Will XRP Price Crash to 0.65?

XRP price is slipping again, and the mood across the market isn’t helping. With Nvidia, Walmart, Target, and Home Depot all reporting earnings this week—plus the return of US economic data after the historic 43-day government shutdown—risk sentiment is shaky. Traders are watching every candle with suspicion. In the middle of all this, XRP price has moved into a fragile zone, raising a tough question: is a drop to 0.65 even on the table?

XRP Price Prediction: Why the Market Mood Matters Right Now

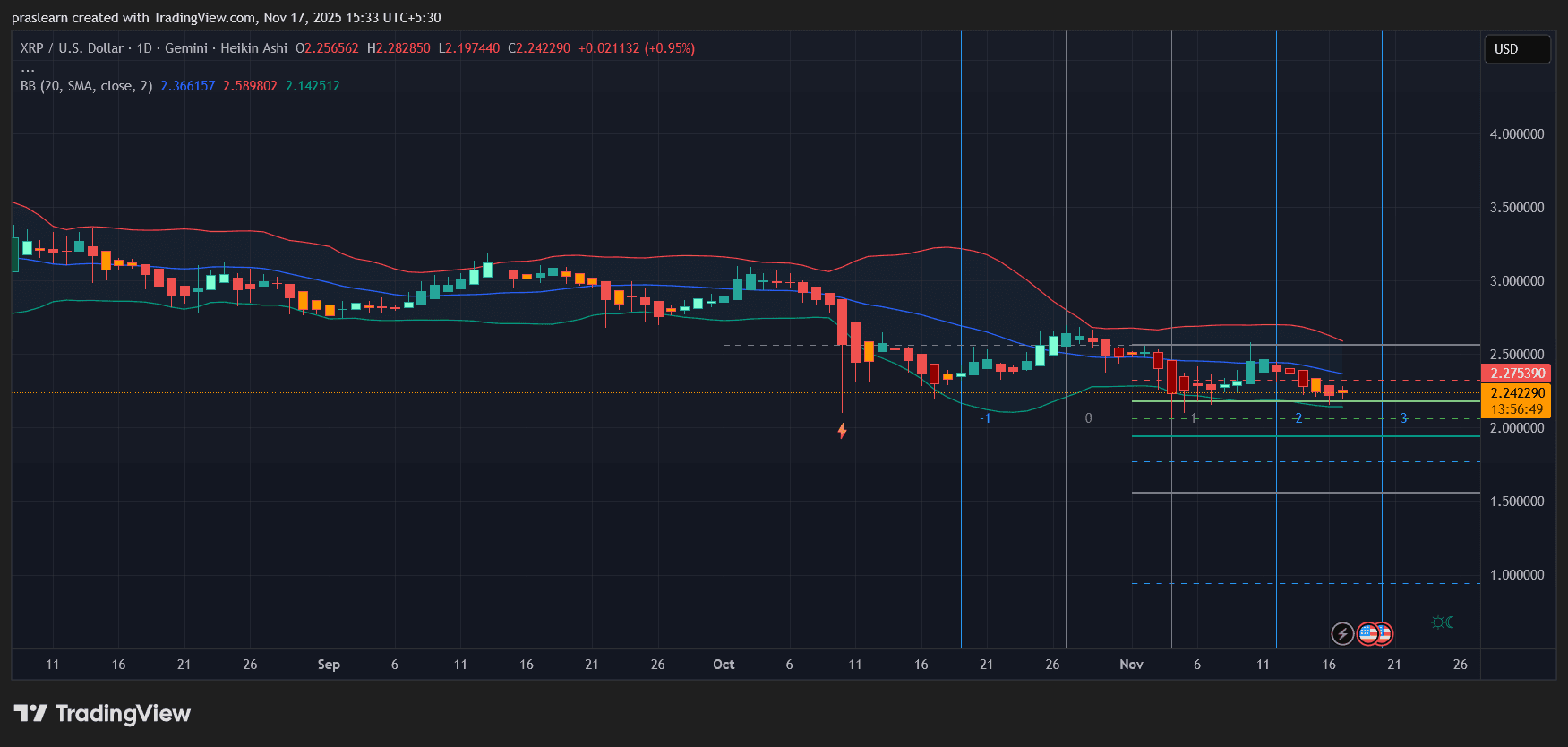

Before jumping into the technicals, it’s worth understanding the backdrop. The shutdown halted key economic reports for more than a month, leaving investors moving blind. As the data pipeline reopens, volatility tends to spike.

Add to that:

- Nvidia’s earnings, which heavily influence risk appetite

- Major retailers reporting results that reflect real consumer strength

- FOMC minutes that may hint at the next interest-rate shift

- Ongoing weakness in housing and sentiment data

This kind of week can easily pressure altcoins. XRP feels that pressure more than most when momentum is already leaning down.

