HBAR Price May Struggle To Climb Past $0.15 as Investors Retract Support

Hedera faces renewed downside pressure as CMF outflows deepen and demand weakens, limiting HBAR’s chances of breaking above $0.15 soon.

Hedera has faced significant downside pressure in recent days, with its price falling 24% over the last two weeks. The decline extends beyond broader market weakness and is increasingly tied to investor behavior.

Weakening demand and sustained outflows are weighing heavily on HBAR’s ability to recover, creating obstacles for any upward movement.

Hedera Investors Withdraw Support And Money

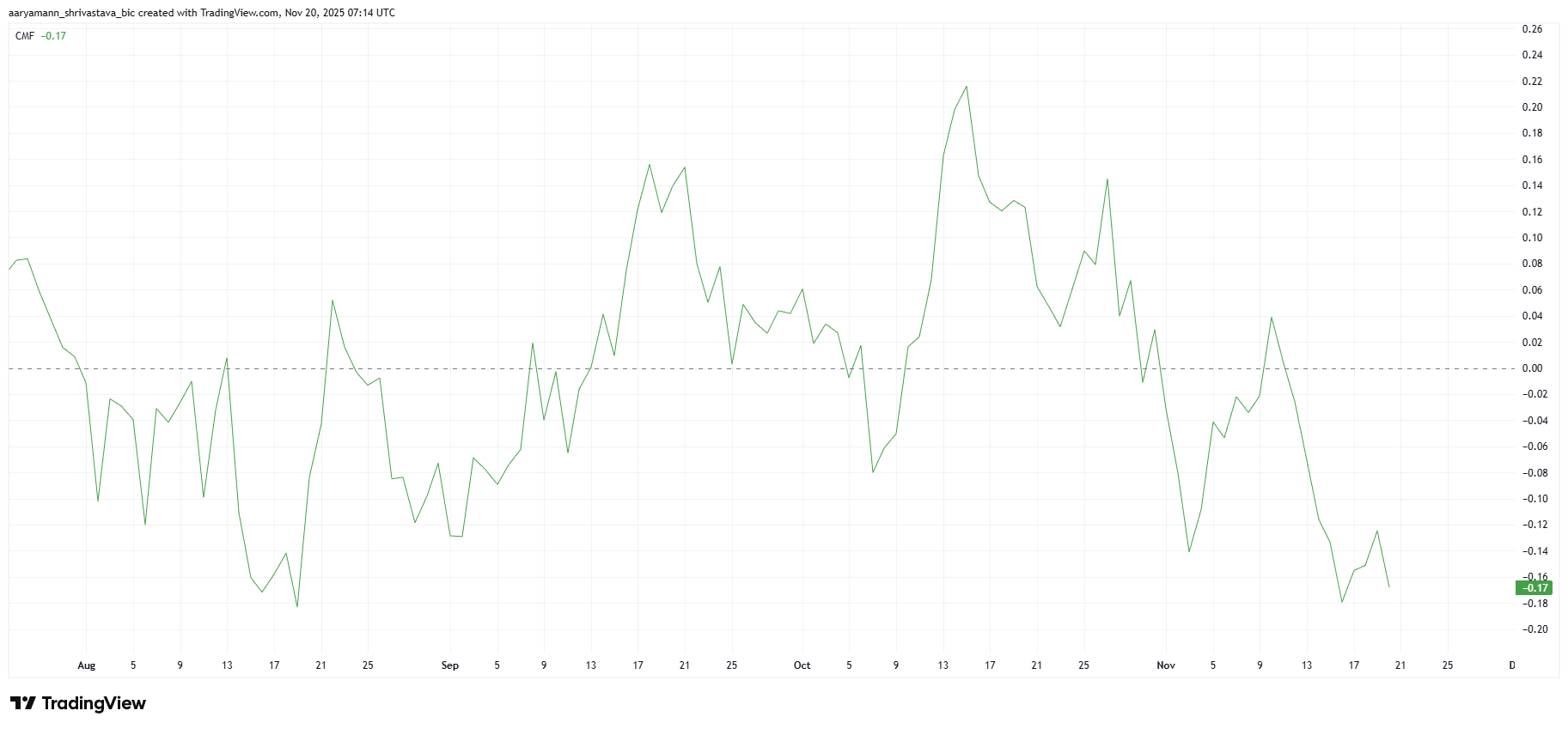

Market sentiment for HBAR has deteriorated sharply as the Chaikin Money Flow signals rising outflows. The indicator has dropped to a three-month low, reflecting a clear shift away from accumulation. When CMF falls this deeply, it often indicates that liquidity is leaving the asset at an accelerated pace.

