Macro Pulse: Why Big Drops Are More Brutal Than the Market Expects

Original Article Title: Why the endgame looks uglier than markets are pricing

Original Author: arndxt

Original Translation: SpecialistXBT

Over the past few months, my stance has undergone a substantial shift:

From "extreme bearishness turning into bullishness" (a form of crowded pessimism often setting the stage for a short squeeze) to "remaining bearish and genuinely concerned that the system is entering a more fragile phase."

This shift is not triggered by a single event but is based on the following five mutually reinforcing dynamics:

1. Policy error risk is on the rise. The Fed is tightening financial conditions due to economic data uncertainties and clear signs of economic slowdown.

2. The AI/Mega-Cap nexus is transitioning from a cash-rich to a leveraged growth model. This shifts risks from pure stock volatility to more classic credit cycle concerns.

3. Private credit and loan valuations are starting to decouple. Beneath the surface, early but worrying signs of model-driven pricing pressure have emerged.

4. The K-shaped economy is solidifying into a political issue. For an increasing swath of the population, the social contract is no longer credible; this sentiment will eventually find political expression.

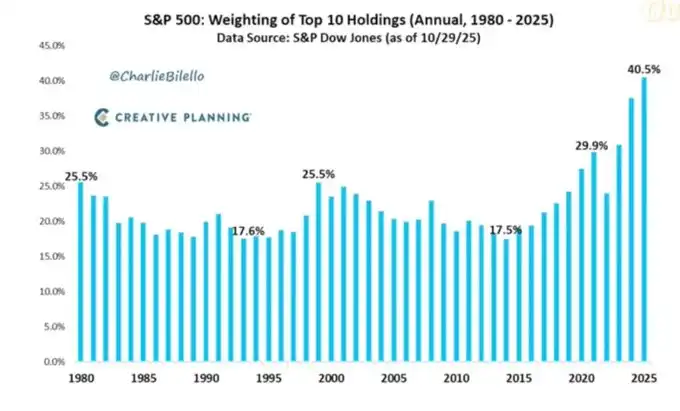

5. Market concentration has become a systemic and political vulnerability. When around 40% of an index's weight is actually concentrated in a few highly geopolitically and leverage-sensitive tech monopolies, they are no longer just growth stories but national security issues and policy targets.

The base case may still be that policymakers will ultimately "do what they always do": inject liquidity back into the system and support asset prices into the next political cycle.

But the path to this outcome looks more turbulent, more credit-driven, and politically less stable than the standard "buy the dip" script assumes.

Macro View

For most of this cycle, holding a "bearish but constructive" stance has been rational:

Inflation, though high, is decelerating.

Policies are broadly supportive.

Risk asset valuations are high, but pullbacks have typically been met with liquidity injections.

Today, several factors have changed:

Government Shutdown: We experienced a prolonged government shutdown, which disrupted the release and quality of key macroeconomic data.

Statistical Uncertainty: Senior officials themselves have acknowledged damage to the federal statistical system, meaning they lack confidence in the statistical series that underpin asset allocations worth trillions of dollars.

From Softness to Hawkishness: In this context, the Federal Reserve chose to pivot towards a more hawkish stance on both rate expectations and its balance sheet. Despite deteriorating leading indicators, they are still tightening financial conditions.

In other words, the system is exacerbating uncertainty and pressure rather than alleviating it. This represents a fundamentally different risk posture.

Policy Tightening in the Fog

The core issue lies not only in policy tightening but in where and how policy is tightening:

Data Fog: Key data releases (inflation, employment) have been delayed, distorted, or called into question post-shutdown. The Fed's "dashboard" has become unreliable at the most critical moment.

Rate Expectations: Despite forward-looking indicators pointing to deflation early next year, the market-implied probability of a near-term rate cut has been reined in as Fed officials make hawkish statements.

Even if the policy rate remains unchanged, the balance sheet's stance on quantitative tightening and the inclination to push more duration assets into the private sector are inherently hawkish for financial conditions.

Historically, the Fed's mistakes have often been mistimed: tightening too late, easing too late as well.

We face the risk of repeating this pattern: tightening in the face of slowing growth and data opacity rather than preemptively easing to address these conditions.

AI and Big Tech Entangled in a Story of "Leveraged Growth"

The second structural shift is in the nature of Big Tech and AI frontrunners:

Over the past decade, the "Mag7" have essentially functioned like equity bonds: holding dominant franchises, massive free cash flows, significant stock buybacks, and limited net leverage.