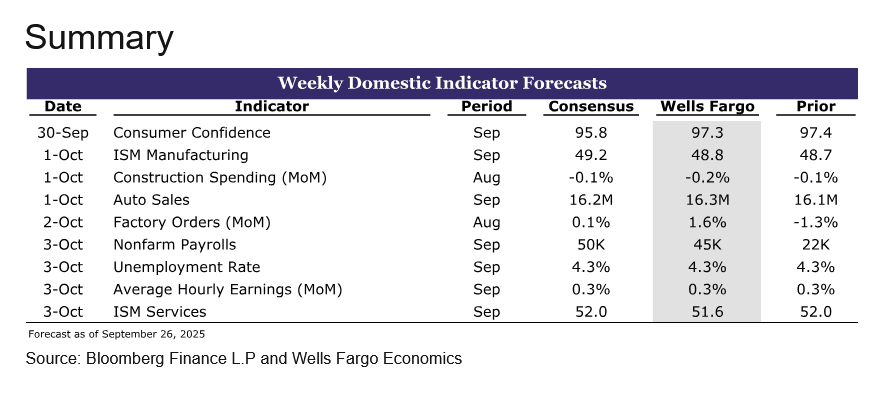

What the XRP Price Daily Chart Is Actually Showing

The daily candles tell a clear story: XRP is in a controlled downtrend, but not a freefall.

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

1. Price Is Stuck Under the Mid-Bollinger Band

The mid-band has acted like a ceiling for nearly the entire month. Every attempt to reclaim it has failed, which shows sellers remain in control.

2. The Lower Bollinger Band Has Started to Slope Down

A downward-angled lower band often precedes another leg lower. It signals room for volatility to expand on the downside.

3. Repeated Taps of the 2.20–2.00 Support Zone

This region is being tested over and over without a convincing rebound. When support becomes a lounge chair instead of a trampoline, breakdowns happen.

4. Heikin Ashi Candles Are Softening

The candles are losing body size, with more flat-bottomed reds showing up. That’s a classic continuation signal in Heikin Ashi analysis. The chart is weak. But weak does not automatically mean catastrophic.

Is 0.65 a Realistic Scenario?

0.65 is nowhere near the current structure. To reach that level, XRP price would need to slice through several major supports that haven’t even been threatened on this timeframe.

For a move toward 0.65, you would need:

- A macro shock hitting all risk assets

- Bitcoin breaking its macro higher-low structure

- Altcoins entering a broad capitulation

- XRP-specific negative catalysts (legal, liquidity, exchange delistings, etc.)

- None of those conditions are present right now.

So while traders often float extreme targets in fear-heavy markets, the chart doesn’t justify a scenario that dramatic.

The More Likely Downside Path

Based on the current structure, the realistic progression looks closer to this:

- 2.20 – First support, already weakening

- 2.00 – Stronger shelf, but vulnerable if momentum stays negative

- 1.75–1.50 – Next demand zone if volatility widens

- 1.00–0.85 – Panic zone, possible only during market-wide distress

A crash straight into 0.65 would require an event far bigger than anything visible on the chart.

What Would Invalidate the Bearish Bias?

XRP needs to prove strength, not hint at it.

A real reversal begins only if:

• It closes a daily candle above the mid-Bollinger band: This would show buyers are finally taking back control.

• It forms two consecutive strong Heikin Ashi green candles: This isn’t happening yet.

• It reclaims the blue moving-average zone: That band has rejected price multiple times. A reclaim would shift the short-term trend.

Until these conditions appear, the bias stays bearish with controlled downside.

XRP Price Prediction: Will XRP Price Crash to 0.65?

The chart points to more downside, but not a collapse to 0.65. $XRP is weak, momentum is fading, and support is slowly eroding. But the structure does not support a multi-level crash that deep unless the entire crypto market enters a panic phase.

For now, the most realistic scenario is a drift toward the lower supports between 2.00 and 1.75, not a meltdown into the 0.60s.

If market conditions worsen after this week’s earnings and economic data flood back, those lower levels become more likely—but 0.65 remains a distant extreme, not an imminent threat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -

DappRadar's Shutdown Reflects Challenges Faced by the Industry Amid Market Volatility

- Web3 analytics firm DappRadar announced its shutdown due to "financially unsustainable market conditions," causing its RADAR token to drop 30%. - Companies like PG Electroplast and GEM Aromatics reported revenue declines amid U.S. tariffs, GST changes, and raw material costs, reflecting broader economic challenges. - Geox cut 2025 sales forecasts by high single digits after 6.2% year-to-date revenue fall, while cost cuts helped stabilize its EBIT margin. - Tech stocks face volatility: Nvidia downgraded a