BlackRock’s Bitcoin ETF Just Logged a Record Outflow

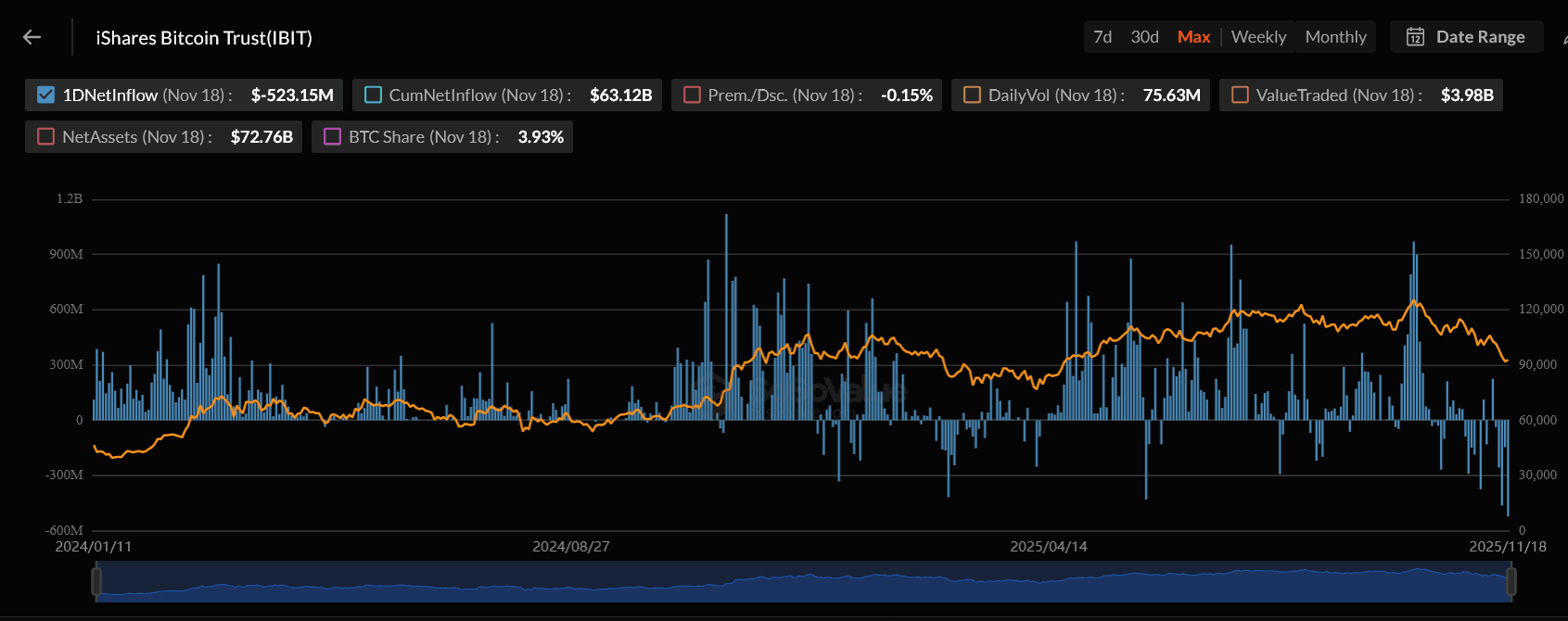

BlackRock’s iShares Bitcoin Trust (IBIT) saw the largest daily net outflow since its launch: $523.15 million leaving in a single day. That figure even beat the previous outflow record set earlier this month. It also capped off five consecutive days of withdrawals that now total $1.43 billion.

IBIT is still the biggest spot bitcoin ETF i n the world, sitting on more than $72 billion in assets, but the tone has shifted. Over the past four weeks, the fund has posted continuous net outflows worth $2.19 billion, lining up almost perfectly with bitcoin’s sharp pullback from its $126,080 all-time high down to below $90,000 earlier this week.

In other words, institutions aren’t dumping bitcoin outright. They’re lightening the load while macro signals remain noisy.

Are Institutions Really Leaving Bitcoin?

Not exactly. Vincent Liu, CIO at Kronos Research, put it plainly: this is recalibration, not capitulation. Big allocators are clipping risk and waiting for clarity. With the U.S. government finally reopening after a prolonged shutdown and the market staring at a December Fed decision that could swing everything, investors are simply protecting themselves.

