November 17th Market Key Insights, How Much Did You Miss?

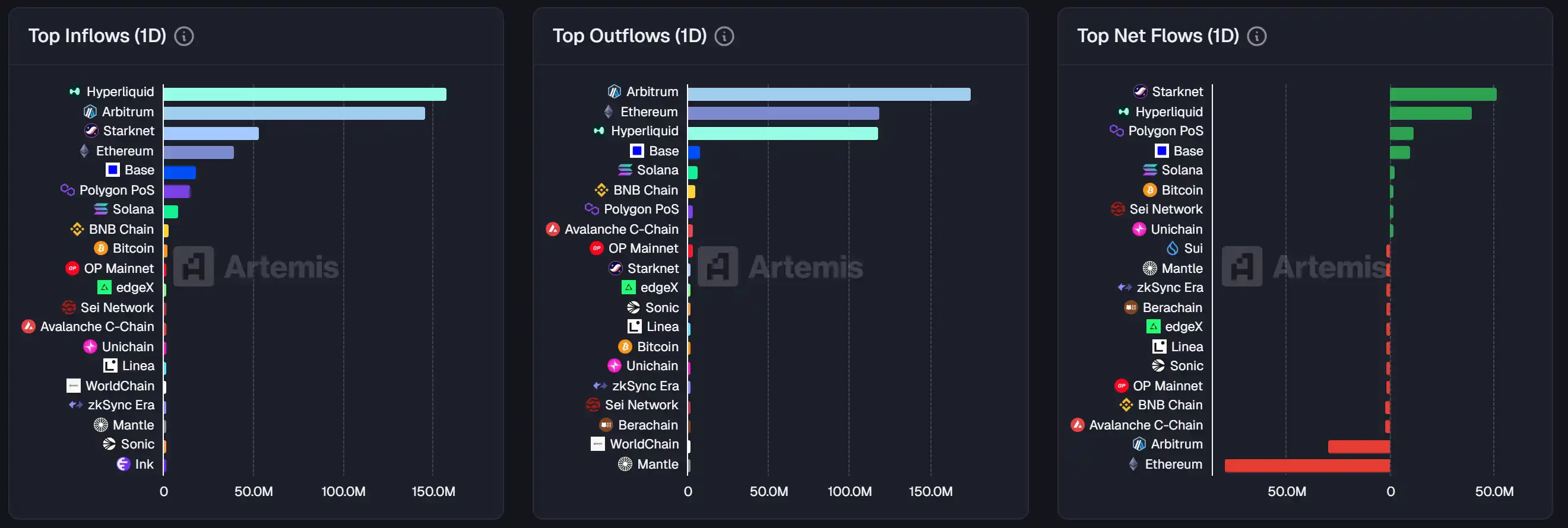

1. On-chain Funds: $51.3M USD flowed into Starknet today; $79.2M USD flowed out of Ethereum 2. Largest Price Swings: $BBT, $USELESS 3. Top News: The "Uniswap Fee Switch Proposal" will enter a snapshot vote tomorrow

Featured News

1. "Uniswap to Launch Fee Switch Proposal," Snapshot Vote to Begin Tomorrow

2. BSC On-Chain Meme "BANANA" Surges 97% in 24 Hours, Reaching a Market Cap of $47 Million

3. Privacy Network Zcash's Mainnet Activity Surges, with Daily Transactions Up Over 1300% Since Price Rally

4. "Hashimi" Market Cap Retraces 40% from Recent High, Giving Up Most of Its Gains

5. Yala's Stablecoin YU Depegs and Falls to $0.47

Featured Articles

1. "CZ's Personal Lawyer Responds to 'Insider Deal with Trump Money Power Pardon'"

On October 22, U.S. President Trump officially signed the pardon for CZ. However, there are still many publicly undisclosed details surrounding the pardon itself. On November 15, CZ's personal lawyer, Teresa Goody Guillén, a partner at the prominent law firm Baker Hostetler, was interviewed by Anthony Pompliano, founder of Morgan Creek. In her conversation with Pompliano, Teresa mentioned many details that were not fully disclosed before regarding the allegations, the pardon's reasons, and the process. CZ himself has retweeted and liked Teresa's interview content.

2. "Is 80% Hype? Six Key Red Flags to Understand Stablecoin's True Intentions"

Recently, Stable completed two substantial rounds of pre-deposit activities in a short period of time. The initial tranche of $8.25 billion was quickly sold out, while the second tranche saw qualified subscriptions exceeding $11 billion, attracting significant industry attention. Behind the impressive numbers, however, there are also key points to clarify: the project is driven by a key figure from Tether, with USDT serving as the native asset forming a strong peg; the pre-deposit amounts are highly concentrated among early institutions and insiders; and the time between the implementation of the "GENIUS Act" and the accelerated project advancement is remarkably tight.

On-chain Data

On-chain fund flow last week on November 17

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What's Next For the Crypto Market?

Bitcoin News Today: Bitcoin as Digital Gold, Ethereum as the Engine of Decentralized Finance: How Cryptocurrencies Are Carving Out Distinct Functions

- BlackRock executives highlight Bitcoin's shift toward "digital gold" as a long-term store of value, supported by institutional demand and fixed-supply models like Bitcoin Munari. - Ethereum's faster transaction velocity (3x BTC) reinforces its "digital oil" role, contrasting with Bitcoin's stable, passive accumulation strategy and macro-hedge appeal. - Regulatory clarity on stablecoins and blockchain transparency could deepen Bitcoin's institutional adoption while highlighting risks in altcoins like Aero

Stargate’s AI Strategy: Safeguarding the Nation or Raising Antitrust Concerns?

- Stargate, a $500B AI joint venture led by OpenAI, Oracle , and Nvidia , aims to consolidate computing power across seven gigawatt data centers in the U.S. and UAE. - Yale scholar Madhavi Singh warns the alliance violates antitrust laws by merging fierce competitors, risking cartel-like behavior and stifling innovation in chips and cloud services. - Critics argue Stargate eliminates competition in key AI sectors, while the Trump administration and lawmakers praise it as a strategic move to counter China,

Bitcoin Updates Today: Bitcoin Faces a Battle: DWF Issues Buy Alert Amid Market Turbulence

- DWF Labs buys Bitcoin at $84,000 amid 30%+ drop from $126,000 peak, signaling institutional confidence despite market turbulence. - U.S. market weakness highlighted by 21-day negative Coinbase premium (-0.0989%) and $3.79B ETF outflows, including $523M from BlackRock's IBIT . - Strategic buyers like Harvard (+250% IBIT holdings) and Japan's Metaplanet (¥15B allocation) contrast with $4B in realized Bitcoin losses and 35% drop in futures open interest. - Long-term bullish factors include U.S. Strategic Bi