Japan’s Metaplanet to raise about $135m to buy Bitcoin

Tokyo-listed Metaplanet plans to issue Class B perpetual shares worth $135 million to expand its Bitcoin reserves.

- Metaplanet announced issuing about $135 million in shares to buy Bitcoin

- Class B shares will have no voting rights, but will have redemption at listing

- The firm currently owns 30,823 Bitcoin, worth about $2.69 billion

As corporate Bitcoin adoption strengthens worldwide, one Metaplanet is taking an increasingly aggressive approach. On Thursday, November 20, the Tokyo-listed Bitcoin treasury firm announced the issuance of 23.61 million Class B Preferred Shares, valued at about $135 million.

The firm will use the proceeds of these sales from these sales to expand its Bitcoin holdings. The firm will issue these shares at ¥900 per share, with an annualised 4.9% dividend rate. Holders will then be able to convert these shares into common shares, which hold voting rights.

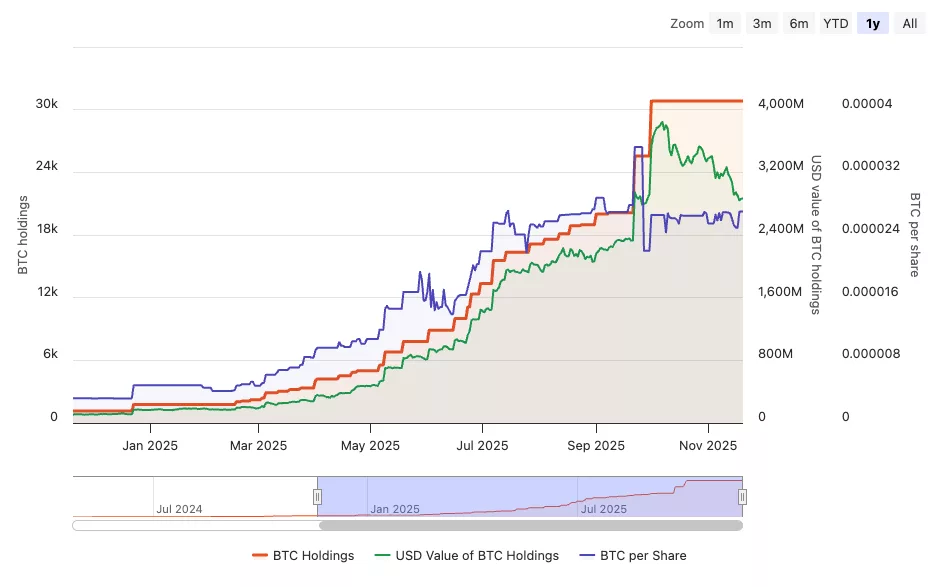

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

What is more, holders will be able to redeem their shares if they are not listed by 20 business days after Dec. 29, 2026.

Metaplanet mirrors Strategy in Bitcoin accumulation

The issuance of Class B Preferred Shares mirrors the model used by Michael Saylor’s Strategy. Notably, it enables the firm to raise more capital to pursue its aggressive accumulation. While the issuance initially dilutes shareholders, it does not immediately increase common stock. For that reason, its profitability hinges on Bitcoin’s near-term growth, which Metaplanet is betting on.

“The Company believes that Bitcoin will deliver long-term returns that exceed the preferred share dividend yield,” Metaplanet wrote in the filing.

Currently, Metaplanet holds 30,823 BTC , worth approximately $2.69 billion. The firm purchased its Bitcoin at an average price of $108,036, and is down 19.33% on its investment. Despite this, the firm has $3 billion in market cap, which is higher than its BTC holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Modern Monetary Theory and the Transformation of Cryptocurrency Valuation: Divergent Policies, Speculative Reassessment, and the Emerging Macro Framework

- MMT-driven fiscal policies in 2025 reshape crypto valuations as central banks prioritize growth over strict inflation targeting, exemplified by Fed rate cuts. - Institutional adoption of crypto accelerates (55% hedge funds by 2025) amid regulatory clarity, but algorithmic stablecoins face fragility during monetary expansion. - Speculative re-rating intensifies with 0.63 crypto-traditional asset correlation, while metrics like MVRV-Z (2.31) suggest markets avoid bubble territory. - Cross-jurisdictional po

VIPBitget VIP Weekly Research Insights

Bitcoin Updates: Negative Cycle Drives Bitcoin Down Even as Long-Term Outlook Remains Positive

- NYDIG reports capital flight from crypto via ETF outflows, stablecoin contractions, and corporate treasury sales, reversing Bitcoin's demand engine. - BlackRock's $520M IBIT ETF redemption highlights institutional shifts, with ETFs now amplifying Bitcoin's downward pressure instead of stabilizing prices. - Stablecoin supply declines and DATs selling assets (e.g., Sequans) create a feedback loop, accelerating Bitcoin's bearish momentum post-October liquidation crisis. - Despite weak near-term indicators,

XRP News Update: Alternative Coin ETFs Launch as Grayscale Broadens Its Reach Past Bitcoin

- NYSE approves Grayscale's GDOG and GXRP ETFs for Dogecoin and XRP , launching Nov 24 after SEC-compliant regulatory clearance. - SEC's 2025 framework enabled rapid altcoin ETF approvals, with Franklin Templeton and others entering competitive XRP market. - GDOG charges 0.35% fees targeting retail investors, while Franklin's fee-free XRP ETF aims to attract institutional capital through Coinbase . - Despite $4B+ outflows in Bitcoin ETFs, JPMorgan forecasts $4-8B in XRP ETF inflows, signaling growing insti