In the last 2-3 years, more and more of these free cash flows have been redirected towards AI capital expenditures: data centers, chips, infrastructure.

We are now entering a new phase where AI's incremental capital expenditure is increasingly financed through debt issuance rather than solely relying on internally generated cash.

This means:

Credit spreads and CDS (Credit Default Swaps) are starting to move. As leverage increases for AI infrastructure financing, the credit spreads of companies like Oracle are widening.

Stock market volatility is no longer the only risk. We are now seeing sectors that once felt "bulletproof" entering into a classic credit cycle dynamic.

Market structure has amplified this. These names have become overly represented in major indices; their transition from "cash cows" to "leveraged growth" has changed the risk profile of the entire index.

This does not automatically mean an AI "bubble" burst. If the returns are genuine and sustainable, leveraging for capital expenditure is also reasonable.

However, it does mean that margin for error has become smaller, especially in a higher interest rate, tighter policy environment.

Signs of a Credit Disconnect with the Private Market

Beneath the surface of public markets, private credit is showing early signs of stress:

The same loan is being substantially differently valued by different managers (e.g., one values it at around 70 cents on the dollar, another at around 90 cents).

This divergence is a typical precursor to a broader debate between model-based valuation and market-based valuation.

This pattern echoes:

2007 - Rise in distressed assets, widening spreads, while stock indices remained relatively calm.

2008 - Markets considered cash equivalents (e.g., auction rate securities) suddenly freezing.

Additionally:

The Fed's excess reserves are starting to decline from their peak.

The Fed is increasingly realizing that some form of balance sheet re-expansion may be needed to prevent financial plumbing problems.

None of this guarantees a crisis will occur. But it aligns with a credit quietly tightening system, still framed as "data-dependent" rather than preemptive.

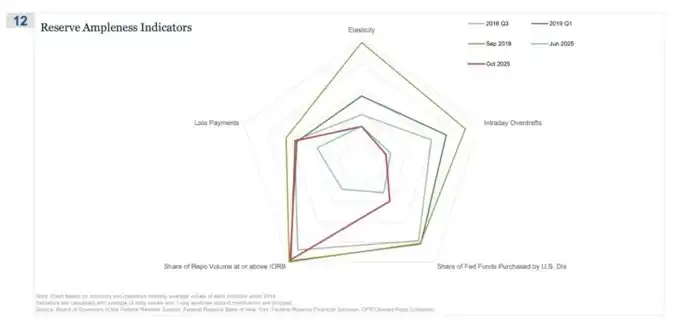

The Repurchase Agreement (REPO) market was the first place where the "not quite abundant" story began to show

In this radar chart, "Repo transaction volume reaching or exceeding the IORB share" is the clearest indicator that we are quietly moving away from a truly ample reserve system.

In the third quarter of 2018 and early 2019, this metric was relatively contained: Ample reserves meant that the majority of repo financing transactions comfortably traded below the IORB lower bound.

By September 2019, just before the repo crisis erupted, this line had sharply widened, with an increasing number of repo transactions trading at or above the IORB—a typical symptom of collateral and reserve scarcity.

Now, consider June 2025 versus October 2025:

The light blue line (June) still securely sits within the bounds, but the red line for October 2025 extends outward, approaching the 2019 shape, indicating more repo transactions are touching the policy floor.

In other words, as reserves are no longer ample, dealers and banks are pushing up overnight funding rates.

Combined with other indicators (more intraday overdrafts, higher discount window usage, and an increase in failed payments), you get a clear signal.

The K-Shaped Economy Evolving Into a Political Variable

What we have long referred to as the "K-shaped" economic divergence, I now see has become a political variable:

Household income expectations are diverging. Long-term financial outlooks (such as 5-year expectations) are showing a staggering gap: some groups expect stability or improvement, while others anticipate sharp deterioration.

Real-world stress indicators are flashing:

Default rates are rising among subprime borrowers.

Homeownership is being delayed, with the median age of first-time buyers nearing retirement age.

Youth unemployment rates in multiple markets are gradually rising.

For a growing segment of the population, the system is not just "unequal"; it's broken:

They have no assets, limited wage growth, and virtually no viable path to participate in asset inflation.

The implicit social contract of "work hard, get ahead, build wealth and security" is crumbling.

In this environment, political behavior will shift:

Voters are no longer selecting the "best caretakers" of the current system.

