DASH Aster DEX Integration and Its Impact on DeFi Liquidity: Evaluating the Strategic Importance of On-Chain Advancements in Developing DEX Networks

- DASH Aster DEX introduces a hybrid AMM-CEX model with $1.399B TVL and $27.7B daily volume, addressing DeFi liquidity fragmentation through AI routing and multi-chain interoperability. - Its ZKP-based Aster Chain offers privacy and scalability (10,000 TPS), competing with privacy coins while maintaining institutional-grade execution efficiency via dark pool-like Pro Mode. - ASTER token's 1,650% post-TGE surge reflects strong demand, but centralized infrastructure ties and regulatory scrutiny over hybrid m

Hybrid AMM-CEX Model: Merging Transparency with Performance

DASH Aster DEX introduces a hybrid model that combines automated market

One standout feature is Pro Mode, which allows for discreet, high-volume trades and helps prevent front-running—a common problem in traditional AMM-based DEXs

AI-Driven Liquidity Routing: Transforming DeFi Trading

The DEX’s AI-based liquidity routing engine enhances trade execution by intelligently pooling liquidity from various blockchains, including

This innovation is particularly valuable for addressing liquidity fragmentation. Many DEXs face challenges with isolated liquidity pools tied to specific chains or protocols. DASH Aster DEX’s AI component overcomes this by directing trades to the most optimal liquidity sources in real time, effectively creating a unified liquidity ecosystem. This strategy is in line with industry trends like the emergence of cross-chain bridges and interoperability solutions, but it implements them with a level of sophistication that sets a new industry standard.

Zero-Knowledge Proofs and Enhanced Privacy Infrastructure

Privacy and compliance continue to be major concerns in DeFi. The forthcoming Aster Chain from DASH Aster DEX, a Layer 1 blockchain leveraging ZKP technology, is designed to address these issues. ZKPs allow for transaction verification without revealing private information,

The integration of ZKPs has significant strategic implications. Unlike Ethereum’s gradual approach to ZK-rollups, Aster Chain is built as a fully ZK-native platform, capable of processing 10,000 transactions per second and securing $50 billion in Layer-2 value. This enables DASH Aster DEX to rival privacy-centric projects like

Tokenomics and Incentive Structures: Driving Expansion and Liquidity

The ASTER token is integral to the platform’s ecosystem. With 53.5% of its total supply dedicated to airdrops and community rewards, the token’s rapid 1,650% price increase after its launch highlights its strong utility-driven demand. ASTER holders can earn annual staking rewards of 5–7%, use the token as 80% margin collateral for leveraged trades, or participate in governance

Nevertheless, the DEX’s aggressive airdrop strategies and dependence on Binance’s infrastructure

Obstacles and Regulatory Challenges

Despite its technological strengths, DASH Aster DEX encounters several obstacles. Regulatory attention on its dark pool-like features—intended to safeguard institutional traders—has led to comparisons with centralized exchanges,

These issues highlight a persistent tension in DeFi: balancing innovation with regulatory requirements. For DASH Aster DEX to retain its leadership, it must skillfully manage these risks while further developing its hybrid model and ZKP-based infrastructure.

Strategic Importance and Future Prospects

The advancements introduced by DASH Aster DEX mark a major leap for DeFi liquidity. By tackling fragmentation, privacy, and scalability through the use of AI and ZKP, the platform illustrates how on-chain progress can foster both institutional engagement and user confidence. Its hybrid and multi-chain strategies also demonstrate a practical approach to scaling DeFi in a competitive environment.

For investors, the platform’s growing TVL, robust tokenomics, and clear technological vision offer attractive prospects. However, it is crucial to consider the risks associated with regulatory scrutiny and centralization. As DeFi continues to evolve, projects that successfully implement advanced technologies like ZKPs and AI are likely to lead the next wave of innovation in the ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

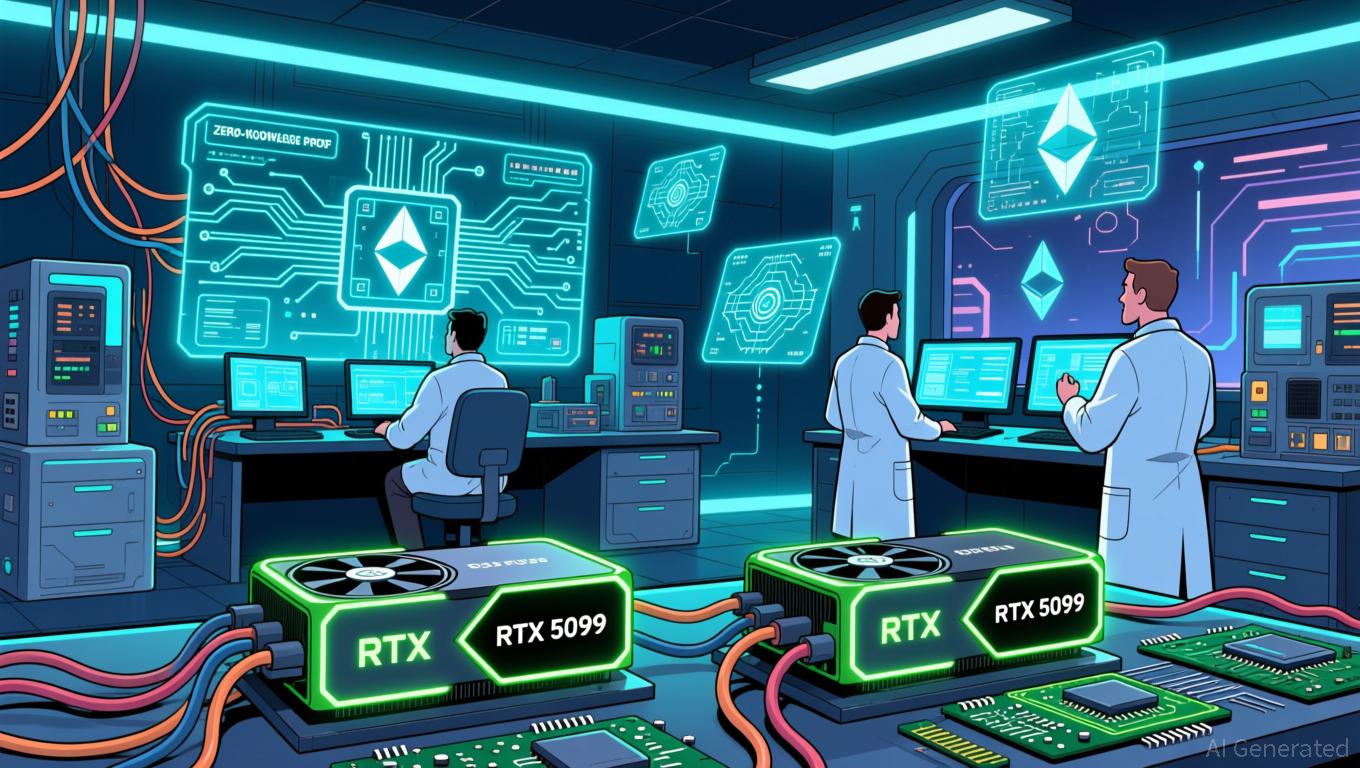

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting