Solana Price Crash To $100 Likely As SOL Nears Death Cross, But There’s A Catch

Solana is facing renewed bearish pressure as its price continues to slide, bringing the altcoin close to a critical support level that has not been tested in more than seven months. The ongoing decline reflects deepening market weakness, and technical indicators suggest that further losses may be ahead unless conditions shift quickly. Solana Investors Are

Solana is facing renewed bearish pressure as its price continues to slide, bringing the altcoin close to a critical support level that has not been tested in more than seven months.

The ongoing decline reflects deepening market weakness, and technical indicators suggest that further losses may be ahead unless conditions shift quickly.

Solana Investors Are Facing Heavy Losses

Solana’s exponential moving averages are signaling the potential formation of a Death Cross.

This pattern occurs when the short-term EMA crosses below the long-term EMA, often indicating the start of a prolonged downtrend. Historical behavior suggests that Solana may be repeating earlier market cycles seen in Q1 and Q2 of this year.

During those periods, SOL fell 59% from the local top before the Death Cross fully materialized.

A similar setup today would send Solana toward $98, extending its current 47% drop from the local top.

These conditions highlight weakening sentiment and reinforce concerns about continued downside risk.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana EMAs. Source:

Solana EMAs. Source:

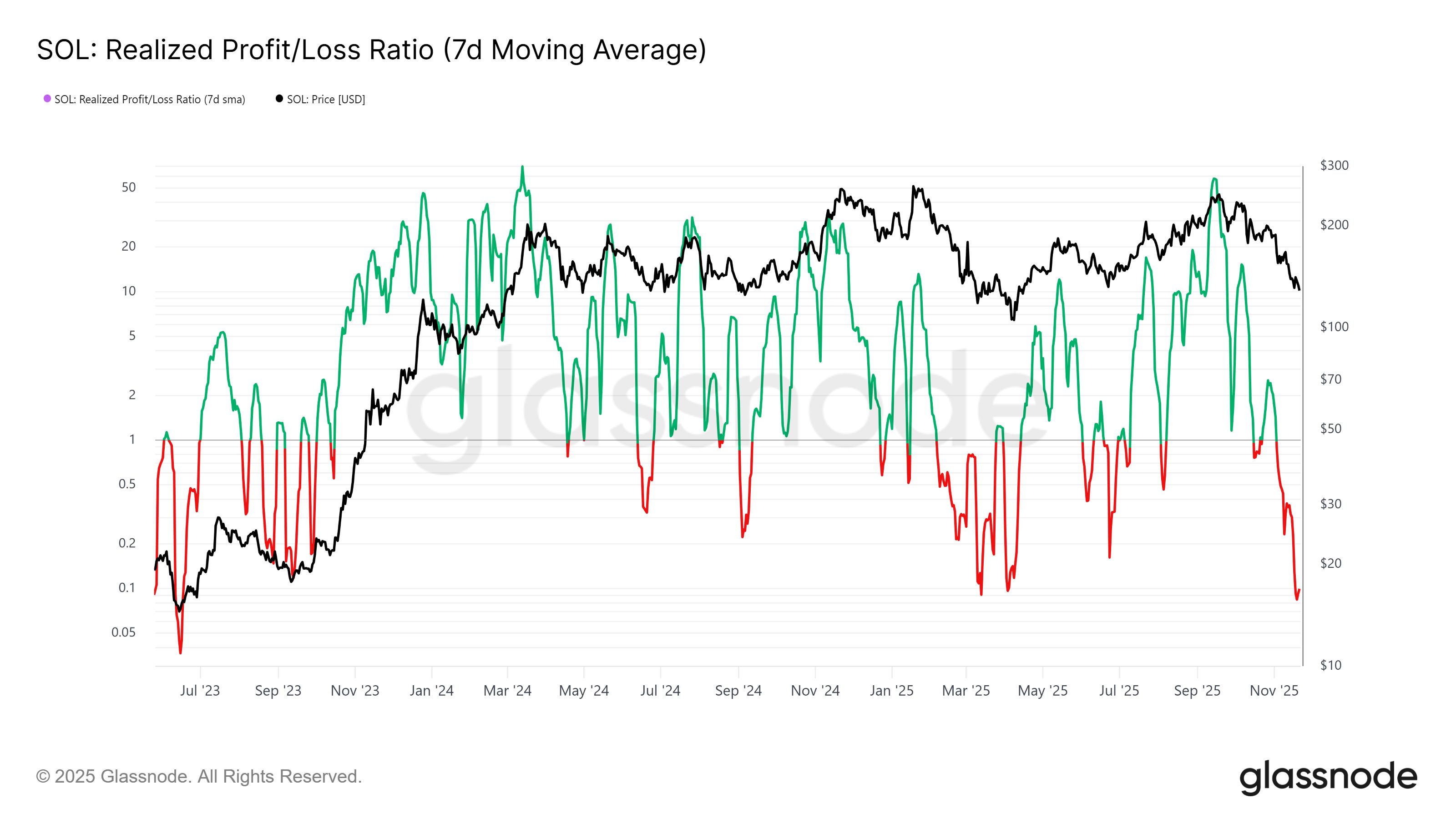

Macro momentum also appears fragile. Solana’s net realized profit/loss ratio has fallen to its lowest level since June 2023, showing that holders are facing significant realized losses following the recent decline.

This metric often reflects broader sentiment shifts as investors reassess risk during rapid market downturns.

However, there is a notable silver lining. When the net realized profit/loss ratio dips below 0.1, reversals have historically followed.

This pattern played out in March, April, and September of 2023, each time signaling the start of a recovery.

If this trend repeats, Solana could see a meaningful bounce as realized losses saturate and selling pressure stabilizes.

Solana Realized Profit/Loss. Source:

Solana Realized Profit/Loss. Source:

Macro momentum also appears fragile. Solana’s net realized profit/loss ratio has fallen to its lowest level since June 2023, showing that holders are facing significant realized losses following the recent decline.

