PEPE Faces a Bearish Turning Point: Head-and-Shoulders Pattern or Triangle Optimism

- Pepe (PEPE) has plunged below $0.00000445, breaching key Fibonacci support and triggering bearish technical signals. - Analysts warn further declines to $0.00000185 are likely if the head-and-shoulders pattern confirms, though a symmetrical triangle hints at potential December upside. - Macroeconomic uncertainty and fading on-chain liquidity amplify risks, with TVL at $4.2M vs. $176M futures open interest showing speculative dominance. - Market awaits a rebound above $0.0000059 to stabilize, but bearish

Pepe (PEPE), a cryptocurrency inspired by memes, has dropped to its lowest point in several months as investors react to a significant breach of major support levels, sparking uncertainty over whether the token can recover or will continue to slide. Its price has slipped beneath $0.00000445,

Technical signals continue to point to selling pressure.

Recent price moves have led to comparisons with a classic head-and-shoulders chart pattern, which often signals a bearish reversal. Crypto analyst Ali Marteniz

The current chart structure for the token closely mirrors a head-and-shoulders formation, where a break below the neckline typically accelerates bearish momentum.

Broader economic uncertainty is also weighing on market sentiment.

Blockchain data highlights waning enthusiasm. The total value locked (TVL) in PEPE’s main decentralized exchange pool is $4.2 million, much less than the $176 million in futures open interest, showing that speculative activity dominates.

Traders are now watching to see if PEPE can reclaim the $0.00000479 mark (the 7-day simple moving average) to help stabilize its price.

With PEPE

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

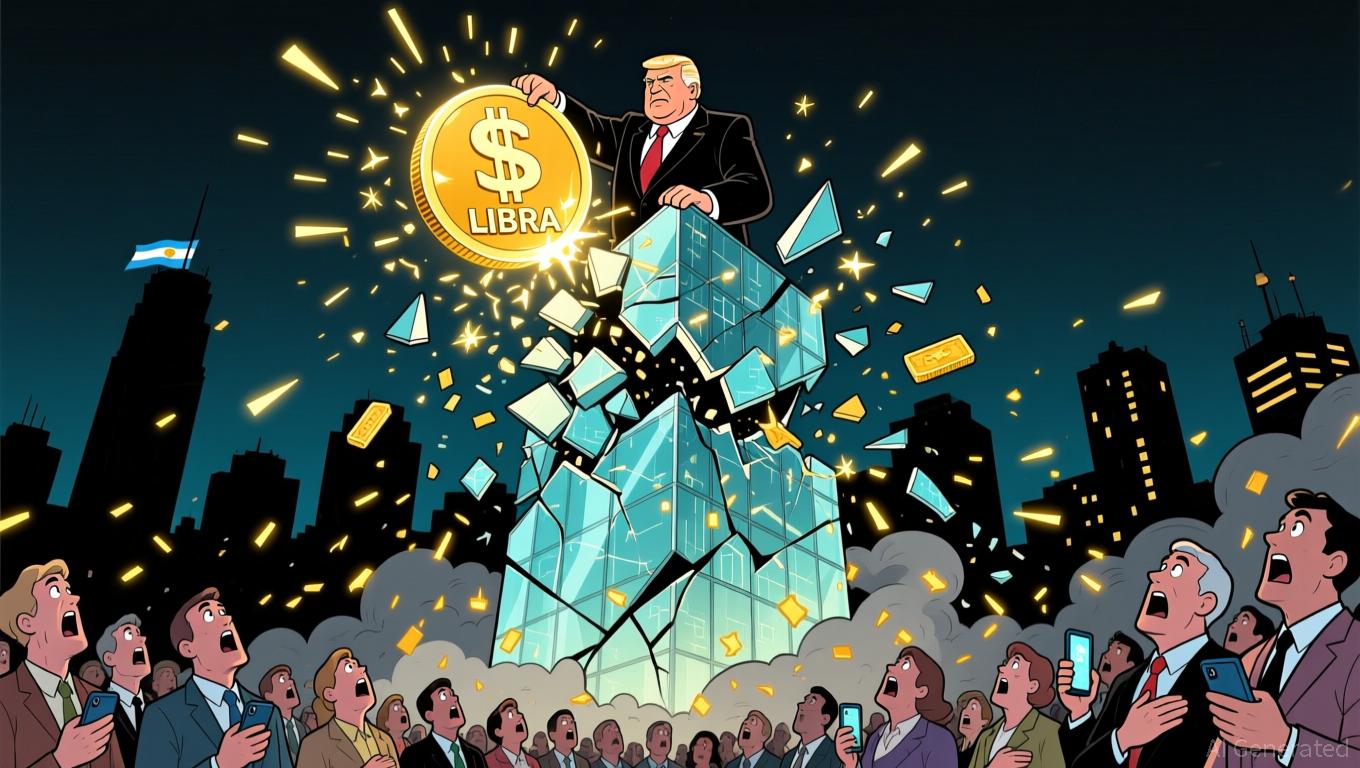

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate

Bitcoin Updates: U.S. Crypto Mining Companies Face Espionage Concerns and Growth Challenges During Bitmain Investigation

- U.S. authorities investigate Bitmain's ASICs for potential espionage risks, impacting miners reliant on its 80% market-dominant hardware . - American Bitcoin's Trump-linked purchase of 16,299 Bitmain miners raises conflict concerns amid strained U.S.-China supply chains. - Canaan Inc. reports record $30.6M Bitcoin mining revenue and 31% North American hardware sales growth despite industry challenges. - SOLAI pivots to infrastructure-as-a-service, earning $2.9M in data center fees as self-mining revenue

Fed's Split Between Doves and Hawks Fuels Crypto's Unsteady Surge

- NY Fed's John Williams hinted at potential December rate cut, sparking crypto market surge as traders priced in 60% cut probability. - Dallas Fed's Lorie Logan warned against premature cuts, highlighting FOMC divisions revealed in October meeting minutes. - BofA's Hartnett linked crypto's 35-45% declines to liquidity risks, noting $2.2B in record fund outflows as caution grows. - Former Fed adviser El-Erian cautioned against overreacting to dovish signals, citing delayed inflation data and hawkish resist

Solana News Today: Solana Faces Key Price Challenge: Can Strong Fundamentals Ignite a Bull Rally?

- Solana shows reversal signals via wallet growth and partnerships expanding real-world crypto utility. - Mastercard's Solflare debit card and 21shares' Solana ETF highlight institutional adoption amid 83% developer growth. - Latin American expansion through MiniPay's local payment integration boosts Solana's low-cost settlement appeal. - Price remains pressured near $125-$130 support, with mixed forecasts predicting 10-30% rebounds by 2025-2026. - Fear & Greed Index at 11 (Extreme Fear) contrasts RSI neut