XRP Loses $16 Million as Crypto Funds Bleed $2 Billion in Policy Chaos

Crypto funds saw $2B in weekly outflows—the largest since February—as US policy turmoil hits markets. XRP lost $16M while BTC and ETH saw heavy selling.

Digital asset funds just suffered their largest weekly outflows since February, with $2 billion exiting crypto ETPs last week. The crypto outflows extended a two-week rout driven by US policy uncertainty, hawkish Fed signals, and renewed whale selling.

XRP, which had previously seen institutional inflows, reversed sharply, with nearly $16 million in outflows, reflecting the breadth of the sentiment shift.

A Second Major Hit: $3.2 Billion Gone in Two Weeks

Last week’s $2 billion outflow follows the $1.17 billion drained the week before, marking a combined $3.2 billion flight from crypto funds in just 14 days.

CoinShares’ research lead, James Butterfill, attributes the downturn to a mix of monetary policy uncertainty, crypto-native whale distribution, and the lingering volatility that followed October’s liquidity shocks.

“We believe the combination of monetary policy uncertainty and crypto-native whale sellers is the main reason for this most recent negative funk,” read an excerpt in the latest report.

Total assets under management in digital asset ETPs collapsed from $264 billion in early October to $191 billion, a steep 27% decline.

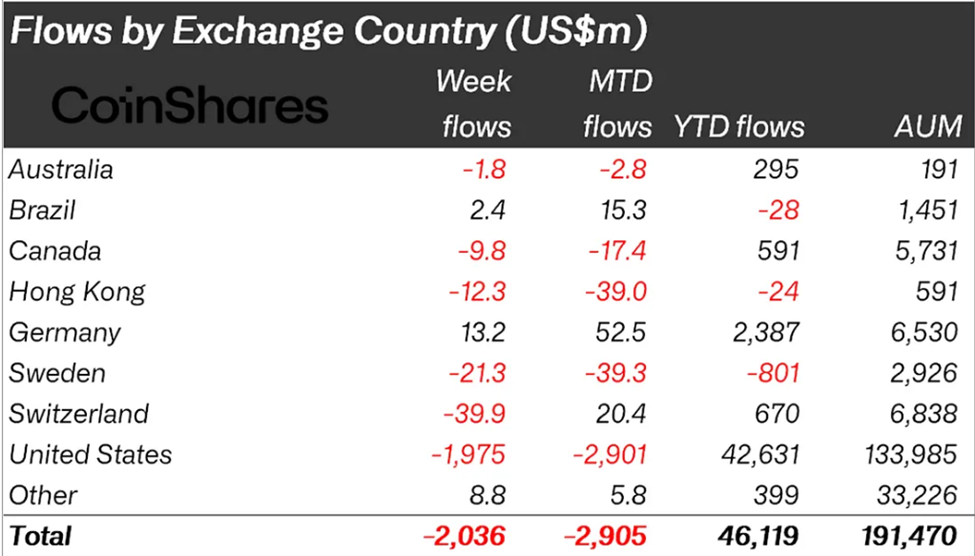

The US accounted for 97% of last week’s outflows ($1.97 billion), a dramatic continuation of the prior week’s $1.22 billion in US-led outflows.