SOL Price Is Vulnerable

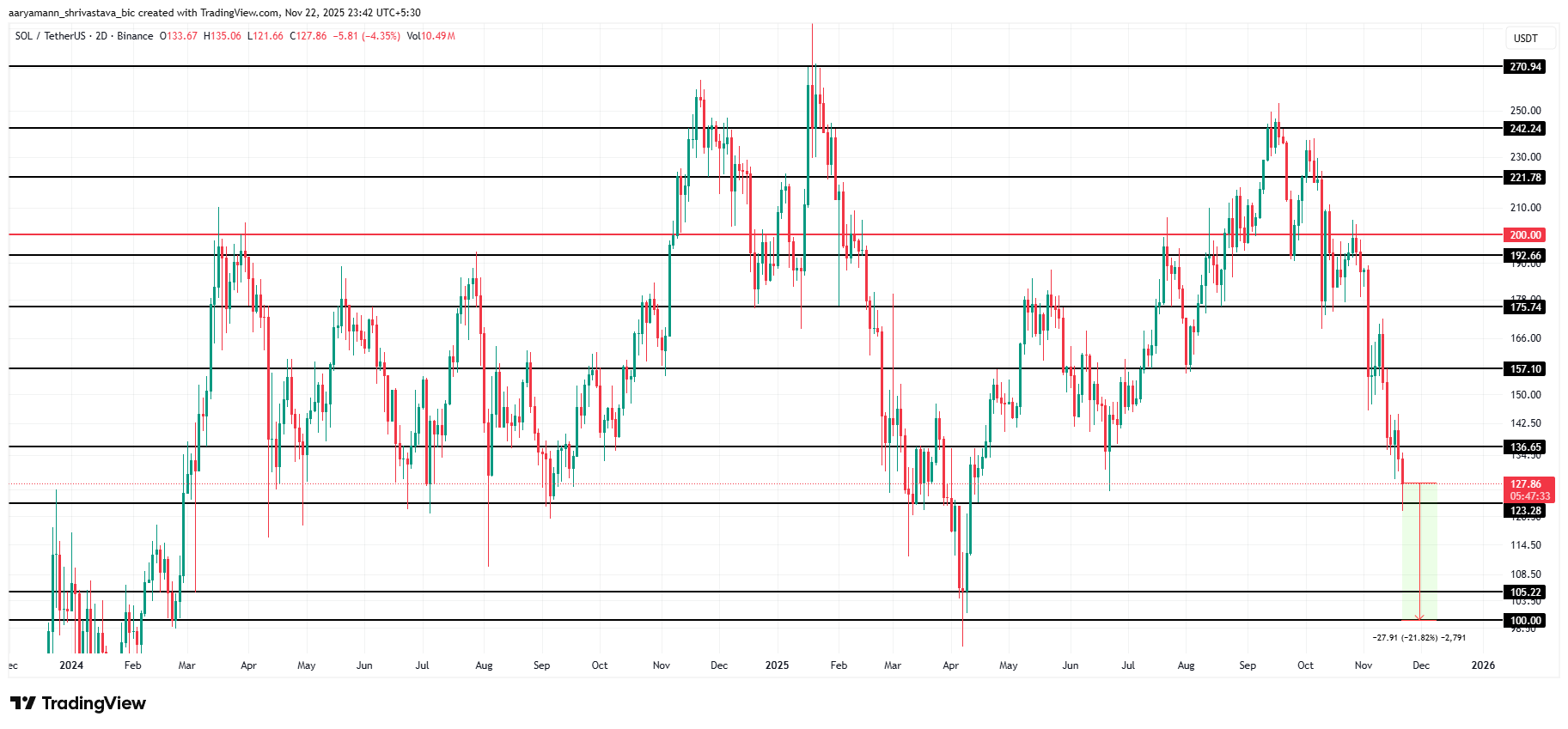

Solana trades at $127, holding just above the $123 support level. The altcoin is waiting for broader market stability and renewed investor confidence to fuel a rebound.

However, the indicators mentioned above suggest that the risks remain skewed to the downside.

If Solana moves closer to confirming a Death Cross, the price may continue falling, breaking below $123 and sliding to $105 or even $100.

Such a move would represent a 21.8% correction from current levels and revisit price zones last seen in March.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

If realized losses stabilize and investor sentiment improves, Solana could bounce from $123 and attempt a climb to $136.

A break above this barrier would open the path toward $157, invalidating the bearish thesis and restoring a more bullish structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: The Ongoing Competition Between Ethereum and Solana to Transform Blockchain Value Acquisition

- Ethereum's Fusaka upgrade (Dec 3) aims to boost scalability and economic incentives, positioning ETH as a cash-flowing asset per Fidelity and Bitwise analyses. - The upgrade harmonizes consensus and execution layers, prioritizing monetization while balancing adoption risks as noted by Max Wadington and Fidelity reports. - Solana's Sunrise initiative streamlines token imports, competing with Ethereum to redefine decentralized value capture through seamless integration strategies. - Analysts warn of trade-

Fed Faces Conflicting Data and Political Tensions as December Verdict Approaches

- The Fed faces internal divisions over rate cuts amid conflicting signals on inflation and a weakening labor market. - A 10–2 vote to lower rates to 3.75%–4% masked broader disagreements, with markets now pricing <35% chance of further cuts in December. - Political pressures intensify as Trump criticizes Powell and pushes for Bessent to lead the Fed, despite Bessent's refusals. - Upcoming November 20 data on payrolls and manufacturing will be critical in resolving the Fed's policy uncertainty.

Bitcoin News Today: Bitcoin Surges to $87k—Is This a Panic-Fueled Bounce or a Sign of Lasting Market Change?

- Bitcoin surged past $87,000 in late November 2025, driven by technical support, shifting institutional sentiment, and historical rebound parallels. - Retail fear and ETF inflows signal potential recovery, while macro factors like Nvidia's earnings and Fed rate cut expectations add uncertainty. - Institutional divergence and macroeconomic headwinds pose risks, with Bitcoin's $87k and Ethereum's $2,800 support levels critical for a sustained rebound.

DASH Aster DEX Integration: Paving the Way for Advanced DeFi Infrastructure and Institutional Embrace in 2026

- DASH Aster DEX listing accelerates DeFi's 2026 growth, targeting $3T+ transaction volume via real-world asset tokenization and cross-chain liquidity. - Aster's on-chain order book architecture bridges CEX speed with DEX transparency, achieving $27.7B daily volume through strategic BNB Chain-Ethereum integration. - Institutional adoption gains momentum as Aster introduces gold/stock trading, privacy-focused ZKP features, and 5-7% annual token burns to enhance $ASTER utility. - Investors gain exposure to n