Bitcoin is already responding with a modest bounce back above $91,000, but liquidity remains tight. The CME’s FedWatch Tool currently shows about a 49 percent chance of a 25-basis-point rate cut next month. Until that becomes more decisive, institutions will probably keep trimming rather than adding.

Also worth noting: IBIT’s giant outflows erased inflows from Grayscale and Franklin Templeton’s bitcoin funds, leaving the entire spot BTC ETF market at a net $372.7 million outflow for the day. Even Ethereum ETFs followed the same script, with BlackRock’s ETHA losing $165 million despite smaller inflows elsewhere.

While Bitcoin Bleeds, Solana ETFs Are Quietly Winning

Now here’s the twist: while bitcoin ETFs are seeing red, Solana ETFs are glowing green.

Tuesday marked the launch of Fidelity’s FSOL and Canary Capital’s SOLC. FSOL pulled in $2.07 million on day one. SOLC saw no flows. But the real action came from the early players:

- Bitwise’s BSOL: $23 million inflows

- Grayscale’s GSOL: $3.19 million inflows

Since BSOL launched on October 28, Solana ETFs have posted 16 straight days of net inflows, totaling $420.4 million.

That streak tells a bigger story. Investors are exploring altcoins that offer yield, activity, and momentum while bitcoin cools off. Liu captures it neatly: Solana is one of the freshest ETFs in the market, and the bundled staking exposure is pulling in a different class of investors—people who want upside plus productive assets.

What About XRP, Litecoin, and Hedera ETFs?

Canary Capital’s spot XRP ETF added $8.32 million on Tuesday, showing steady demand.

Meanwhile, its Litecoin ETF and Hedera ETF didn’t see any flows.

It doesn’t reflect rejection; it reflects attention gravity. Right now, Solana is the hot trade, bitcoin is in risk-off mode, and the rest of the market is waiting for direction.

IBIT’s record outflow is a flashing headline, but not a panic signal. Institutions are moderating exposure until macro conditions settle. Bitcoin remains the anchor, but Solana is the one quietly stealing the spotlight.

If liquidity improves and the Fed leans dovish in December, this entire dynamic could flip again. For now, the rotation tells the real story: capital isn’t leaving crypto—it’s moving around inside it

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: U.S. Bitcoin Reserve Seeks to Offset $38 Trillion Debt and Rising Inflation

- U.S. House introduces Bitcoin for America Act 2025, enabling tax payments in Bitcoin without capital gains liability. - Proceeds would fund a Strategic Bitcoin Reserve, holding assets for 20 years to hedge inflation and $38T national debt. - BPI projects 4. 3M BTC accumulation by 2045 at $3.25M/coin, creating $13.8T reserve via 1% tax participation. - Critics warn Bitcoin's volatility could disrupt federal budgeting and require system overhauls for transaction compliance.

Hyperliquid News Today: Institutions Choose Anchorage Digital to Access Compliant DeFi Returns

- Anchorage Digital, the U.S.'s sole federal crypto bank, expands services by integrating HYPE staking on HyperCORE via Figment, offering institutions regulated yield opportunities. - The partnership enables staking through Anchorage's U.S. and Singapore entities and Porto wallet, leveraging Figment's infrastructure to ensure compliance while accessing Hyperliquid's DeFi ecosystem. - This aligns with growing institutional demand for crypto yields amid market volatility, as major players like Coinbase and C

XRP News Update: XRP ETFs Get Green Light as Payment Capabilities Rival Ethereum’s Smart Contract Dominance

- NYSE approves Grayscale's XRP (GXRP) and Dogecoin (GDOG) ETFs for trading on November 24, 2025, expanding institutional crypto access. - ETFs charge 0.35% fees and transition from closed-end funds, following SEC regulatory clarity and Ripple's 2023 legal victory. - XRP's $128B market cap and Ripple's infrastructure investments contrast with Ethereum's smart contract dominance, while Dogecoin's meme coin status highlights speculative demand. - Nine XRP ETFs approved in October 2025 signal structural marke

HYPE Token's Rapid Rise and What It Means for Altcoin Holders

- HYPE Token's price surge and $14M market cap highlight institutional adoption via Anchorage Digital's staking access, boosting credibility but introducing regulatory risks. - Speculative risks persist, as seen in WLFI's 35% decline despite buybacks, underscoring crypto market volatility's impact on tokens lacking deflationary models. - Community engagement remains unclear for HYPE, contrasting with EDU's $50M institutional buyback strategy, which ties utility to real-world applications. - Investors must