Did the US Really “Manufacture” the Bitcoin Crash? What to Know About the MSTR Buyout Rumor

Over the course of last week, and even before that, the Bitcoin price recorded a concerning pattern. The US trading sessions drove Bitcoin losses, while Asian markets consistently bought the dip, indicating sharp regional divergence. New reports allege that the government may have orchestrated the sell-off seen during the US sessions as part of its

Over the course of last week, and even before that, the Bitcoin price recorded a concerning pattern. The US trading sessions drove Bitcoin losses, while Asian markets consistently bought the dip, indicating sharp regional divergence.

New reports allege that the government may have orchestrated the sell-off seen during the US sessions as part of its broader investment strategy.

US Buyout Rumors Hit MicroStrategy as Bitcoin Crashes to $85,000

Bitcoin’s recent price decline revealed a sharp split in trading, with US sessions driving sell-offs while Asian traders steadily buy the dip.

According to Max Keiser, a Bitcoin pioneer, the US government may be eyeing MicroStrategy ($MSTR) and Coinbase ($COIN), potentially capitalizing on Bitcoin’s steep sell-off in November.

RUMOR: The U.S. is contemplating a multibillion investment in $MSTR & $COIN

While no evidence confirms the claims, the speculation has spread. Some suggest that this interest drove the government to orchestrate the recent Bitcoin sell-off to the sub-$90,000 range.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

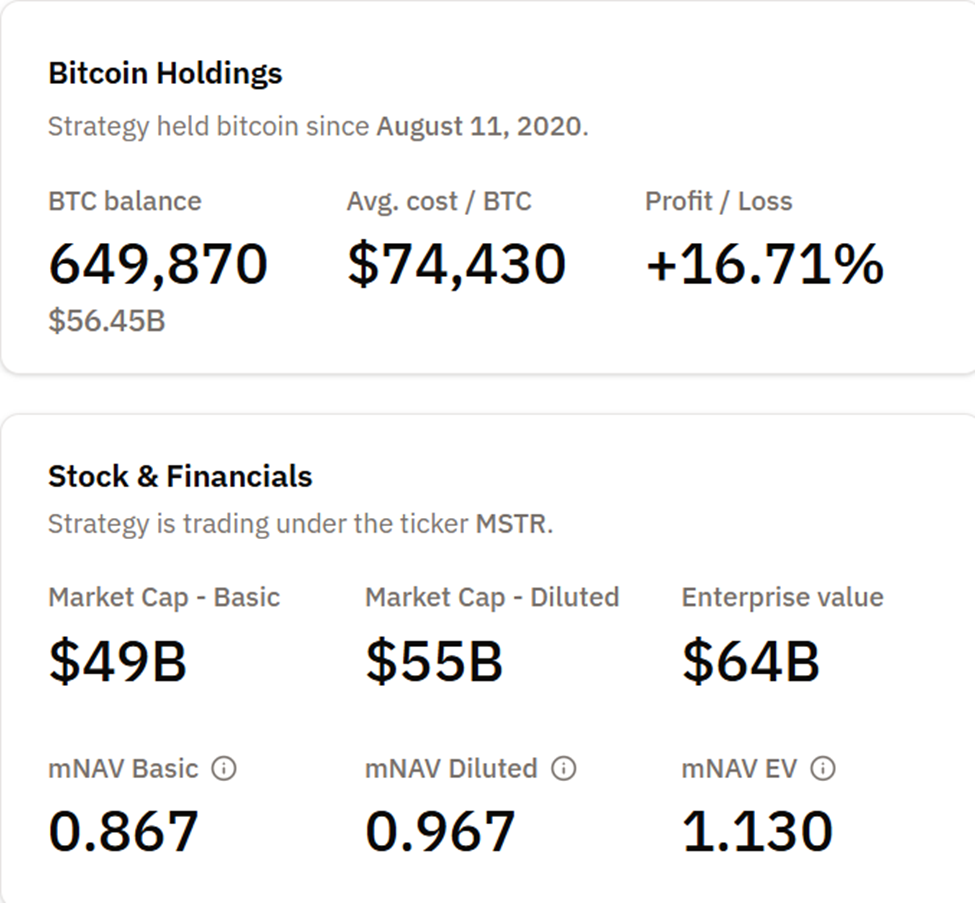

Allegedly, US government officials wanted MicroStrategy’s market value to net asset value (mNAV) near 1.0 and therefore manufactured a crash on Bitcoin to compress the premium.

“The US is contemplating a multi-billion-dollar investment in MSTR, and they needed the mNAV to be 1 before it made sense for them to invest, so they manufactured a crash on bitcoin,” Teddy, a popular user.

Mike Alfred names officials such as President Donald Trump, Treasury Secretary Scott Bessent, and allies, citing a multi-step plan to bolster Bitcoin, MSTR, and stablecoins while simultaneously defunding JP Morgan, the Fed, and the US banking cabal to protect US citizens.

Again, there are no official statements or regulatory filings backing these claims. No representatives from the US Treasury, White House, or regulatory agencies have addressed or confirmed the rumors.

“The administration views it as a defining battle,” Alfred noted.