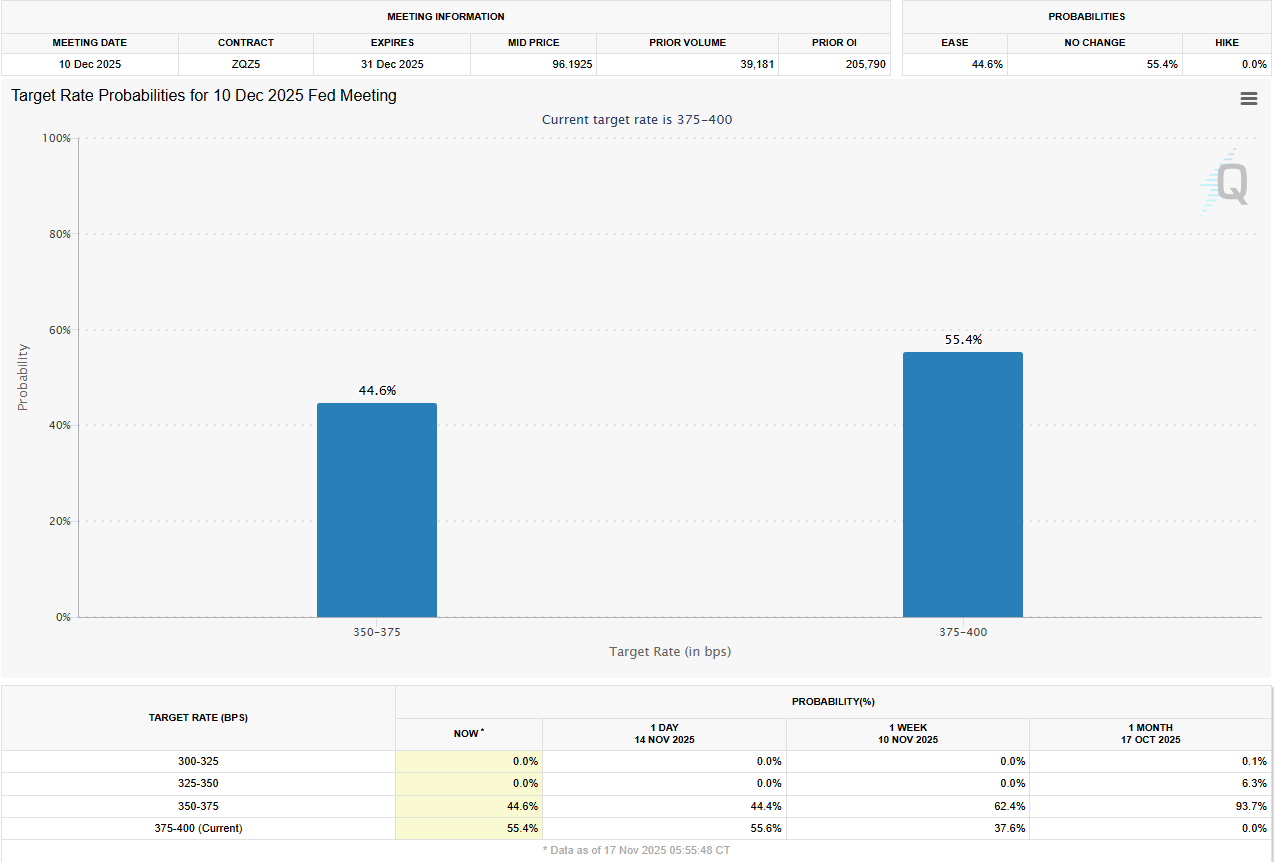

The catalyst: Federal Reserve Chair Jerome Powell’s hawkish tone, including resistance to cutting rates and renewed focus on inflation risks. Hopes for a December rate cut evaporated, replaced by fear of prolonged tight liquidity and the rising threat of a government budget standoff.

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

The result has been a broad risk-off shift, with ETP investors quickly reducing exposure to Bitcoin, Ethereum, and high-beta crypto assets.

Switzerland and Hong Kong followed with outflows of $39.9 million and $12.3 million, respectively. At the same time, Germany again broke from the trend, adding $13.2 million in inflows last week after recording $41.3 million in inflows the week prior. Europe’s comparative optimism remains one of the few bright spots in an otherwise negative global picture.

Crypto Outflows by Region. Source:

CoinShares Report

Crypto Outflows by Region. Source:

CoinShares Report

XRP Outflows Near $16 Million as Altcoins Lose Momentum

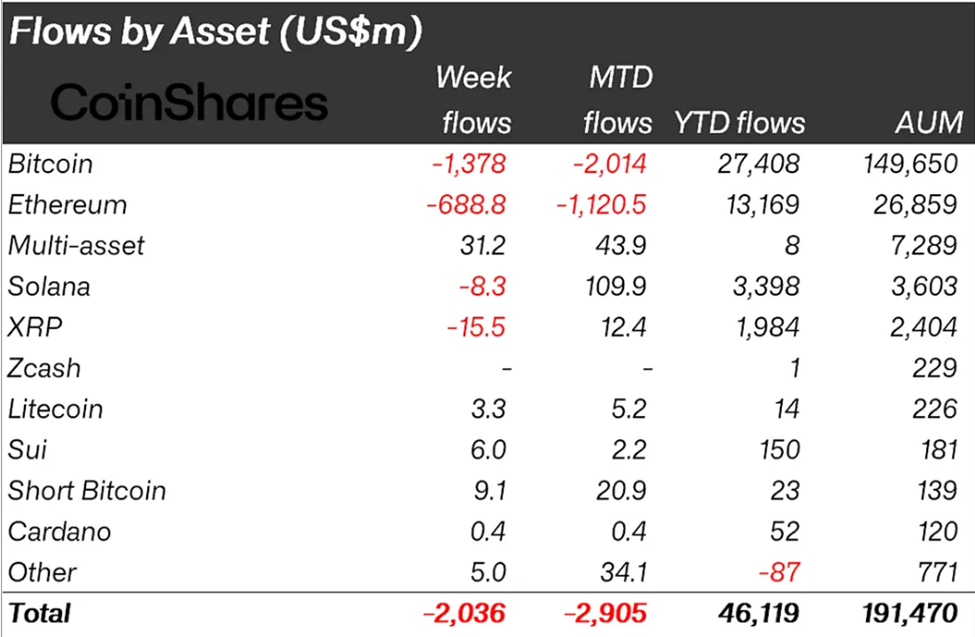

XRP, which recently benefited from moderate inflows, saw $15.5 million in outflows, marking a notable reversal from earlier strength.

Solana also experienced minor outflows of $8.3 million, a sharp contrast from previous weeks when Solana products saw record inflows, driven by new US ETF demand.

Bitcoin ETPs lost $1.38 billion last week, bringing their three-week total to 2% of AUM. The prior week saw another $932 million drained, confirming that institutional sentiment toward BTC has turned sharply defensive.

Ethereum fared proportionally worse, with $689 million in outflows, representing 4% of its AUM. This builds on the previous week’s $438 million in ETH outflows, reflecting widening investor uncertainty about Ethereum’s near-term performance.

Short-Bitcoin products continued to attract inflows—another sign that institutions are hedging against further downside.

Even so, investors did rotate $69 million into multi-asset ETPs, signaling a search for diversification rather than a complete retreat from crypto exposure.

Crypto Outflows by Asset. Source: CoinShares Report

Crypto Outflows by Asset. Source: CoinShares Report

With US policy uncertainty dominating global investor behavior, fund flows are likely to hinge on upcoming Fed communications, potential budget resolutions, and broader macroeconomic stability. Another hawkish pivot, or renewed political gridlock, could prolong outflows.

However, a shift toward clearer guidance or easing inflation pressures may revive demand, particularly for the assets hardest hit in the recent selloff.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink's cross-chain bridges drive a $35 billion boom in tokenized finance

- Grayscale files to convert its $29M Chainlink Trust into a staking-enabled ETF (GLNK), positioning LINK as crypto infrastructure. - Chainlink's CCIP bridges traditional finance and blockchain via cross-chain interoperability, recently collaborating with J.P. Morgan and Ondo Finance. - The tokenized assets market is projected to grow to $35B, with Chainlink addressing compliance and data transfer challenges in decentralized finance. - Strategic integrations with S&P Global and Bittensor's AI networks high

Bitcoin Updates: Trump Urges Rate Cuts While Fed Remains Cautious—Bitcoin Drops Into Bear Market

- Trump pressures Fed for aggressive rate cuts, joking about firing Bessent if rates remain high, risking policy instability. - Bitcoin enters "most bearish" phase with Bull Score at 20/100, price below $102,600 as institutional demand wanes. - Fed chair replacement process nears conclusion, with potential impacts on crypto markets and global capital flows. - India debates stablecoin regulation while Leverage Shares plans 3x crypto ETFs, reflecting volatile market dynamics. - Bitcoin's $200,000 trajectory

Fed's Change in Liquidity Fuels Debate: AI Breakthrough or Speculative Frenzy?

- The Fed's halt of QT by December 1, 2025, risks injecting trillions into AI markets, reigniting speculative concerns amid record $57B Nvidia quarterly revenue. - AI infrastructure spending surges with FEDGPU's GPU clusters and Gartner projecting $2 trillion global AI spending by 2026. - Skeptics warn of debt-driven overinvestment, citing Meta/Oracle stock declines and unproven economic returns despite "depth and breadth" of AI innovation claims. - Historical parallels to the dot-com bubble emerge as anal

XRP News Today: Grayscale’s Altcoin ETFs Transform Market Liquidity, Connecting Digital Assets with Conventional Finance

- NYSE approves Grayscale's XRP and Dogecoin ETFs for Nov 24 trading, expanding regulated crypto access in the U.S. - ETFs convert private trusts to public structures under SEC's post-shutdown regulatory clarity, targeting major altcoins. - Products charge 0.35% fees with direct asset holdings, attracting $12.7B XRP and $7.2B Dogecoin derivatives pre-launch. - Competitors like Bitwise and Franklin Templeton also launch XRP ETFs, signaling growing institutional confidence amid Bitcoin outflows. - Regulatory