They are increasingly willing to support left-wing or right-wing disruptive or extreme candidates because, for them, the downside is limited: "It can't get any worse than this anyway."

Future policies regarding taxation, redistribution, regulation, and monetary support will be formulated in this context. This is not neutral for the market.

High Market Concentration as a Systemic and Political Risk

Market value is highly concentrated in the hands of a few companies. However, what is less discussed is its systemic and political impact:

The top 10 companies now represent about 40% of the major U.S. stock indexes.

These companies:

- Are core holdings of pension funds, 401(k)s, and retail investment portfolios.

- Are increasingly leveraged to AI, exposed to the Chinese market, and sensitive to the interest rate path.

- Effectively hold a monopoly position in multiple digital domains.

This creates three intertwined risks:

1. Systemic market risk. Shocks to these companies—whether from earnings, regulation, or geopolitics (such as Taiwan, China demand)—would quickly transmit to the entire household wealth complex.

2. National security risk. When so much national wealth and productivity are concentrated in a few externally dependent companies, they become a strategic weakness.

3. Political risk. In a K-shaped, populist environment, these companies are the most visible targets of resentment: higher taxes, windfall profit taxes, buyback restrictions. They will face antitrust-driven breakups and strict AI and data regulation.

In other words, these companies are not just growth engines; they are also potential policy targets, and the probability of them becoming targets is increasing.

Bitcoin, Gold, and the Failure (Temporary) of the "Perfect Hedge" Narrative

In a world full of policy error risk, credit pressure, and political instability, one might have expected Bitcoin to thrive as a macro hedge. However, gold has behaved more like a traditional crisis hedge: steadily strengthening, low volatility, increasing correlation in portfolios.

Bitcoin's trading performance resembles more of a high Beta risk asset:

- Highly correlated with liquidity cycles.

- Sensitive to leverage and structured products.

- Old-guard long-term holders (OG) are selling in this environment.

The original decentralized/currency revolution narrative remains conceptually compelling, but in practice:

- Today's dominant fund flows are financialized: yield strategies, derivatives, and short-volatility behavior.

- Bitcoin's empirical behavior is closer to a Tech Stock Beta than a neutral, robust hedging tool.

- I still see a plausible path where 2026 becomes a significant inflection point for Bitcoin (next policy cycle, the next wave of stimulus, and further erosion of trust in traditional assets).

But investors should recognize that, at this stage, Bitcoin does not provide many with the hoped-for hedging properties; it is part of the same liquidity complex that concerns us.

Scenario Framework Towards 2026

A useful framework for understanding the current environment is: this is a managed bubble deleveraging designed to create space for the next round of stimulus.

The sequence might be as follows:

2024 to mid-2025: Managed tightening and pressure.

- Periodic drags from government shutdowns and political dysfunction.

- The Fed tilts hawkish in rhetoric and on the balance sheet, tightening financial conditions.

- Credit spreads modestly widen; speculative sectors (AI, long-duration tech stocks, certain private credits) absorb initial shocks.

End of 2025 to 2026: Reintegration into the political cycle.

- As inflation expectations fall and the market corrects, policymakers regain a ‘space’ for easing.

- We see rate cuts and fiscal measures calibrated to support growth and election goals.

- Given the lag, inflation consequences will come into view post significant political milestones.

Post-2026: Systemic repricing.

- Depending on the scale and form of the next round of stimulus, we face a new cycle of asset inflation with higher political and regulatory interventions, or more abruptly confront issues of debt sustainability, concentration, and social contracts.

This framework is not deterministic, but it aligns with current incentives:

- Politicians prioritize re-election over long-term equilibrium.

- The simplest toolbox remains liquidity and transfer payments rather than structural reforms.

- to employ this toolbox again, they first need to squeeze out some of today's froth.

Conclusion

All signals point to one conclusion: the system is entering a phase of increased fragility and lower tolerance for error.

In fact, historical patterns show that policymakers will ultimately respond with a heavy dose of liquidity.

But moving into the next stage requires first going through:

- Tighter Financial Conditions

- Increasing Credit Sensitivity

- Political Turbulence

- Growingly Non-linear Policy Response

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why the plunge was even more severe than the market expected

System uncertainty and pressure are increasing.

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capture this trend.

ETH Plummets and Rebounds: A Market Baptism Amidst the Storm

Bitcoin market reshuffle: who is selling?