Bitcoin ETFs Hit Record $11.5 Billion Volume as Most Investors Slip Into Losses

Despite market volatility, the 12 Bitcoin ETFs posted net inflows of more than $238 million as some investors bought the dip.

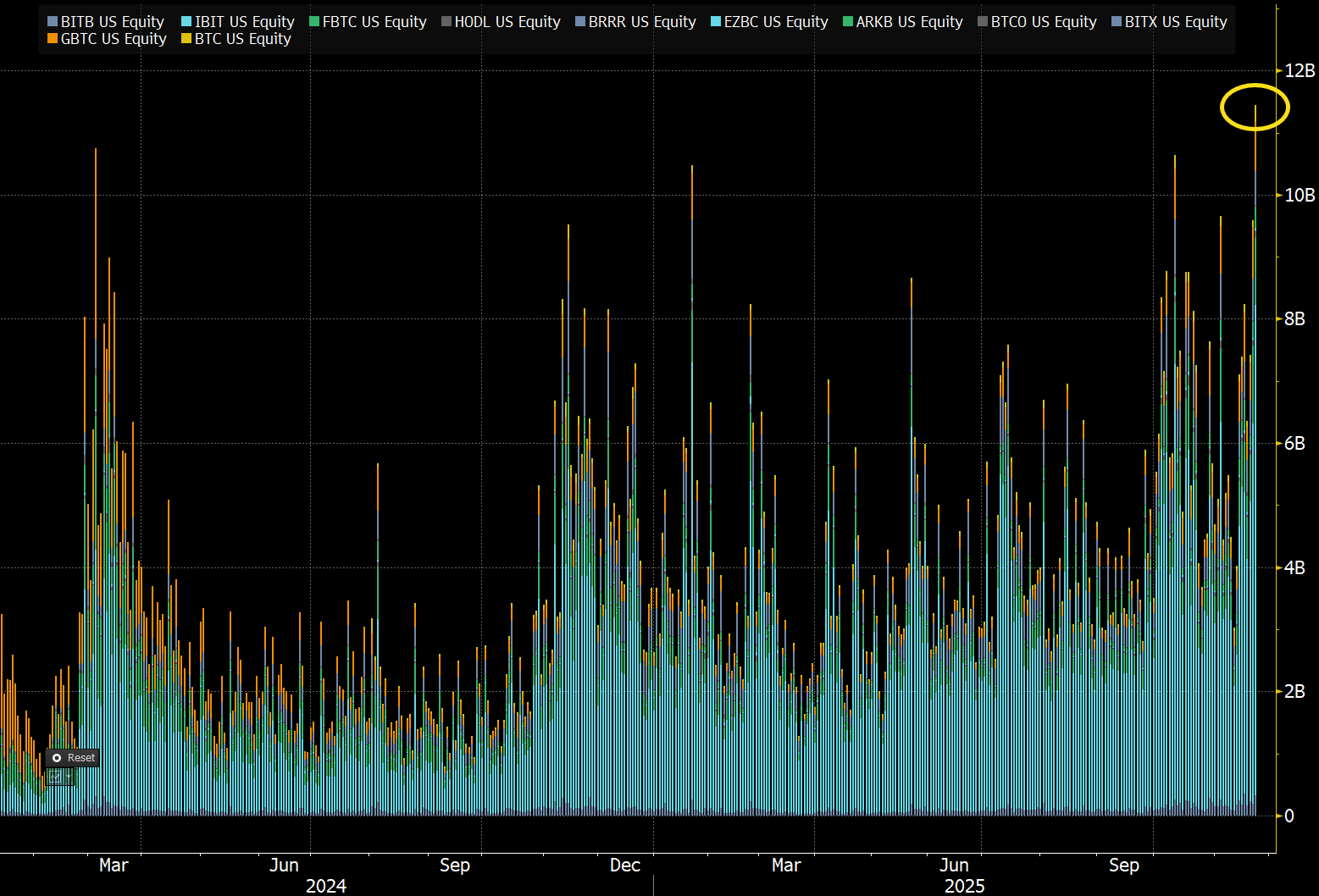

US spot Bitcoin exchange-traded funds just posted their busiest trading session ever, even as the recent slide in the cryptocurrency’s price has left the average ETF investor holding losses.

The surge in activity marks a new phase in the market’s adjustment to this month’s selloff in the sector.

BlackRock’s IBIT on Top as $238 Million Inflows Return Amid Market Stress

On November 21, Bloomberg Senior ETF Analyst Eric Balchunas reported that the 12 spot Bitcoin ETFs recorded $11.5 billion in combined trading volume.

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

Balchunas described the spike in volume as “wild but normal,” noting that ETFs and other asset classes tend to record elevated turnover during periods of market stress.

He said such bursts of activity often signal the release of liquidity as investors reshuffle positions.

The elevated turnover reflected brisk two-way participation, with some investors cutting exposure while others took advantage of lower prices to add to positions.

BlackRock’s IBIT led the surge, generating $8 billion in turnover and accounting for more than 69% of all spot Bitcoin ETF trading that day. This was IBIT’s highest-volume session since launch, though the fund still ended the day with $122 million in outflows.

“Also, no surprise record week for Put volume in IBIT.. this is one thing that may help people stay the course, they can always buy some puts as a hedge while they stay long,” Balchunas added.

Meanwhile, other Bitcoin ETFs, led by Fidelity’s FBTC, posted net inflows of more than $238 million.

Despite this inflow, the 12 Bitcoin investment vehicles are on course for their worst trading month, with net outflows of more than $3.5 billion.

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

This substantial outflow and record session come as the average spot Bitcoin ETF holder has slipped into the red.

Data from Bianco Research shows the weighted average purchase price for spot Bitcoin ETF inflows stood at $91,725 as of November 20.

The average Spot BTC ETF holder is now in the red.

— Jim Bianco (@biancoresearch) November 20, 2025

Bitcoin’s drop below that level this week pushed most holders, including those who entered the market in January 2024, into unrealized losses.

Bitcoin fell roughly 12% this week to as low as $80,000 before recovering to $84,431 as of press time. This price performance extends a month-long slide and reinforces the risk-off sentiment across digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Investors Place Significant Bets on Solana ETFs Amid 30% Price Drop, Challenging the Strength of $130 Support

- Solana's ETFs (BSOL/FSOL) drew $476M in 17 days despite SOL's 30% price drop to $130, signaling institutional confidence. - $130 support level shows buying pressure with RSI rising to 50, though $160 EMA remains a key reentry target for bulls. - On-chain growth (18% active address rise) and projects like GeeFi reinforce Solana's infrastructure, but $140 resistance remains fragile. - Mixed futures signals (5% higher OI, positive funding rates) highlight uncertainty, with $120 as next potential downside ri

PEPE Balances on a Fine Line: Key Support at $0.0547 and Resistance at $0.05504 Under Scrutiny

- PEPE cryptocurrency stabilized above $0.0547 support, trading within a narrow range as of mid-November 2025. - Technical indicators show neutral sentiment with RSI at 50.62 and MACD near zero, per xt.com and BitGet analyses. - Whale movements and exchange flows drive volatility, while long-term forecasts range from 140,000% to 28.6 million% gains by 2030-2050. - Market depends on meme culture relevance, institutional adoption, and broader crypto trends like Ethereum's price and ETF regulations.

Bitcoin Updates Today: Kiyosaki Turns Bitcoin Profits into Ongoing Income, Living by His Own Advice

- Robert Kiyosaki sold $2.25M in Bitcoin at $90,000/coin, reinvesting in surgical centers and billboards for tax-free income. - He aims for $27,500 monthly cash flow by 2026, aligning with his passive-income strategy while maintaining Bitcoin's $250K/2026 price target. - Bitcoin's 33% drop from $126K peaks reflects broader market slump driven by Fed rate uncertainty and offshore trading pressures. - Kiyosaki advocates gold/silver and warns of systemic risks, contrasting with analysts who see intact fundame

Bitcoin Updates: Abu Dhabi and Major Institutions Drive Bitcoin Accumulation Strategy for 2025

- Max Keiser argues Bitcoin is entering a critical accumulation phase, with institutional ETF inflows and Abu Dhabi’s strategic buy-ins signaling potential for a 2025 all-time high. - Technical analysis highlights $84,243 support and $86,700–$89,900 resistance, with sustained ETF inflows potentially pushing BTC past $90,000. - Over 95% of Bitcoin ETF assets are held by investors aged 55+, stabilizing the market during corrections and cushioning declines. - Despite short-term volatility, ETF-driven liquidit