MicroStrategy’s Index Risk Matters More Than the Noise

Several factors have factually influenced recent price volatility. Strategy Inc. faces the potential impact of MSCI’s proposed index exclusion for companies with more than 50% of their assets in Bitcoin or similar cryptocurrencies. If adopted, this policy could trigger as much as $8.8 billion in passive fund outflows from the stock.

At the same time, shifting outlooks on Fed rate cuts and volatility in bond markets have pressured riskier investments, leading to increased market declines.

Michael Saylor, CEO of MicroStrategy, rejects attempts to reclassify his company as a fund or trust, emphasizing its ongoing software and active treasury operations.

With MSCI’s January 2026 decision approaching, the company continues to face real business hurdles unrelated to online conspiracy theories.

Speculation on X ties Bitcoin’s crash to imagined government accumulation plans, including:

- Claims that the government will “step in and buy MicroStrategy,” creating a new “failsafe.”

- Theories that crashing Bitcoin allows the US to reach a hypothetical 1 million BTC reserve target.

- Assertions that MicroStrategy could be a long-running “honeypot” leading to eventual asset seizure.

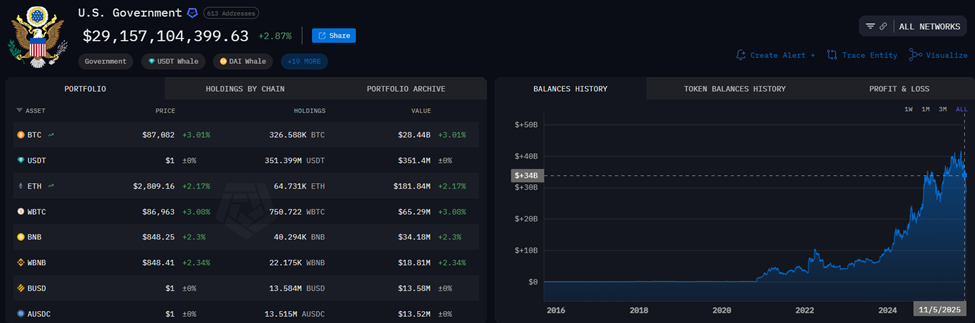

Blockchain data indicates that the US government holds more than 326,000 BTC from prior forfeitures, fueling continued speculation.

US Government Bitcoin. Source:

US Government Bitcoin. Source:

MicroStrategy, whose balance sheet is dominated by Bitcoin, dropped more than 60% from its highs, pushing its mNAV to levels below 1 as of November 23.

MicroStrategy mNAV. Source:

MicroStrategy mNAV. Source:

Even without evidence of a government bid, the rumors highlight several key realities:

- MicroStrategy’s valuation remains tightly correlated with Bitcoin volatility.

- Index-eligibility reviews could materially impact liquidity for $MSTR.

- Social media-driven narratives can influence sentiment during high-volatility periods.

While these remain speculation from some of the industry’s loudest voices, the timing of these posts, amidst one of Bitcoin’s sharpest weekly declines of 2025, may be exacerbating the spread.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: The Ongoing Competition Between Ethereum and Solana to Transform Blockchain Value Acquisition

- Ethereum's Fusaka upgrade (Dec 3) aims to boost scalability and economic incentives, positioning ETH as a cash-flowing asset per Fidelity and Bitwise analyses. - The upgrade harmonizes consensus and execution layers, prioritizing monetization while balancing adoption risks as noted by Max Wadington and Fidelity reports. - Solana's Sunrise initiative streamlines token imports, competing with Ethereum to redefine decentralized value capture through seamless integration strategies. - Analysts warn of trade-

Fed Faces Conflicting Data and Political Tensions as December Verdict Approaches

- The Fed faces internal divisions over rate cuts amid conflicting signals on inflation and a weakening labor market. - A 10–2 vote to lower rates to 3.75%–4% masked broader disagreements, with markets now pricing <35% chance of further cuts in December. - Political pressures intensify as Trump criticizes Powell and pushes for Bessent to lead the Fed, despite Bessent's refusals. - Upcoming November 20 data on payrolls and manufacturing will be critical in resolving the Fed's policy uncertainty.

Bitcoin News Today: Bitcoin Surges to $87k—Is This a Panic-Fueled Bounce or a Sign of Lasting Market Change?

- Bitcoin surged past $87,000 in late November 2025, driven by technical support, shifting institutional sentiment, and historical rebound parallels. - Retail fear and ETF inflows signal potential recovery, while macro factors like Nvidia's earnings and Fed rate cut expectations add uncertainty. - Institutional divergence and macroeconomic headwinds pose risks, with Bitcoin's $87k and Ethereum's $2,800 support levels critical for a sustained rebound.

DASH Aster DEX Integration: Paving the Way for Advanced DeFi Infrastructure and Institutional Embrace in 2026

- DASH Aster DEX listing accelerates DeFi's 2026 growth, targeting $3T+ transaction volume via real-world asset tokenization and cross-chain liquidity. - Aster's on-chain order book architecture bridges CEX speed with DEX transparency, achieving $27.7B daily volume through strategic BNB Chain-Ethereum integration. - Institutional adoption gains momentum as Aster introduces gold/stock trading, privacy-focused ZKP features, and 5-7% annual token burns to enhance $ASTER utility. - Investors gain exposure to n