XRP Whale Selling Hits $480 Million In 48 Hours As Price Falls Below $2

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders. This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook. XRP Whales Switch Their Stance Whales

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders.

This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook.

XRP Whales Switch Their Stance

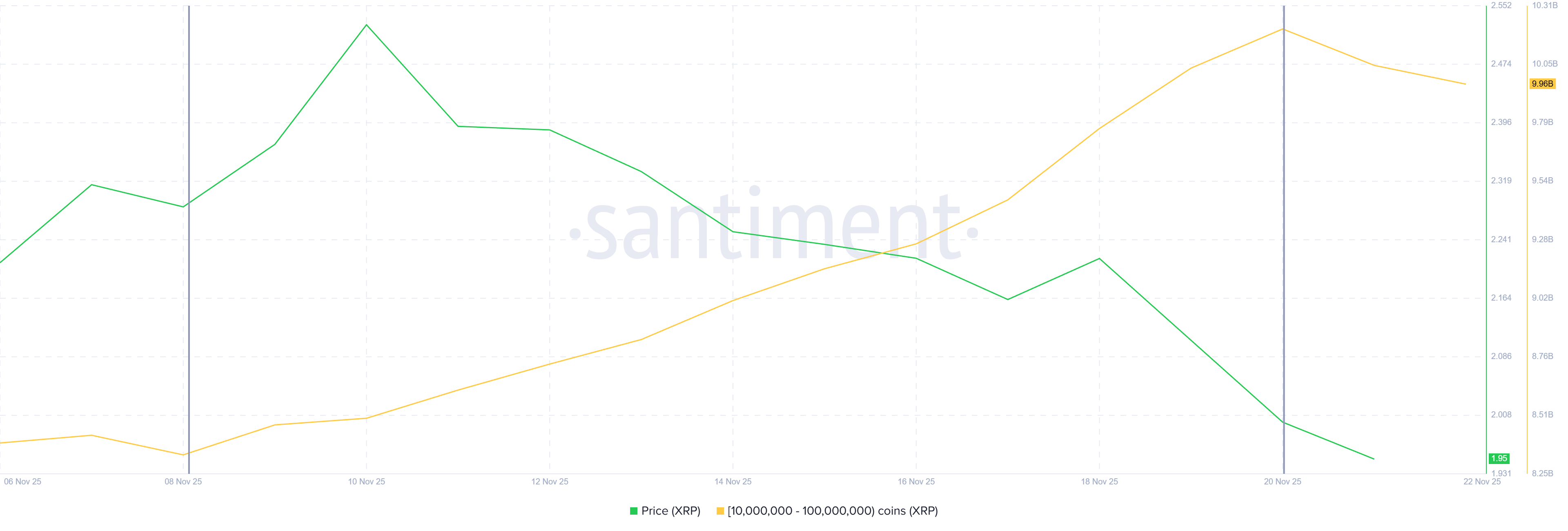

Whales have moved decisively from accumulation to heavy selling. Addresses holding between 10 million and 100 million XRP have dumped more than 250 million tokens in the past 48 hours alone, worth over $480 million.

This selling wave follows more than 20 consecutive days of accumulation by the same group of holders.

Such an abrupt shift signals a loss of conviction among large investors who had previously supported XRP’s rise. Their exit removes a crucial source of market strength and may prolong XRP’s decline. Without renewed confidence from whales, recovery momentum could weaken further and keep prices under pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source:

Santiment

XRP Whale Holding. Source:

Santiment

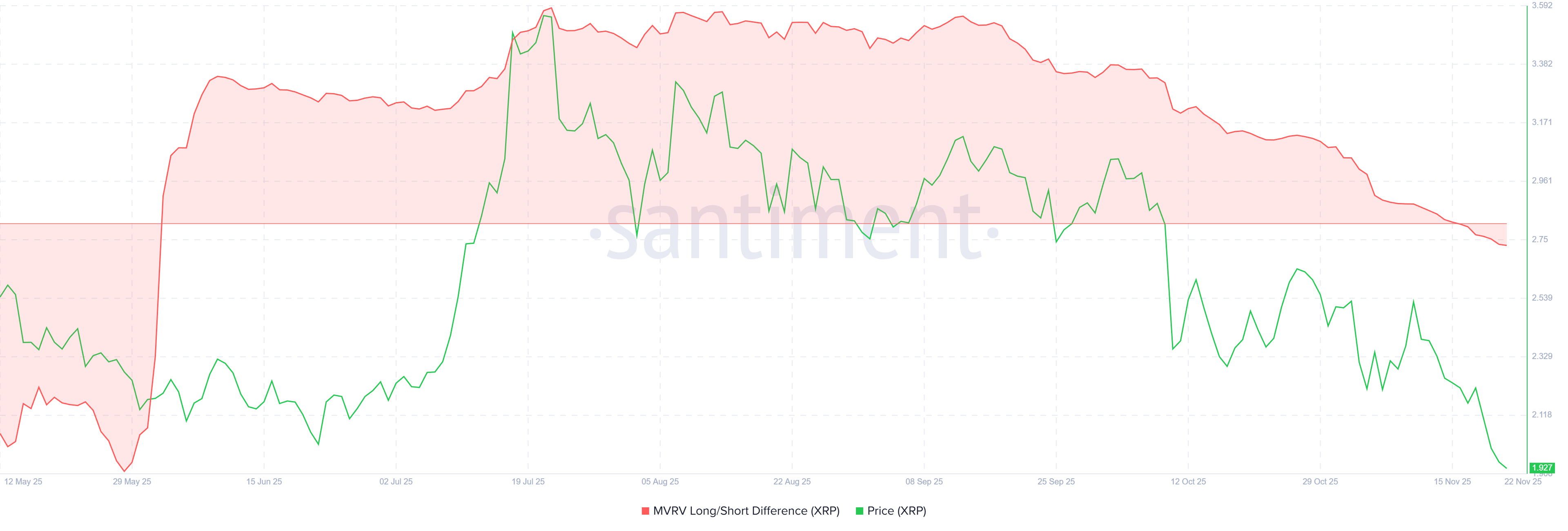

Macro indicators also highlight growing fragility. The MVRV Long/Short Difference has slipped below zero for the first time in five months, indicating that long-term holders have lost profitability. This shift pushes profit opportunity toward short-term holders, who tend to sell quickly once prices rise.

If XRP’s price rebounds even modestly, short-term holders may capitalize on their gains by selling, which could suppress upward movement. This dynamic often keeps volatility elevated and limits breakout potential.

XRP MVRV Long/Short Difference. Source:

Santiment

XRP MVRV Long/Short Difference. Source:

