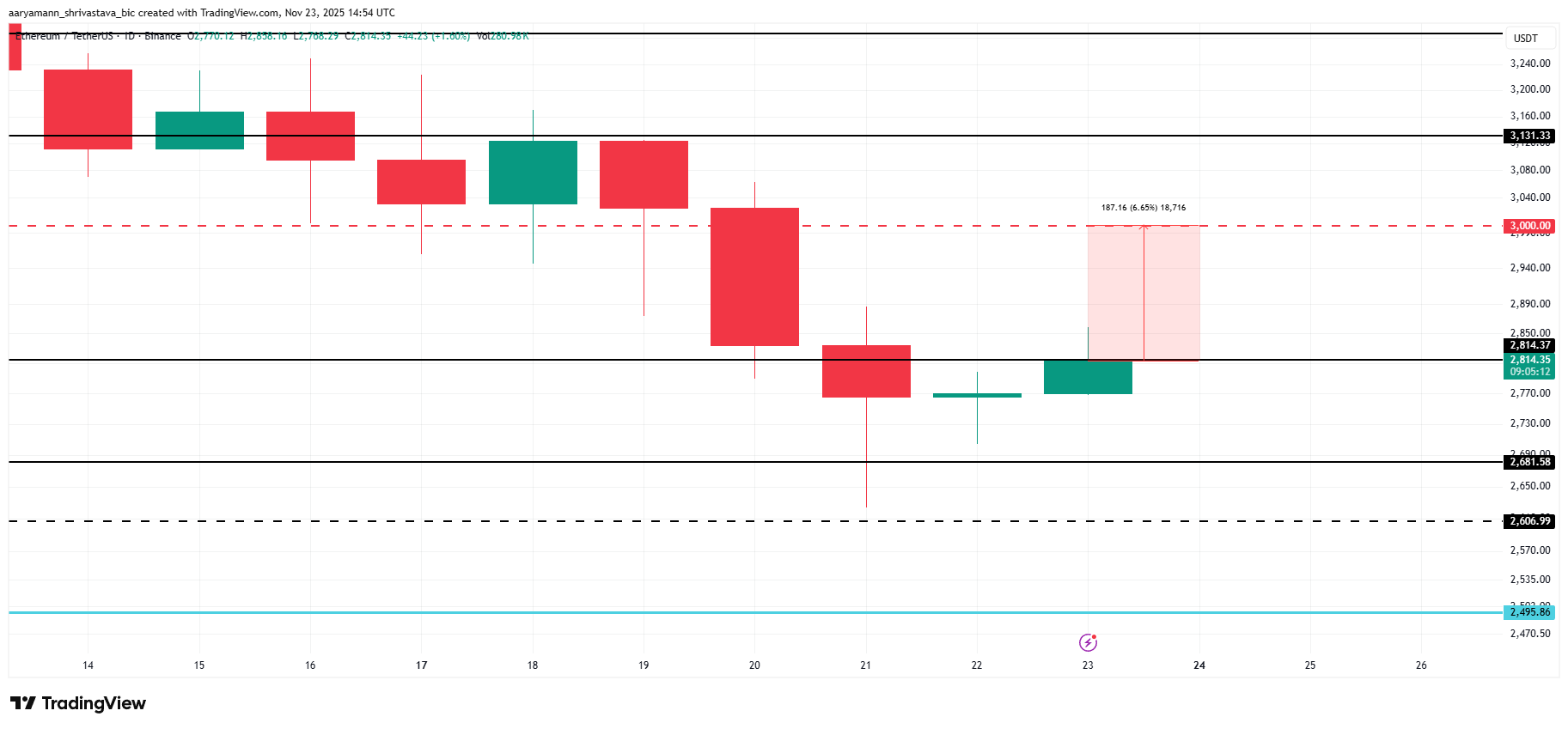

Ethereum is trading at $2,814, sitting directly beneath a key resistance level. At this distance, ETH is just 6.6% away from reclaiming $3,000, a psychologically significant barrier for both traders and long-term investors.

For Ethereum to reach this threshold, support from new investors is essential. If new demand remains weak, ETH may consolidate below $3,000 as existing capital alone may not be sufficient to drive an extended rally. The altcoin king needs broader participation to sustain a breakout.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If inflows improve and new investors re-engage, Ethereum could rally to $3,000 and attempt to flip the level into support. Successfully reclaiming this zone may pave the way for $3,131 or higher. This would invalidate the bearish outlook and restore bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether CEO: Bitcoin’s Strength Stems from Economic Independence

- Tether CEO Paolo Ardoino reaffirmed Bitcoin's value as a tool for financial freedom, emphasizing its role in enabling self-custody and autonomy from centralized institutions. - Tether's partnership with Ledn expands Bitcoin's utility by offering lending services without selling holdings, reinforcing its infrastructure-building strategy for digital assets. - Meanwhile, crypto firms like BitMine and Strategy face market volatility and regulatory risks, with BitMine reporting $328M income but declining stoc

Zcash (ZEC) Halving Scheduled for November 2025: Driving Market Outlook and Influencing Price Trends

- Zcash's 2025 halving cut block rewards by 50%, reducing daily supply to 1,800 ZEC and boosting institutional interest. - Arthur Hayes urged ZEC holders to shift funds to shielded pools, reducing liquidity amid EU AML pressures. - Cypherpunk and Grayscale's $137M investments, plus Zashi Wallet's launch, expanded Zcash's institutional and privacy-driven appeal. - ZEC surged to $750 post-halving, fueled by $108M in treasury investments and 104% growth in futures trading volume. - U.S. regulatory clarity and

Privacy-focused cryptocurrency ZEC sees price jump amid regulatory changes and shifting market sentiment

- Zcash (ZEC) surged to $683 in 2025, driven by U.S. regulatory clarity via the Clarity and Genius Acts, which legitimized privacy-focused crypto. - Institutional adoption grew, with Grayscale, Cypherpunk, and Winklevoss investing $137M-$58.88M in ZEC, viewing privacy as a strategic asset. - Quantum-resistant upgrades and shielded pools boosted ZEC's utility, though risks like regulatory shifts and overbought conditions remain. - Analysts debate ZEC's long-term viability, balancing its privacy innovation a

Bitcoin Updates: As Investors Pull Out of Bitcoin ETFs, Altcoins See Increased Inflows During November Sell-Off

- U.S. bitcoin ETFs lost $1.22B in net outflows for the week ending Nov 21, extending a four-week negative streak with total November redemptions reaching $3.79B. - Bitcoin fell below $82,000 amid a 7-month low, triggering a $350B crypto market cap drop as Citi noted 3.4% price declines per $1B ETF outflow. - Solana and XRP ETFs bucked the trend with $300M and $410M inflows, attracting institutional interest despite broader market weakness. - Analysts warn of potential 50% further Bitcoin declines, while F