BlackRock Sidesteps the Solana ETF Showdown — Is It a Miss or Masterplan?

The Solana ETF race is intensifying as major firms push into the sector, leaving observers questioning BlackRock’s decision to stay focused solely on Bitcoin and Ethereum. Institutional interest in SOL continues to climb despite the firm’s strategic absence.

Fidelity’s Solana ETF, launching on November 19, 2025, with a 25-basis-point fee, marks the entry of traditional asset managers into the Solana ETF market. BlackRock, the world’s largest asset manager, is notably not participating in this competition.

As major financial institutions move swiftly to capture market share in the growing Solana ETF sector, BlackRock’s decision to focus solely on Bitcoin and Ethereum products raises questions about the future of altcoin-based funds.

Major Asset Managers Enter Solana ETF Arena

The Solana ETF market is expanding quickly as several firms announce new products. Bitwise’s BSOL debuted with around $450 million in assets, while VanEck’s VSOL launched on November 18, 2025.

Fidelity’s FSOL, set for release on November 19, is a milestone as it brings the largest traditional asset manager into this growing sector.

Bloomberg ETF analyst Eric Balchunas highlighted the competition, noting Fidelity’s position as the largest asset manager in the Solana ETF category. The 25 basis point fee positions FSOL to compete closely with other leading products as firms strive for market leadership in this new area.

Fidelity Solana ETF $FSOL is slated to launch TOMORROW. Fee is 25bps. Easily the biggest asset manager in this category with BlackRock sitting out. $BSOL got out first, has $450m, $VSOL launched today, Grayscale is in mix. Game on.

— Eric Balchunas (@EricBalchunas) November 17, 2025

Canary Capital is also entering the field with its Solana ETF, ticker SOLC, which features on-chain staking through a partnership with Marinade Finance.

ALSO. @CanaryFunds will be launching their Solana ETF — $SOLC — tomorrow too. It’s in partnership with @MarinadeFinance who will be doing the staking.

— James Seyffart (@JSeyff) November 18, 2025

According to Nasdaq’s official listing announcement, the Canary Marinade Solana ETF began trading on November 18, 2025. Grayscale has added further competition in this forming segment.