Santiment

XRP Price May Need Support

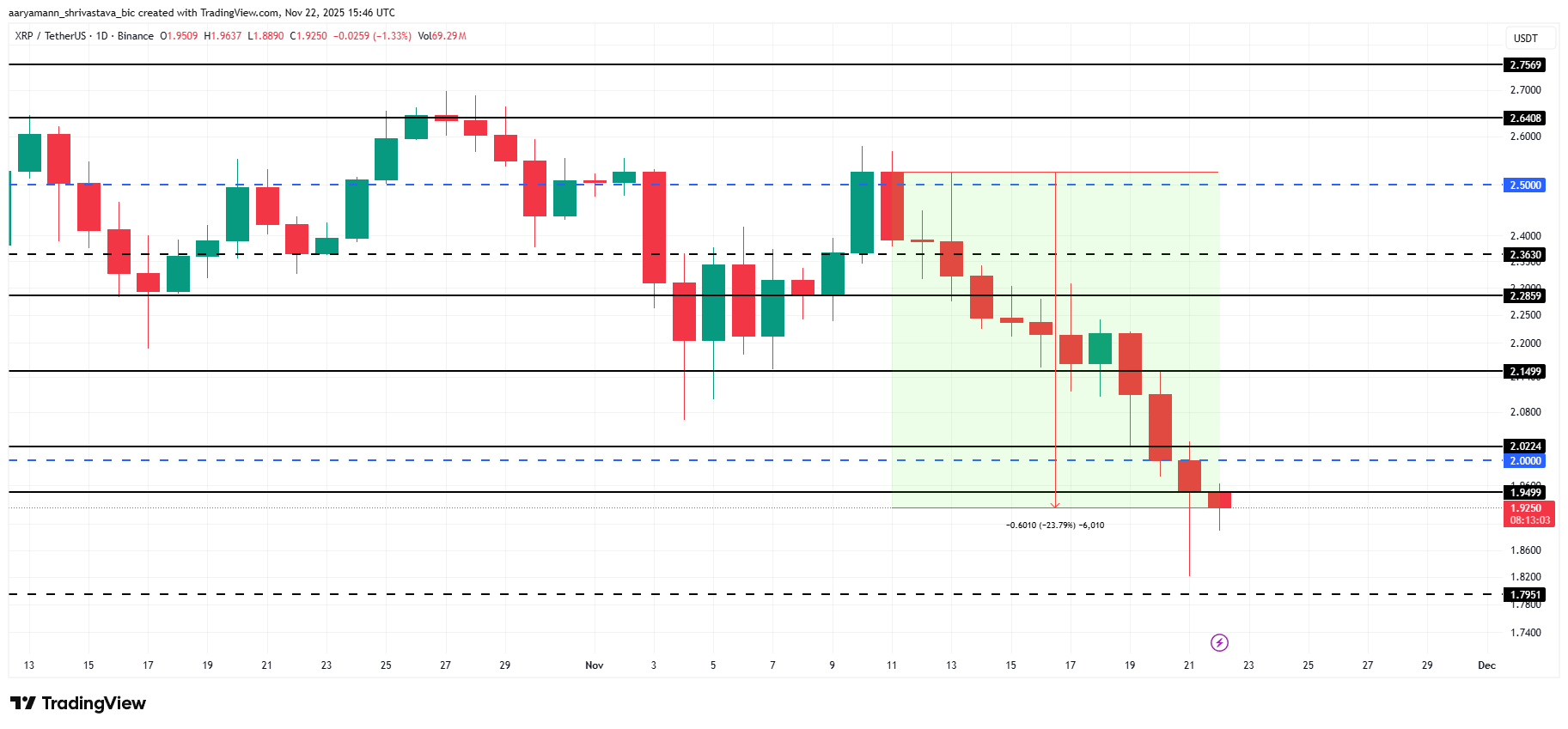

XRP has fallen 23% over the past 11 days and trades at $1.92, sitting just under the $1.94 resistance level. The drop below $2.00 marks a significant psychological break and reinforces the current bearish sentiment across the market.

If whale selling accelerates and macro indicators worsen, XRP could fall further toward $1.79 or even lower. Such a move would deepen losses and extend the current downtrend as market sentiment weakens.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if investor support stabilizes or broader market conditions improve, XRP may be able to reclaim $2.00 as support.

A successful recovery could lift the price toward $2.14 and higher, helping reverse recent losses and invalidating the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto ATM Operator Eyes $100M Sale Amid Founder’s Money Laundering Case

Why is Crypto Up Today? Here's What you didn't Notice...

Ethereum News Today: Ethereum's Recent Overselling: Is a Recovery Imminent or Will the Decline Continue?

- Ethereum faces mounting bearish pressure amid crypto market selloff, with technical indicators and extreme fear metrics signaling a stretched downtrend. - Market capitalization dropped 8% in 24 hours, Bitcoin dominance rose to 56%, while ETH trades below key EMAs with an oversold RSI of 27. - Binance confirms "Strong Sell" signals for ETH/USD, with 12 bearish moving averages and a 14-day RSI of 30.48 reinforcing the negative bias. - DeFi liquidity crisis ($12B idle assets) and a Fear & Greed Index at 14

Blockchain’s Evolving Foundations: Institutional Embrace Fueled by Governance and Privacy

- Tezos (XTZ) shows steady recovery via governance-driven upgrades, regaining $0.60 support amid growing institutional altcoin interest. - Zero Knowledge Proof (ZKP) gains traction with privacy-focused tech, $100M engineering investment, and transparent ICA token distribution. - Both projects highlight blockchain 3.0 priorities: Tezos emphasizes forkless governance adaptability, ZKP advances verifiable privacy infrastructure. - Analysts project XTZ reaching $1.20 by 2026 through RWA partnerships, while ZKP