Investors pulling capital out of HBAR suggest fading confidence in near-term recovery. This lack of conviction is directly impacting price stability, reducing buying pressure when the asset needs it most. Without renewed inflows, HBAR may struggle to generate upward momentum, delaying any meaningful rebound.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

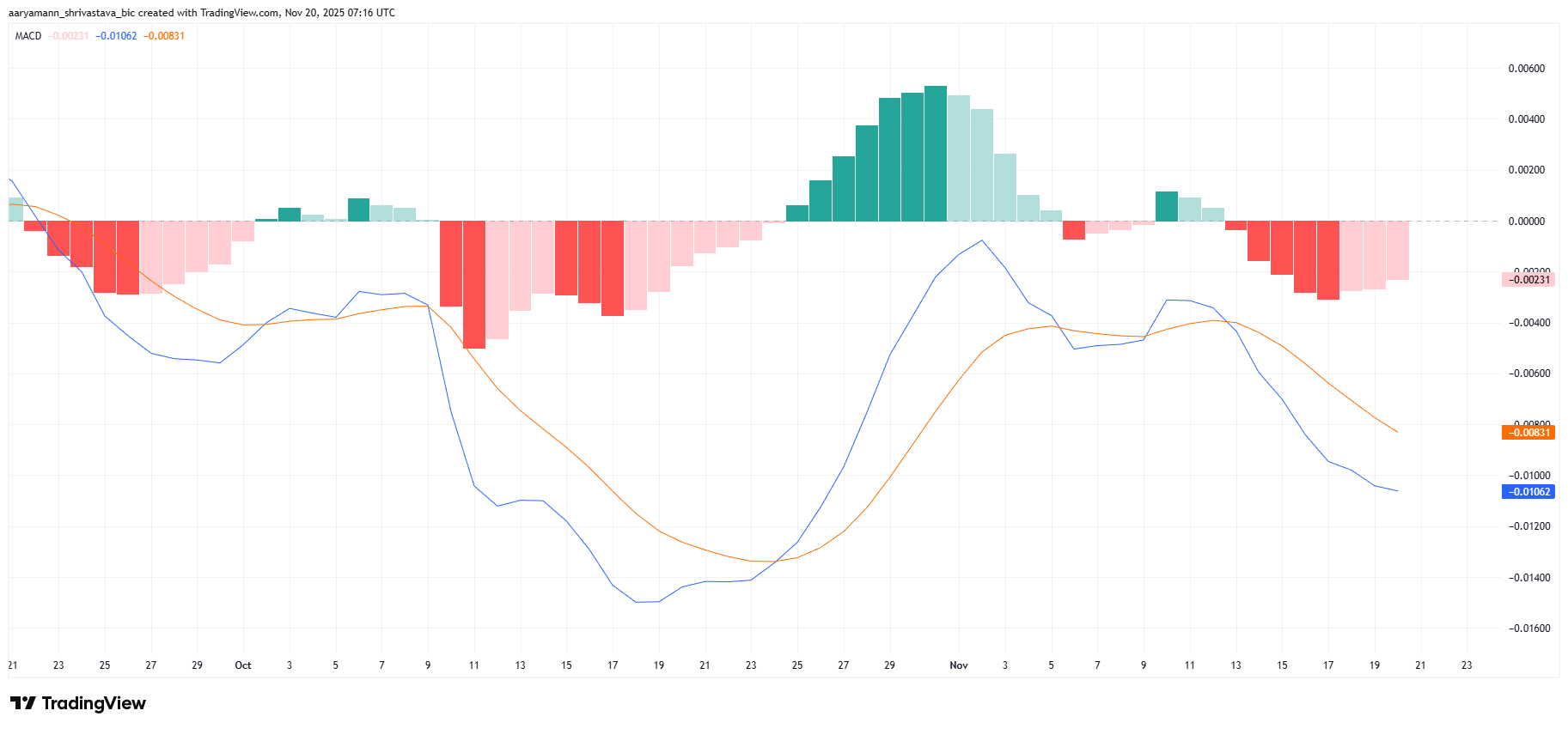

Macro momentum indicators are showing mixed signals. Hedera’s Moving Average Convergence Divergence indicator remains in a bearish crossover, confirming ongoing downside momentum. However, the histogram bars are shrinking, which suggests that bearish pressure may be weakening.

For a full shift in trend, the MACD must flip to a bullish crossover. Without that change, the broader bearish structure remains intact. If momentum fails to turn positive soon, HBAR may continue facing downward pressure as traders wait for clearer signals of strength.

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

Will HBAR Price Decline Continue?

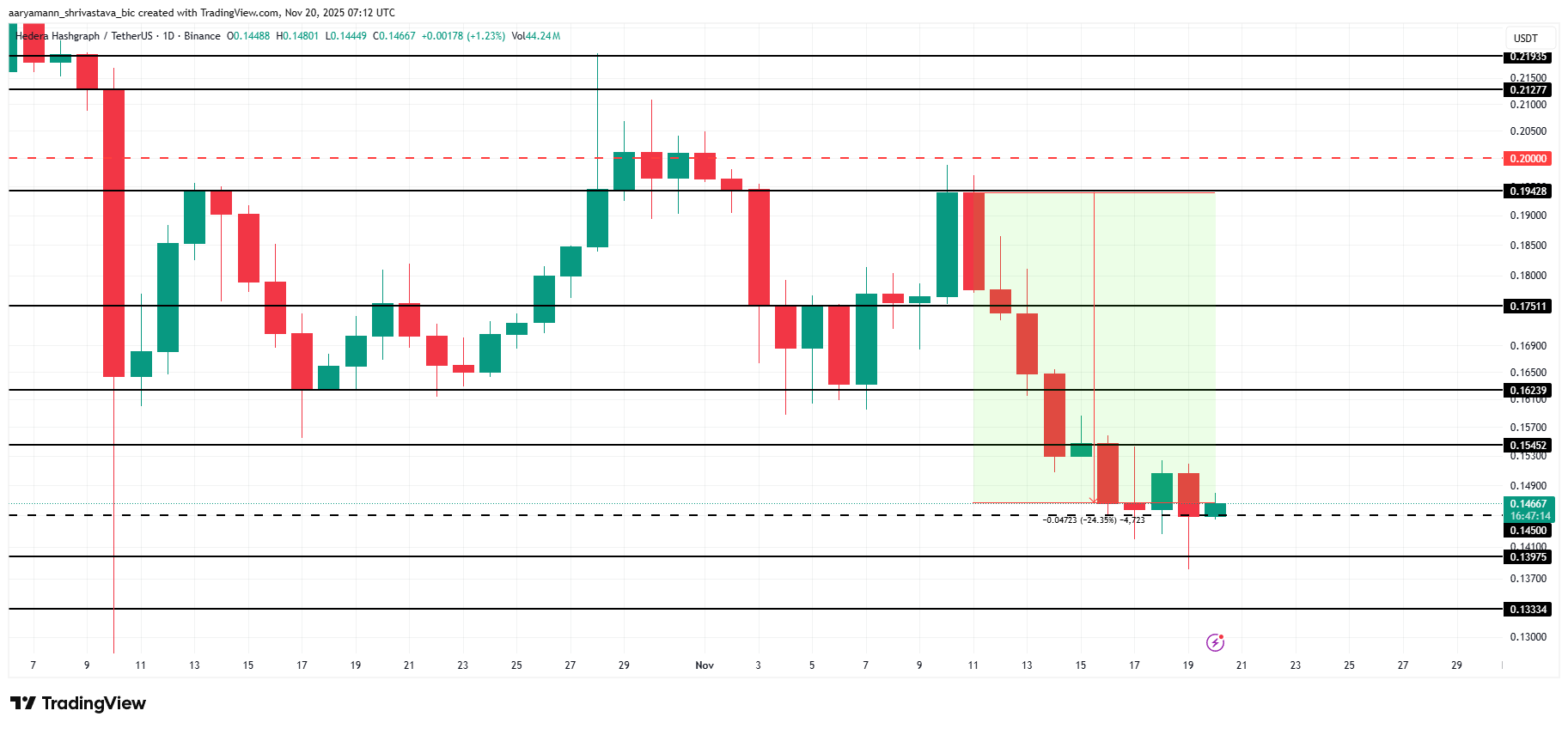

HBAR trades at $0.146 after dropping 24% in the past 10 days. The altcoin has managed to hold above the $0.145 support level, which has provided temporary stability. Maintaining this range is crucial for preventing deeper losses and keeping recovery prospects alive.

If bearish momentum intensifies, HBAR could break below $0.145 and drop toward $0.139 or even $0.133. Such a move would extend investor losses and reinforce market concerns. Weak demand and persistent outflows make this scenario increasingly plausible unless conditions improve.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If bullish momentum returns, HBAR could rebound and climb toward $0.154 or $0.162. A recovery of this magnitude would help restore confidence and invalidate the bearish thesis. Renewed inflows and improving sentiment would be essential to supporting this upward move.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks

Ethereum Updates: Centralized DNS Compromise Highlights DeFi Weaknesses as Aerodrome Suffers $1 Million Loss

- Aerodrome Finance suffered a DNS hijacking attack on Nov 22, 2025, redirecting users to phishing sites that siphoned over $1M in assets through deceptive transaction approvals. - Attackers exploited vulnerabilities in centralized domain registrar Box Domains, forcing users to approve unlimited access to NFTs and stablecoins via two-stage signature requests. - The protocol shut down compromised domains, urged ENS-based access, and revoked recent token approvals, marking its second major front-end breach i

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu

Bitcoin News Update: Navigating Crypto’s Balancing Act to Steer Clear of 2018’s Downturn as Global Economic Conditions Evolve

- Crypto markets avoid 2018-style collapse as macro-driven cycles and reduced speculation prolong volatility, per Lyn Alden. - Fed policy uncertainty and leveraged ETF launches highlight risks and innovations amid $2.2B crypto outflows and $914M liquidations. - MSTR's BTC gains and Gunden's $1.3B sell-off reflect divergent investor strategies, while Munari's Solana project targets long-term adoption. - Analysts split between 65-70% Bitcoin retracement forecasts and prolonged cycles driven by institutional