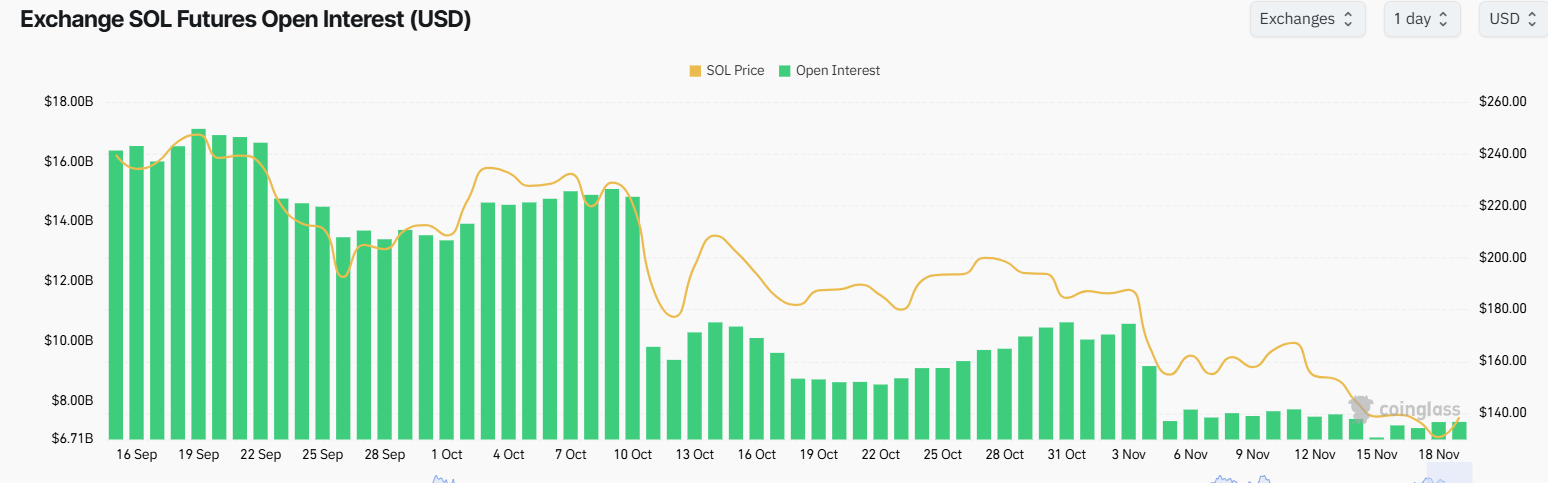

Solana’s market activity demonstrates the growing attention. Open interest in SOL futures is rising as November 19 approaches, indicating increased trader participation and engagement.

Solana Futures Open Interest. Source:

Coinglass

Solana Futures Open Interest. Source:

Coinglass

This recent activity signals rising institutional interest in Solana exposure, even as the price consolidates.

BlackRock’s Strategic Focus on Bitcoin and Ethereum

Meanwhile, BlackRock has made its position clear, to concentrate exclusively on Bitcoin and Ethereum ETFs, not expanding into altcoins.

Robert Mitchnick, the firm’s digital assets head, expressed at the Bitcoin 2024 conference in Nashville that assets beyond BTC and ETH lack the maturity, liquidity, and market capitalization necessary for ETF products.

According to BlackRock’s leadership, the next-largest cryptocurrency after Ethereum accounts for approximately 3% of the total cryptocurrency market capitalization, which is well below the firm’s product launch thresholds.

“I don’t think we’re going to see a long list of crypto ETFs. If you think of Bitcoin, today it represents about 55% of the market cap. Ethereum is at 18%. The next plausible investible asset is at, like, 3%. It’s just not close to being at that threshold or track record of maturity, liquidity, etc.,” Mitchnick said.

Jay Jacobs and Robert Mitchnick have stressed that only a minority of BlackRock’s clients currently own IBIT or ETHA, hence their pivot.

“We’re really just at the tip of the iceberg with Bitcoin and especially ethereum. Just a tiny fraction of our clients own ($IBIT and $ETHA) so that’s what we’re focused on (vs launching new alt coin ETFs)” – Jay Jacobs of BlackRock at ETFs in Depth.

— Eric Balchunas (@EricBalchunas) December 12, 2024

BlackRock’s Bitcoin ETF, IBIT, has delivered strong results since its January 2024 debut. Similarly, BlackRock’s Ethereum ETF, ETHA, reached over $1 billion in assets under management within two months of launch.

However, the financial instruments have been recording outflows over the past few weeks, which could move the firm to consider joining the Solana ETF frenzy.

Meanwhile, analysts have dissected theories that TradFi players like BlackRock foraying into the Bitcoin ETF market is a demonstration of bullishness.

According to BitMEX co-founder Arthur Hayes, their move is a calculated basis trade, with this hidden institutional strategy now distorting ETF inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON’s DeFi Transformation: Ending the Algorithmic Era to Embrace a Stability-Secured Tomorrow

- TRON's USDJ algorithmic stablecoin ends after 5.5 years, transitioning to a fixed 1 USDJ = 1.5532 TRX rate as part of strategic realignment. - The shift reflects TRON's focus on liquidity-backed stablecoins like USDD, aligning with industry trends toward overcollateralized models for market stability. - USDJ's decline followed waning liquidity and persistent undervaluation, prompting a phased wind-down to eliminate confusion and provide clear exit paths for holders. - Community reactions are mixed, with

Cloudflare Disruption Highlights the Inherent Dangers of Centralized Internet Infrastructure

- Cloudflare's Nov 18 global outage disrupted services for ChatGPT, X, Shopify , and crypto platforms due to a configuration file error exceeding expected size limits. - The incident caused 500 errors affecting 20% of Cloudflare-dependent websites, with 5,000+ user complaints reported at peak disruption. - Shares fell 4% premarket as experts warned about systemic risks from internet infrastructure consolidation, highlighting vulnerabilities exposed by outages at Amazon , Microsoft , and now Cloudflare . -

New Toku–PDAX partnership lets Filipino workers receive pay in stablecoins