Bots Take the Lead Online as Automated Content Reshapes User Experience

Artificial intelligence is reshaping how people experience and interact with the online world. Major platforms now face a surge of non-human traffic and synthetic content, pushing the internet into a stage where real users must question both what—and whom—they are interacting with. Researchers say this shift is eroding trust as machine-generated material spreads across spaces once dominated by people.

In brief

- Automated traffic hit 51% in 2024, marking the first year bots outnumbered human users across major platforms and public networks.

- Machine-written articles surpassed human output in late 2024, adding stronger concerns about authenticity across the online world.

- Users report weaker cues for spotting real people as automated posts copy human behavior and blur the line between real and synthetic.

- More people move to private chats and closed groups as public platforms grow noisier, less trustworthy, and harder to navigate.

Bots Overtake Humans Online, Raising New Questions for Crypto Platforms

Much of the internet still relies on human activity, but recent trends indicate a significant shift toward automation. AI-created posts and bot networks move through social platforms at a pace that makes the digital world feel less human than before. According to researchers, the trend reflects the ideas behind the “Dead Internet Theory,” a once-fringe belief that posits a significant portion of online content is generated by machines mimicking human behavior.

Many dismissed the theory as conspiracy talk when it first surfaced years ago on forums such as 4chan and Agora Road’s Macintosh Café. However, the rising prevalence of automated activity has prompted some experts to reevaluate how unrealistic it once seemed.

Imperva’s 2025 Bad Bot Report found that bots made up 51% of all web traffic in 2024—marking the first time automated systems outnumbered humans . Advanced and moderate bots accounted for 55% of attacks that year, with many built to copy human browsing patterns. These systems can evade detection by mimicking the behavior of ordinary users, making it far harder to identify them.

Basic bot attacks are also on the rise, with automated activity reaching 45% in 2024, up from 40% the previous year. Analysts link the rise to easy-access automation tools that allow less-skilled attackers to run high-volume campaigns with minimal effort.

Synthetic Articles Outpace Human Writers as Trust Declines Online

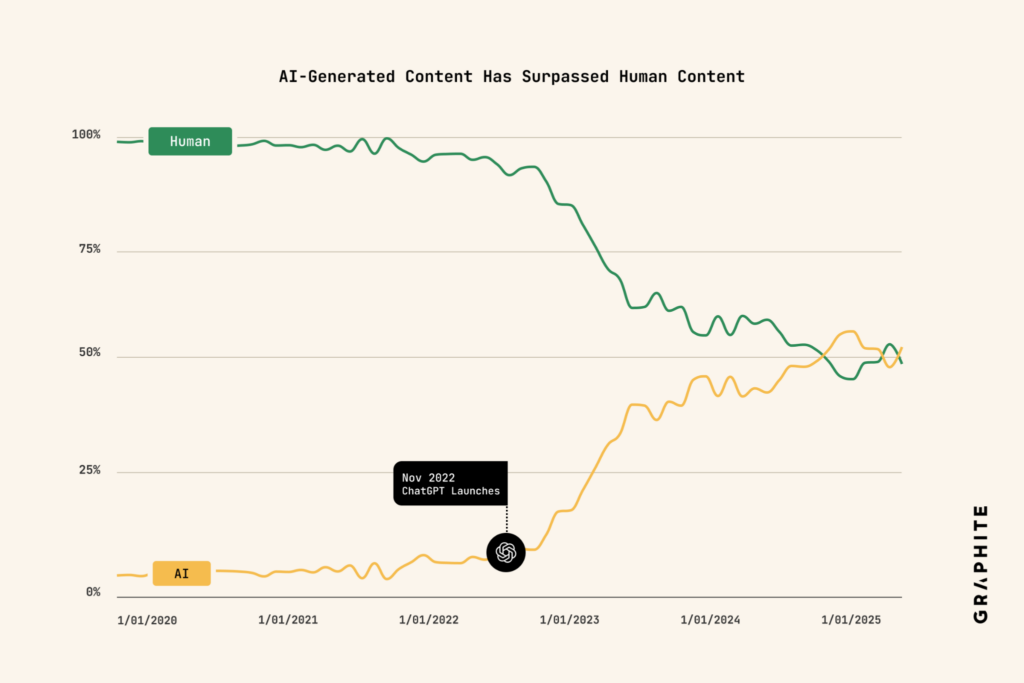

Apart from automated bot attacks, articles and content trends appear to be following a similar path. Analytics firm Graphite reported that machine-generated articles outnumbered human-written work for the first time in late 2024. The shift adds to growing concerns about authenticity across news sites and social platforms.

Sociologist Alex Turvy explained that, while precise measurement is impossible, clear signs indicate that online spaces are undergoing significant changes. Automated posts now fill comment sections, timelines, and forums, often appearing no different from genuine human input.

Concerns extend beyond traffic numbers, as people now have to rely on subtle behavioral cues to determine whether someone is genuine. Once bots start copying those cues, user confidence begins to weaken. Some users withdraw; others start to question nearly everything they see.

Key pressures shaping the shift include:

- Rising automated activity across major platforms.

- Growing use of tools that imitate human behavior .

- Increasing output of synthetic articles and posts.

- Decreasing reliable signals for identifying real users.

- Rising movement toward smaller, more controlled online communities.

Many users now move to private spaces, such as Discord channels or group chats, where their identity feels easier to confirm. Turvy said communities can adapt, but trust may continue to shrink as automated activity grows . For now, people remain active online, but they face more machine-driven noise than ever before.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Following Significant Network Update: Enhanced On-Chain Governance and Layer 1 Expansion Drive DeFi Advancement

- ICP's token price surged 30% in 2025 due to transformative upgrades in on-chain governance and Layer 1 scalability. - Fission and Knot upgrades enabled 1,200+ TPS with reverse gas model, outperforming Ethereum's scalability limitations. - Active Liquid Democracy governance and Neuron Fund attracted 2,155+ developers, boosting TVL by 22.5% in one day. - Price gains correlate with DeFi adoption, institutional staking, and cross-chain integrations via Chain Fusion technology.

Solana News Update: Major Investors Place Significant Bets on Solana ETFs Amid 30% Price Drop, Challenging the Strength of $130 Support

- Solana's ETFs (BSOL/FSOL) drew $476M in 17 days despite SOL's 30% price drop to $130, signaling institutional confidence. - $130 support level shows buying pressure with RSI rising to 50, though $160 EMA remains a key reentry target for bulls. - On-chain growth (18% active address rise) and projects like GeeFi reinforce Solana's infrastructure, but $140 resistance remains fragile. - Mixed futures signals (5% higher OI, positive funding rates) highlight uncertainty, with $120 as next potential downside ri

PEPE Balances on a Fine Line: Key Support at $0.0547 and Resistance at $0.05504 Under Scrutiny

- PEPE cryptocurrency stabilized above $0.0547 support, trading within a narrow range as of mid-November 2025. - Technical indicators show neutral sentiment with RSI at 50.62 and MACD near zero, per xt.com and BitGet analyses. - Whale movements and exchange flows drive volatility, while long-term forecasts range from 140,000% to 28.6 million% gains by 2030-2050. - Market depends on meme culture relevance, institutional adoption, and broader crypto trends like Ethereum's price and ETF regulations.

Bitcoin Updates Today: Kiyosaki Turns Bitcoin Profits into Ongoing Income, Living by His Own Advice

- Robert Kiyosaki sold $2.25M in Bitcoin at $90,000/coin, reinvesting in surgical centers and billboards for tax-free income. - He aims for $27,500 monthly cash flow by 2026, aligning with his passive-income strategy while maintaining Bitcoin's $250K/2026 price target. - Bitcoin's 33% drop from $126K peaks reflects broader market slump driven by Fed rate uncertainty and offshore trading pressures. - Kiyosaki advocates gold/silver and warns of systemic risks, contrasting with analysts who see intact fundame