November 21st Market Key Intelligence, How Much Did You Miss?

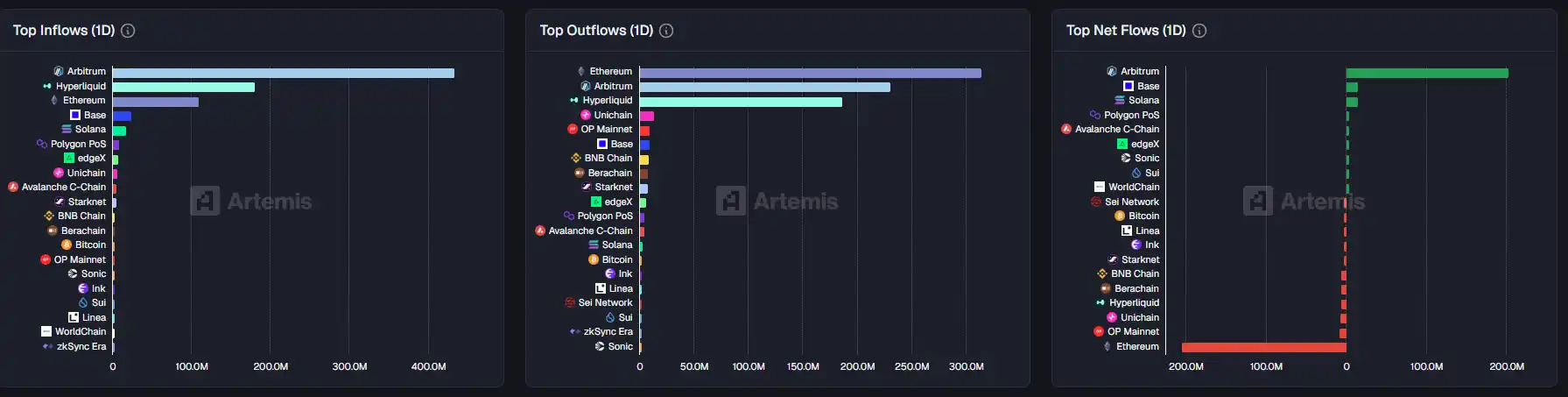

1. On-Chain Flows: $203.3M USD inflow to Arbitrum today; $204.6M USD outflow from Ethereum 2. Largest Price Swings: $TNSR, $OOB 3. Top News: DAT Flywheel Stalls as Top Investor Suggests DAT Corp Reserves Sell-Off, Market Poised for Further Deep Dive

Featured News

1. DAT Flywheel Stalls, Top Investor Suggests DAT Company Will Sell Reserves, Market Still Faces Deep Washout

2. Bitcoin Breaks Below $82,000 Again, 24-hour Decline Widens to 8.9%

3. Independent Researcher Claims $610 Billion AI Ponzi Scheme Collapse

4. Global Mainstream Assets Experience Broad Declines, US Stocks, European Stocks, Oil, Silver See Varied Declines

5. "Binance Life" Market Cap Falls Below $1 Billion, 24-hour Decline Exceeds 26%

Featured Articles

1. "Where Is the Strongest ZEC Copycat Headed in This Round?"

Over the past 2 months, ZEC, which has surged nearly 10 times and has maintained its independent trend, has always been the focal point of the market. The logical discussion around ZEC has gradually evolved from early endorsements of privacy concepts by figures such as Naval, Arthur Hayes, and Ansem to the current stage of debate between the bullish view based on the actual demand for privacy Track, and the bearish view from the perspective of mining power and mining revenue of the coin. So, apart from the endorsements of well-known figures, what are the detailed arguments for the bullish and bearish sides of ZEC?

2. "Dialogue Between the Strongest Bulls and Bears in the Crypto Community: Has the Four-Year Crypto Cycle Failed?"

The 2025 crypto market is at a delicate inflection point: Bitcoin ETF approval, intertwining liquidity and debt refinancing cycles, the AI boom siphoning off funds, and traditional financial and tech giants accelerating their embrace of blockchain. Against this backdrop, the market structure has become anomalous, with a lack of buying pressure for altcoins, underperformance of high-performance blockchains like Solana, and investor sentiment swinging between extreme optimism and fear. In this issue of "The Journey Man," Raoul Pal (former global macro investor, Real Vision founder) and Chris Burniske (Placeholder partner) delve deep into market cycles, liquidity dynamics, investor psychology, and industry structural changes.

On-Chain Data

On-chain fund flows for the week of November 21

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: The Ongoing Competition Between Ethereum and Solana to Transform Blockchain Value Acquisition

- Ethereum's Fusaka upgrade (Dec 3) aims to boost scalability and economic incentives, positioning ETH as a cash-flowing asset per Fidelity and Bitwise analyses. - The upgrade harmonizes consensus and execution layers, prioritizing monetization while balancing adoption risks as noted by Max Wadington and Fidelity reports. - Solana's Sunrise initiative streamlines token imports, competing with Ethereum to redefine decentralized value capture through seamless integration strategies. - Analysts warn of trade-

Fed Faces Conflicting Data and Political Tensions as December Verdict Approaches

- The Fed faces internal divisions over rate cuts amid conflicting signals on inflation and a weakening labor market. - A 10–2 vote to lower rates to 3.75%–4% masked broader disagreements, with markets now pricing <35% chance of further cuts in December. - Political pressures intensify as Trump criticizes Powell and pushes for Bessent to lead the Fed, despite Bessent's refusals. - Upcoming November 20 data on payrolls and manufacturing will be critical in resolving the Fed's policy uncertainty.

Bitcoin News Today: Bitcoin Surges to $87k—Is This a Panic-Fueled Bounce or a Sign of Lasting Market Change?

- Bitcoin surged past $87,000 in late November 2025, driven by technical support, shifting institutional sentiment, and historical rebound parallels. - Retail fear and ETF inflows signal potential recovery, while macro factors like Nvidia's earnings and Fed rate cut expectations add uncertainty. - Institutional divergence and macroeconomic headwinds pose risks, with Bitcoin's $87k and Ethereum's $2,800 support levels critical for a sustained rebound.

DASH Aster DEX Integration: Paving the Way for Advanced DeFi Infrastructure and Institutional Embrace in 2026

- DASH Aster DEX listing accelerates DeFi's 2026 growth, targeting $3T+ transaction volume via real-world asset tokenization and cross-chain liquidity. - Aster's on-chain order book architecture bridges CEX speed with DEX transparency, achieving $27.7B daily volume through strategic BNB Chain-Ethereum integration. - Institutional adoption gains momentum as Aster introduces gold/stock trading, privacy-focused ZKP features, and 5-7% annual token burns to enhance $ASTER utility. - Investors gain exposure to n