Barclays: Powell May Push the Federal Reserve to Cut Rates Next Month

Jinse Finance reported that Barclays Research pointed out that there is still uncertainty regarding the Federal Reserve's interest rate decision next month, but Chairman Powell is likely to push the FOMC to make a rate cut decision. According to recent statements, Barclays believes that Governors Milan, Bowman, and Waller may support a rate cut, while regional Fed Presidents Musalem and Schmid tend to favor keeping rates unchanged. The latest remarks from Governors Barr and Jefferson, as well as Goolsbee and Collins, indicate that their attitudes are not yet clear, but they are more inclined to maintain the status quo. Governors Cook and Williams rely on data, but seem to be more supportive of a rate cut. Barclays stated: "This means that before considering Powell's position, there may be six voters inclined to keep rates unchanged and five inclined to cut rates." The bank added that Powell will ultimately dominate this decision, as it is a high threshold for governors to publicly oppose his position. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A certain whale has rebuilt a position of 90.85 WBTC at an average price of $87,242.

Economist: December rate cut becomes highly probable again, Williams' remarks set the tone for the market

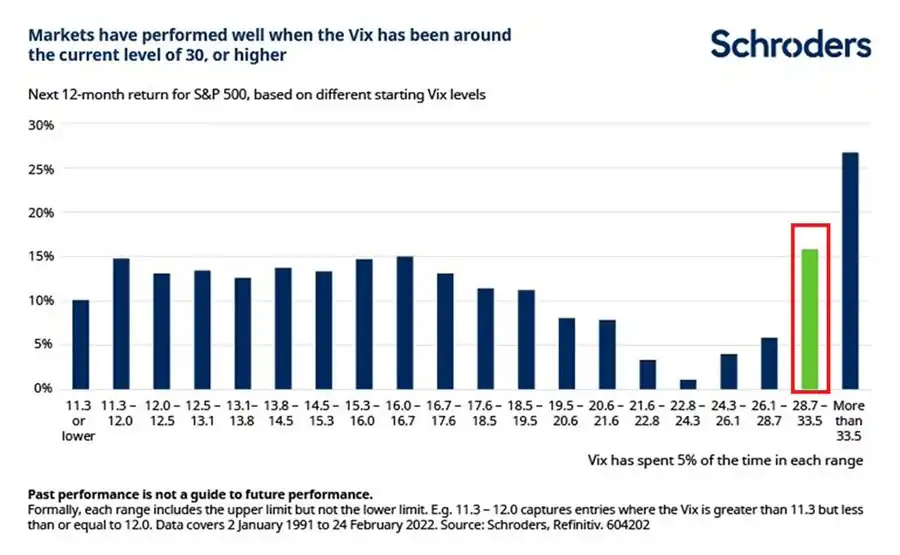

Analysis: When the volatility index VIX exceeds 28.7, the S&P 500 often delivers strong returns

Trading volume on BSC remains sluggish, with most popular meme tokens seeing transactions below $1 million.